Alpha Capital Group can assist you in trading if you wish to perform or invest in a live trading account. The technologically sophisticated trading firm, Alpha Capital Group, also relies on education, training with in-depth market knowledge, and risk analytics to assist both new and seasoned traders in making a profit.

In the competitive world of proprietary trading, Alpha Capital Group has rapidly gained attention. But is it a legit investment partner or just another overhyped scam? Established in 2021 and based in London, this firm promises traders access to significant capital without the need for personal financial risk. While Alpha Capital Group reviews show rising popularity among traders, especially with flexible funding programs like the Alpha Pro Challenge, Alpha Swing Challenge, Alpha One-Step Challenge, and Alpha Three-Step Challenge, there’s still a lot of skepticism surrounding the firm. These challenges evaluate traders’ skills based on profit targets and drawdown limits — but does this really guarantee success, or is it just a marketing gimmick?

Once funded, traders can access accounts ranging from $5,000 to $200,000, with the potential to scale up to $2,000,000. The firm offers a competitive 80% profit split, which sounds great in theory, but how well does it really work in practice? The firm allows news trading, overnight, and weekend holding in most programs — but is this as flexible as it sounds, or are there hidden catches? Moreover, the use of the Alpha Capital Group MT5 trading platform, with its ability to manage positions within Alpha Capital Group max lot size and Alpha Capital Group max allocation limits, adds more to the equation.

But does the potential outweigh the concerns? Some traders point out issues like lack of regulatory oversight, occasional price slippage, and limited customer support options. While Alpha Capital Group profit split is appealing, the Alpha Capital Group prop firm reviews raise questions about whether these terms are truly as attractive as they seem.

In this review, we’ll take a deep dive into Alpha Capital Group’s evaluation process, account types, fees, trading conditions, and overall legitimacy — and see if it’s truly a reliable investment partner or just another flashy scheme.

Table of Contents

Who are Alpha Capital Group?

Alpha Capital Group is a proprietary trading firm founded on November 2, 2021, and headquartered in London, United Kingdom. The firm operates under the legal entity Alpha Capital Group Limited, with its registered office at 6-7 Waterside Station Road, Harpenden, England, AL5 4US. The company is led by CEO George Kohler and focuses on providing traders with capital and educational resources to enhance their trading careers.

As an Alpha Capital prop firm, the company offers funding programs designed to help traders access capital without risking their own funds. Traders can participate in one-step or two-step evaluations, with account sizes ranging from $5,000 to $200,000. Alpha Capital Group provides an 80% profit split, which can increase to 90% for consistently profitable traders.

The Alpha Capital prop firm supports trading in various financial instruments, including forex, commodities, and indices. The firm places a strong emphasis on trader development, offering educational materials, market insights, mentorship, and proprietary technology to enhance trading performance.

Transparency and trader support are central to Alpha Capital prop firm’s mission. By combining access to capital with expert guidance and innovative trading tools, the firm aims to create an environment where traders can develop long-term success.

Brokers That Are Used By Alpha Capital Group?

Alpha Capital Group operates as a proprietary trading firm, providing traders with access to industry-leading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognized for their advanced charting tools, automated trading capabilities, and seamless execution speeds.

The firm partners with regulated liquidity providers to ensure traders experience competitive spreads, minimal slippage, and low latency. While Alpha Capital Group does not publicly disclose the names of its brokers, it emphasizes offering a secure and efficient trading environment through institutional-grade execution.

By integrating MT4 and MT5, Alpha Capital Group ensures that traders can execute strategies efficiently across forex, commodities, and indices, making it a preferred choice for those looking for a robust trading infrastructure.

Who is the Managing Director of Alpha Capital Group?

The Managing Director of Alpha Capital Group is George Kohler, a finance professional with a background in institutional forex trading. After earning a degree in banking and finance, he spent two years at a FTSE-listed company, managing exchange rate risk using spot, forward, and option contracts.

Recognizing the potential in proprietary trading, George transitioned to full-time trading, focusing on forex, indices, and gold. He later founded Alpha Capital Group to provide traders with education, funding, and advanced trading technology. Under his leadership, the firm is developing a cutting-edge account statistics dashboard and fostering strong relationships with funded traders to enhance their success.

