Blue Guardian

Blue Guardian is committed to the professional growth of its traders. Clients are expected to be disciplined individuals who take risk management seriously and prioritize consistency over the short term. They can manage accounts worth up to $200,000 while keeping 85% of the profits for themselves. To do this, they can trade in foreign currency pairs, commodities, stock indexes, and digital currencies

Blue Guardian

Blue Guardian is committed to the professional growth of its traders. Clients are expected to be disciplined individuals who take risk management seriously and prioritize consistency over the short term. They can manage accounts worth up to $200,000 while keeping 85% of the profits for themselves. To do this, they can trade in foreign currency pairs, commodities, stock indexes, and digital currencies