Alpha Capital Group Scaling Plan & Funding Programs

Alpha Capital Group offers traders a structured pathway to access substantial capital through its diverse funding programs and scaling plan. These initiatives are designed to identify and nurture trading talent, providing opportunities for growth and profit sharing.

Funding Programs Overview

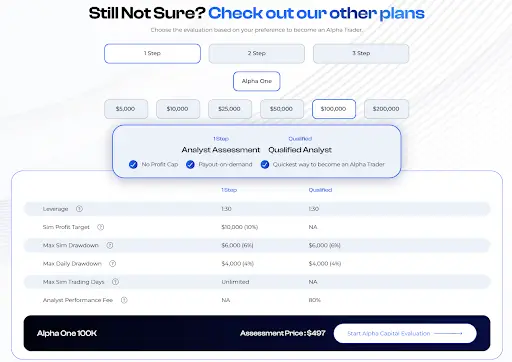

Alpha Capital Group provides four distinct funding programs, each tailored to accommodate various trading styles and preferences:

| Program | Key Features | Scaling & Profit Split | Who It’s For? |

| Alpha Pro Challenge | – Two-phase evaluation: Phase 1 (8% profit target, 5% max daily loss, 10% max loss), Phase 2 (5% profit target, same risk parameters).- No max trading days, minimum of 3 trading days per phase.- Leverage up to 1:100.- Profit split: 80%.- Fees vary by account size.- Overnight & weekend holding allowed once funded; news trading restricted once funded. | – No maximum trading period.- Traders can scale accounts up to $2,000,000.- Profit split starts at 80%. | Traders who prefer structured evaluations with clear profit targets and defined risk parameters. |

| Alpha Swing Challenge | – Two-phase evaluation: Phase 1 (8% profit target, 5% max daily loss, 10% max loss), Phase 2 (5% profit target, same risk parameters).- No max trading days, minimum of 3 trading days per phase.- Leverage up to 1:30.- Profit split: 80%.- Fees align with Alpha Pro Challenge.- Overnight & weekend holding allowed; news trading allowed. | – No maximum trading period.- Traders can scale accounts up to $2,000,000.- Profit split starts at 80%. | Swing traders looking for flexible trading conditions, including overnight and weekend holding. |

| Alpha One-Step Challenge | – Single-phase evaluation: 10% profit target, 5% max daily loss, 10% max loss.- No minimum trading days, no maximum trading period.- Leverage up to 1:100.- Profit split: 80%.- Fees similar to other challenges.- Overnight & weekend holding allowed; news trading allowed. | – No maximum trading period.- Traders can scale accounts up to $2,000,000.- Profit split starts at 80%. | Traders seeking a fast-track funding process with fewer evaluation steps. |

| Alpha Three-Step Challenge | – Three-phase evaluation: Phase 1 (6% profit target, 5% max daily loss, 10% max loss), Phase 2 (4% profit target), Phase 3 (2% profit target).- No max trading days, minimum of 3 trading days per phase.- Leverage up to 1:100.- Profit split: 80%.- Fees consistent with other programs.- Overnight & weekend holding allowed; news trading allowed. | – No maximum trading period.- Traders can scale accounts up to $2,000,000.- Profit split starts at 80%. | Traders who prefer a gradual, lower-risk evaluation process. |

Key Takeaways

- Diverse Evaluation Programs: Alpha Capital Group offers multiple evaluation challenges, catering to various trading styles and risk appetites.

- Flexible Trading Conditions: With allowances for overnight and weekend holdings, traders have the flexibility to implement diverse trading strategies.

- Attractive Profit Sharing: An 80% profit split ensures that traders retain the majority of their earnings, with potential increases through consistent performance and scaling.

- Structured Scaling Opportunities: The scaling plan provides a clear pathway for traders to expand their account sizes, rewarding consistent profitability with increased capital allocations.

Alpha Capital Group’s funding programs and scaling plan are structured to support traders in achieving substantial growth, offering a comprehensive framework that balances risk management with profit potential.

Alpha Capital Group Review: How to Get Funded?

Alpha Capital Group offers a structured pathway for traders to secure funding through a comprehensive evaluation process. Here’s a step-by-step guide to getting funded:

1. Choose a Funding Program

Alpha Capital Group provides multiple funding programs, including the Alpha Pro Challenge, Alpha Swing Challenge, Alpha One-step Challenge, and Alpha Three-step Challenge. Each program has distinct requirements and objectives. For instance, the Alpha Pro Challenge is a two-step evaluation where traders must achieve specific profit targets without breaching predefined risk parameters. To access these programs, traders can complete the Alpha Capital Group login process on the official platform. The Alpha Capital Group login portal allows users to track their progress, manage their accounts, and stay updated on their funding status.

2. Undergo the Evaluation Process

- Phase One: Achieve an 8% profit target without exceeding a 5% daily loss or a 10% overall loss. There’s no maximum trading period, but a minimum of three trading days is required.

- Phase Two: Attain a 5% profit target under the same risk constraints as Phase One. Similar to the first phase, there’s no maximum trading period, but at least three trading days are necessary.

3. Complete the Know Your Customer (KYC) Process

Upon successfully passing both evaluation phases, you’ll receive an email prompting you to complete the KYC process through Alpha Capital Group’s verification partner, Veriff.

4. Receive a Funded Account

After KYC approval, you’ll be granted an Alpha Capital Group funded account. This account allows you to trade with the firm’s capital, adhering to the established risk management rules.

5. Profit Sharing and Withdrawals

As a funded trader, you’re entitled to an 80% profit share. Performance fees can be requested through the dashboard and are processed within two business days. Ensure all trades are closed when making a withdrawal request.

6. Scaling Opportunities

Alpha Capital Group offers a scaling plan for consistent performers. Traders who achieve a 10% virtual capital growth can request a 10% increase in their initial account balance. The maximum virtual capital growth is capped at $2 million across all scaled accounts.

By following this structured process, traders can effectively secure funding and grow their trading careers with Alpha Capital Group.

Alpha Capital Group Trading Instruments and Platforms

Alpha Capital Group offers traders a diverse range of trading instruments and access to advanced platforms, catering to various trading styles and strategies.

Trading Instruments at Alpha Capital Group

Alpha Capital Group provides access to a broad spectrum of financial instruments across multiple asset classes, ensuring traders can diversify their portfolios and strategies. The key trading instruments include:

- Forex: Major, minor, and exotic currency pairs are available for trading, offering opportunities in the highly liquid forex market.

- Indices: Trade global indices such as EUSTX50, GER30, HK50, JPN225, NAS100, UK100, US30, and US500, which represent major global economies.

- Commodities: Instruments like UKOIL and USOIL are accessible for diversification and hedging strategies.

This wide selection supports a comprehensive trading approach, ensuring that both beginner and advanced traders can find suitable markets to engage with.

Alpha Capital Group Trading Platforms

Alpha Capital Group supports multiple advanced trading platforms, providing flexibility and advanced tools for executing trading strategies. The platforms include:

- MetaTrader 5 (MT5): Known for its reliability and user-friendly interface, MT5 is ideal for forex and CFD trading. It supports Expert Advisors (EAs) for automated strategies and offers comprehensive charting tools.

- cTrader: A modern platform offering advanced charting, one-click trading, and algorithmic trading through cAlgo. It’s well-suited for both beginner and experienced traders.

- DXtrade: This cloud-based platform provides customizable interfaces and access to various asset classes. It supports advanced order types and risk management tools.

Alpha Capital Group’s commitment to offering multiple platforms ensures that traders can select the one that best fits their style and strategy. Each platform is equipped with features to support in-depth market analysis and efficient trade execution.

Overall, Alpha Capital Group’s extensive selection of trading instruments and platforms enhances the trading experience, providing flexibility and comprehensive tools to help traders succeed in their trading endeavors.

Alpha Capital Group Trading Conditions: Spreads, Fees, and Rules

Alpha Capital Group offers traders a structured and transparent trading environment, emphasizing competitive spreads, clear fee structures, and well-defined trading rules.

Spreads

- Standard Assessment: Features floating spreads with no commission fees across all asset classes.

- RAW Assessment: Offers raw spreads starting from 0.1 pips, with a commission of $2.5 per lot per transaction.

This flexibility allows traders to choose an account that best aligns with their trading strategies and cost preferences.

Fees

- Commission Fees:

- Standard Assessment: No commission fees across all asset classes.

- RAW Assessment: $2.5 per lot per transaction.

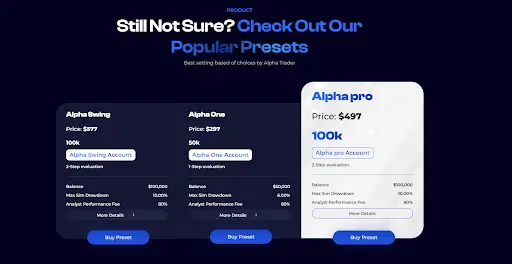

- Evaluation Fees: Traders can select from various account sizes with corresponding fees:

- $10,000 account: $97

- $25,000 account: $197

- $50,000 account: $297

- $100,000 account: $497

- $200,000 account: $997

Trading Rules

- Profit Targets:

- Phase 1: 8% profit target.

- Phase 2: 5% profit target.

- Drawdown Limits:

- Maximum Daily Loss: 5% of the initial account balance.

- Maximum Overall Loss: 10% of the initial account balance.

- Trading Days: Unlimited trading days are provided to complete the assessment, allowing traders to operate at their own pace.

- Leverage: Set at 1:100 across all instruments, enabling traders to manage positions effectively.

- Best Day Rule: No single trading day should account for more than 40% of the total generated profits. For instance, if a trader earns $1,000 on a particular day, they can request a withdrawal only after the account balance exceeds $2,500, ensuring the $1,000 does not represent more than 40% of total profits.

By understanding these trading conditions, traders can align their strategies with Alpha Capital Group’s expectations, fostering a disciplined and informed trading approach.

Subscription and Payment Methods at Alpha Capital Group

Alpha Capital Group offers a variety of subscription options and payment methods tailored to accommodate traders’ diverse needs. Understanding these options is crucial for traders aiming to engage with the firm’s funding programs effectively.

Subscription Options and Associated Fees

Alpha Capital Group provides multiple assessment programs, each with distinct structures and associated fees. The primary programs include:

- Alpha Pro – 2-Step Challenge: This program requires traders to achieve an 8% profit target in the first phase and a 5% target in the second phase. The one-time fees for this program are as follows:

| Account Size | Challenge Fee (USD) | Refundable |

| $5,000 | $70 | Yes |

| $10,000 | $97 | Yes |

| $25,000 | $247 | Yes |

| $50,000 | $397 | Yes |

| $100,000 | $647 | Yes |

| $200,000 | $997 | Yes |

- Alpha One – 1-Step Challenge: This program offers a streamlined evaluation process with a single assessment phase. The fee structure is as follows:

| Account Size | Challenge Fee (USD) | Refundable |

| $5,000 | $50 | Yes |

| $10,000 | $100 | Yes |

| $25,000 | $250 | Yes |

| $50,000 | $375 | Yes |

| $100,000 | $497 | Yes |

| $200,000 | $997 | Yes |

Refund Policy

Alpha Capital Group offers a trader-friendly refund policy:

- Refundable Fees: The challenge fee is refunded once you become a funded trader.

Available Payment Methods

To facilitate a seamless subscription process, Alpha Capital Group supports a variety of payment methods:

| Payment Method | Availability | Processing Time |

| Bank Transfer | Worldwide | 1-3 business days |

| Credit/Debit Card | Visa, MasterCard | Instant |

| E-Wallets | PayPal, Rise, Wise | Instant |

| Cryptocurrency | Bitcoin, Ethereum | Within a few hours |

Payout Methods

For performance fee payouts, Alpha Capital Group offers multiple methods:

- Rise: A platform facilitating quick and secure transactions.

- Wise: Known for its low fees and favorable exchange rates for international transfers.

- Bank Transfer: Traditional method suitable for direct deposits into bank accounts.

Traders often inquire about Alpha Capital Group payout time, and the company ensures timely processing across all available payout methods.

Commission Fees

Alpha Capital Group’s fee structure varies based on the chosen assessment type:

- Standard Assessment: Zero commission fees are applicable across all asset classes.

- RAW Assessment: A charge of $2.5 per lot is incurred for each transaction in both directions. Notably, indices are commission-free across both account types.

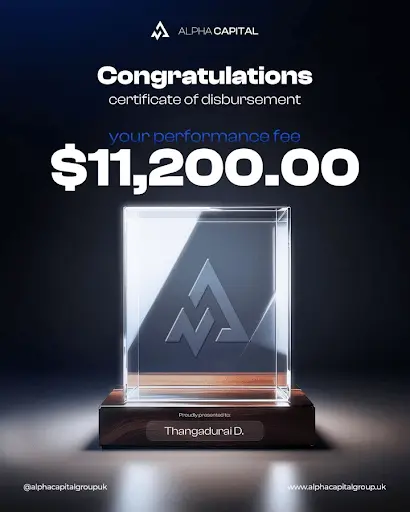

Payment Proof

Alpha Capital Group ensures transparency in its payout process, with multiple traders sharing proof of successful withdrawals, including the Alpha Capital Group certificate of performance for verified traders. Performance fees are processed through secure methods like Rise, Wise, and bank transfers. One notable example is Alpha Capital Group payout recipient Ashley Govender, who earned a $4,031 performance fee — a testament to the firm’s consistent and reliable payment process. Many traders have confirmed receiving payouts on platforms such as Trustpilot, Reddit, and trading forums, showcasing Alpha Capital Group’s reliability. For those looking into Alpha Capital Group withdrawal methods, options like bank transfers, Wise, and Rise provide secure and efficient transactions.

For more verification, traders can check official reviews and testimonials on the company’s website and social media.

Third-Party Payments

It’s important to note that Alpha Capital Group does not accept payments made via third-party cards or accounts. All transactions related to assessment purchases and account trading must be conducted in the name of the cardholder.

Performance Fee On-Demand

Traders have the flexibility to request performance fee payouts on-demand, provided they adhere to the 40% Best Day Rule and have a minimum of 2% of gross profits on the account balance. This feature allows traders to access their earnings without waiting for a fixed payout schedule.

In summary, Alpha Capital Group offers a comprehensive and flexible approach to subscriptions and payments, catering to the diverse needs of traders. The variety of assessment programs, transparent fee structures, multiple payment options, and flexible payout methods make it a compelling choice for both novice and experienced traders seeking funding opportunities.

Alpha Capital Group vs Blue Guardian vs Quant Tekel: A Comparative Overview

When evaluating proprietary trading firms, it’s essential to compare key aspects such as evaluation processes, funding options, leverage, profit targets, fee refunds, payout schedules, and support structures. Below is a comparative overview of Alpha Capital Group, Blue Guardian, and Quant Tekel based on available information.

| Aspect | Alpha Capital Group | Blue Guardian | Quant Tekel |

| Evaluation Time Limit | No limit (pass at own pace) | No time limit in all phases | Information not specified |

| Funding Options | 2-step evaluation accounts: Alpha Pro and Alpha Swing, with funding up to $200,000 | Evaluation accounts with funding up to $800,000 | Evaluation accounts with funding up to $200,000 |

| Scaling Potential | Up to $2 million through scaling plan | Information not specified | Information not specified |

| Leverage | Alpha Pro: Up to 1:100; Alpha Swing: Up to 1:30 | 1:100 maximum leverage | Information not specified |

| Profit Targets | Phase 1: 10%; Phase 2: 10% | Phase 1: 8%; Phase 2: 4% | Stage 1: 8%; Stage 2: 5% |

| Fee Refund | Refundable upon first profit withdrawal | Refundable upon reaching Guardian Trader status | Information not specified |

| Payout Schedule | Bi-weekly (every two weeks) | Bi-weekly (every two weeks) | Bi-weekly (every two weeks) |

| Support & Community | Live chat and email support; limited educational resources | 24/7 support; active trader community | Information not specified |

Key Takeaways:

- Alpha Capital Group offers a flexible evaluation process with no time limits and provides a scaling plan that allows traders to grow their virtual capital up to $2 million. However, the firm has limited educational resources and lacks phone support.

- Blue Guardian provides substantial funding opportunities up to $800,000 with no time constraints during evaluations. The firm also offers a high-profit split of up to 90% and maintains an active trader community with 24/7 support.

- Quant Tekel has a structured evaluation process with clear profit targets and drawdown limits. The firm offers bi-weekly payouts with an 80% profit split.

Each firm caters to different trader preferences. Alpha Capital Group is suitable for traders seeking flexibility and significant scaling potential. Blue Guardian appeals to those aiming for higher initial funding and profit splits without time pressures. Quant Tekel offers a clear evaluation structure with competitive profit-sharing, making it a viable option for disciplined traders.

Alpha Capital Group Trader Community and Support

Alpha Capital Group has developed a robust ecosystem to support and enhance the trading experiences of its analysts. This comprehensive support system includes educational resources, active community engagement platforms, and dedicated customer support services, all aimed at fostering trader development and success.

Educational Resources & Webinars

Central to Alpha Capital Group’s commitment to trader education is its comprehensive Help Center, which offers a wealth of resources to assist traders at all levels. The Help Center provides detailed articles covering various topics, including platform setup guides, trading strategies, risk management, and frequently asked questions. For instance, traders can access the cTrader Setup Guide, which offers step-by-step instructions on downloading, installing, and configuring the cTrader platform. Additionally, Alpha Capital Group offers insights into mastering risk management, guiding traders on effective strategies to manage risks within their proprietary trading framework. These resources are designed to enhance traders’ knowledge and skills, promoting informed decision-making and consistent profitability.

Community Engagement & Social Presence

Alpha Capital Group fosters a vibrant community through multiple channels:

- Discord Channel: An exclusive platform where traders can engage in real-time discussions, share insights, and collaborate on trading strategies. This active community, known as the Alpha Capital Group Discord, facilitates idea exchange and mutual support among traders.

- Trader Interviews: The firm showcases interviews with successful analysts, providing insights into proven strategies and expert perspectives. These interviews serve as both inspiration and education for the trading community.

- Social Media Presence: Alpha Capital Group maintains active profiles on platforms like Twitter, regularly sharing updates, educational content, and success stories to keep the community informed and engaged.

These initiatives underscore Alpha Capital Group’s dedication to fostering a supportive and interactive trading environment.

24/7 Trader Support & Success Team

Recognizing the dynamic nature of trading, Alpha Capital Group offers dedicated customer support to ensure traders’ needs are promptly addressed:

- Multilingual Support: Assistance is available in multiple languages, ensuring traders from diverse backgrounds can communicate effectively.

- Multiple Communication Channels: Traders can reach the support team via email, live chat, and the Discord channel during business hours. While email support is available on weekdays from 08:00 to 20:00 GMT, the Discord channel offers a platform for real-time assistance and community support.

This robust support system ensures that traders have access to timely and effective assistance, enhancing their overall trading experience.

Knowledge Base & Help Center

Alpha Capital Group’s comprehensive Help Center serves as a valuable resource for traders, offering detailed information on trading objectives, account management, and platform navigation. This repository empowers traders to find answers to common questions and effectively resolve issues, promoting a smoother trading experience. Additionally, traders can stay updated with the latest news and developments through the Help Center, ensuring they are informed about important updates and changes.

Community Initiatives & Giveaways

To further enrich the trader experience, Alpha Capital Group organizes various community initiatives, including trader interviews, educational content, and exclusive giveaways—such as limited-time Alpha Capital Group discount codes for premium tools. These activities not only incentivize participation but also strengthen the sense of community among traders, fostering a collaborative and supportive environment.

Why It Matters

Alpha Capital Group’s dedication to providing extensive educational resources, fostering community engagement, and offering unwavering support plays a pivotal role in trader development. Through initiatives like the Alpha Capital Group competition, traders can test their skills in a structured environment while gaining hands-on experience. These support systems, including mentorship programs and the Alpha Capital Group competition challenges, equip traders with the necessary tools, knowledge, and guidance to navigate the complexities of trading, manage risks effectively, and work towards achieving consistent profitability.

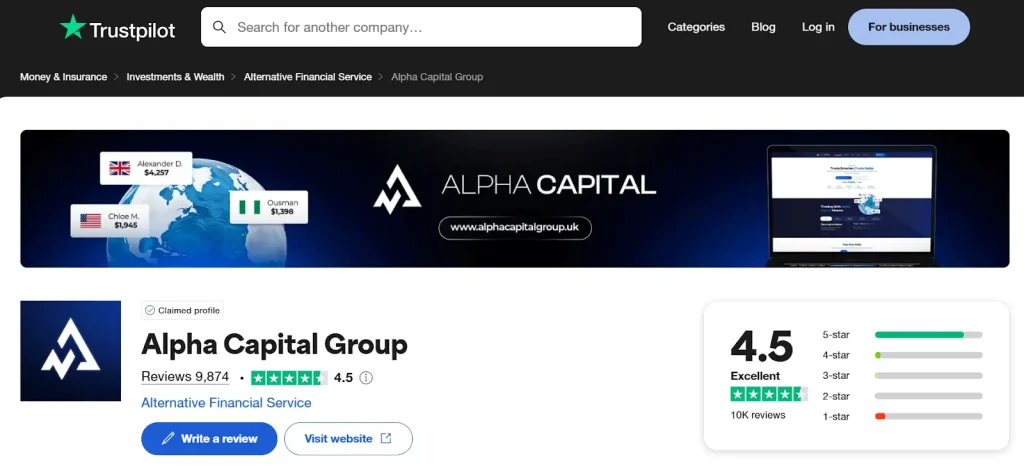

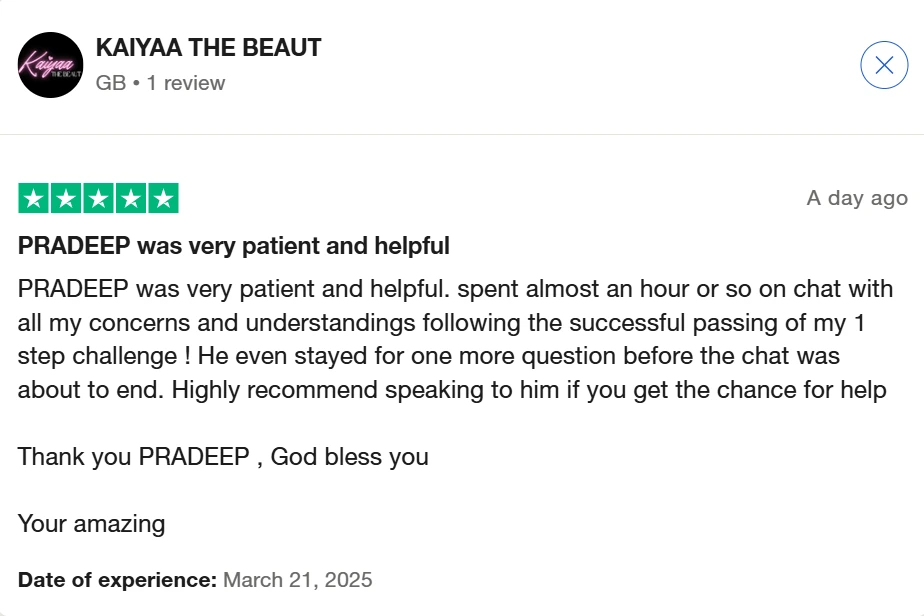

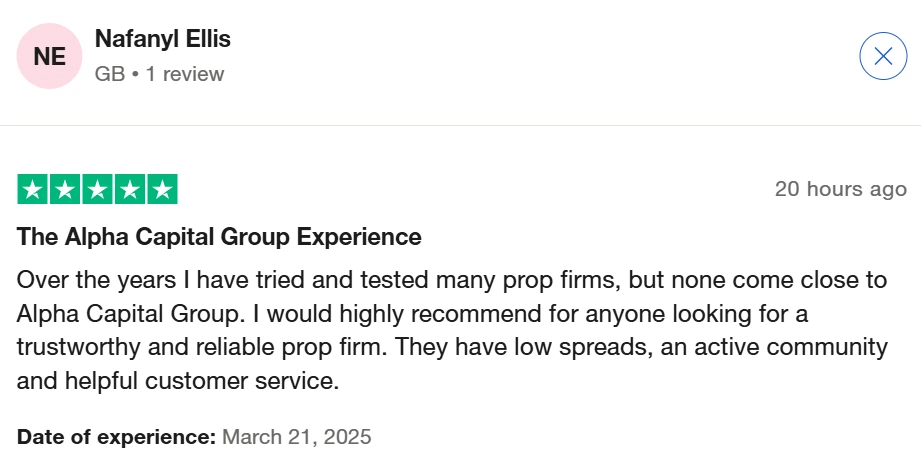

Traders’ Opinion

Alpha Capital Group Trustpilot has 9,874 reviews from users and an impressive 4.5 average rating out of five stars. They also provide a prompt and dependable customer service team that can answer any questions you may have. If you have any kind of issue, they will assist you and point you in the right direction so that you can fix it.

Another community member echoed the praise for their excellent support staff. They answer quickly and efficiently, and they always point you in the right direction to find what you need.

The majority of users are impressed by Alpha Capital Group’s user-friendly interface and the absence of trading commissions.

Alpha Capital Group: Pros and Cons

Evaluating the strengths and weaknesses of Alpha Capital Group is essential for traders considering their proprietary trading programs. Understanding these aspects helps align the firm’s offerings with individual trading goals and risk tolerance.

| Pros | Cons |

| Access to Significant Capital: Alpha Capital Group offers traders the opportunity to manage accounts up to $2,000,000, enabling substantial profit potential without risking personal funds. | Subscription-Based Fees: Unlike many proprietary trading firms that operate on one-time evaluation fees, Alpha Capital Group uses a subscription-based model, with fees ranging from $79 to $239 per month depending on the account size. This can become costly for traders requiring longer evaluation periods. |

| Competitive Profit Sharing: Traders can retain 80% of their profits, aligning incentives and rewarding successful trading strategies. | Strict Evaluation Process: The firm’s evaluation process requires adherence to specific trading objectives, which can be stringent and challenging for some traders. |

| Diverse Asset Offering: Alpha Capital Group supports trading across various assets, including forex pairs, commodities, and indices, allowing for diversified trading strategies. | Risk Management Rules: Traders must comply with strict risk management parameters, such as daily and overall drawdown limits, which may limit certain trading styles. |

| Comprehensive Support and Resources: The firm offers a professional trader dashboard, educational videos, market insights, mentoring, and custom-built technology to enhance trader performance. | Lot Size Limitations: Once funded, traders may face lot size limits, potentially restricting certain trading strategies. |

Keynotes:

- Alpha Capital Group’s model allows traders to leverage substantial capital without personal financial risk, making it an attractive option for skilled traders.

- The firm’s stringent evaluation process ensures that only disciplined and proficient traders manage their funds, maintaining high trading standards.

- Prospective traders should carefully consider the subscription-based fees and ensure they are comfortable with the imposed risk management rules before engaging with Alpha Capital Group.

Is Alpha Capital Group Worth It?

Alpha Capital Group has established itself as a notable name among Forex Prop Firms, offering traders access to funding up to $2,000,000. This substantial capital allocation allows traders to implement and scale diverse trading strategies without risking personal funds. The firm provides a variety of evaluation programs, including two-step, one-step, and three-step processes, catering to different trading styles and preferences. Traders benefit from an 80% profit split, competitive leverage up to 1:100, and the flexibility to trade various financial instruments such as forex pairs, commodities, and indices.

If you’re considering joining, it’s worth checking whether Alpha Capital Group has an active promo code—this could help reduce the cost of your evaluation phase. Beyond potential discounts, the firm offers a comprehensive support system featuring educational videos, market insights, mentoring, and custom-built technology to enhance trader performance. However, the firm’s subscription-based fee structure, ranging from $79 to $239 per month depending on the account size, may become costly for traders requiring longer evaluation periods.

Overall, Alpha Capital Group presents a compelling opportunity for traders seeking substantial funding and robust support, provided they are comfortable with the ongoing subscription fees.

Final Verdict

Alpha Capital Group has quickly built a strong reputation in the prop trading industry, offering up to $2,000,000 in funding with an 80% profit split. Its flexible evaluations, advanced platforms, and trader-focused resources make it an attractive choice. However, the subscription-based fees may be a drawback for some. It’s a solid option for traders seeking substantial capital and professional growth.

FAQs

Is Alpha Capital Group Legit?

Alpha Capital Group is a verified proprietary trading firm with positive Trustpilot reviews, offering funded accounts since 2020 to traders worldwide (excluding restricted regions).

Is Alpha Capital Group Regulated?

While not directly regulated, the firm partners with FCA-licensed brokers for trade execution, ensuring compliance with financial standards for client funds.

What is Alpha Capital Group?

A prop trading firm providing evaluation-based funded accounts up to $100,000, with profit splits of 80-90% across forex, indices, and commodities.

Does Alpha Capital Group Accept US Clients?

No, Alpha Capital Group does not accept US clients or traders from Canada and OFAC-sanctioned countries due to regulatory restrictions.

What Are Alpha Capital Group’s Fees?

Traders pay a one-time evaluation fee (99–499 based on account size) and a 10-20% profit share, with no recurring monthly charges.

How Long Do Withdrawals Take?

Withdrawal processing typically takes 3-5 business days for e-wallets and 5-7 days for bank transfers after initial account verification.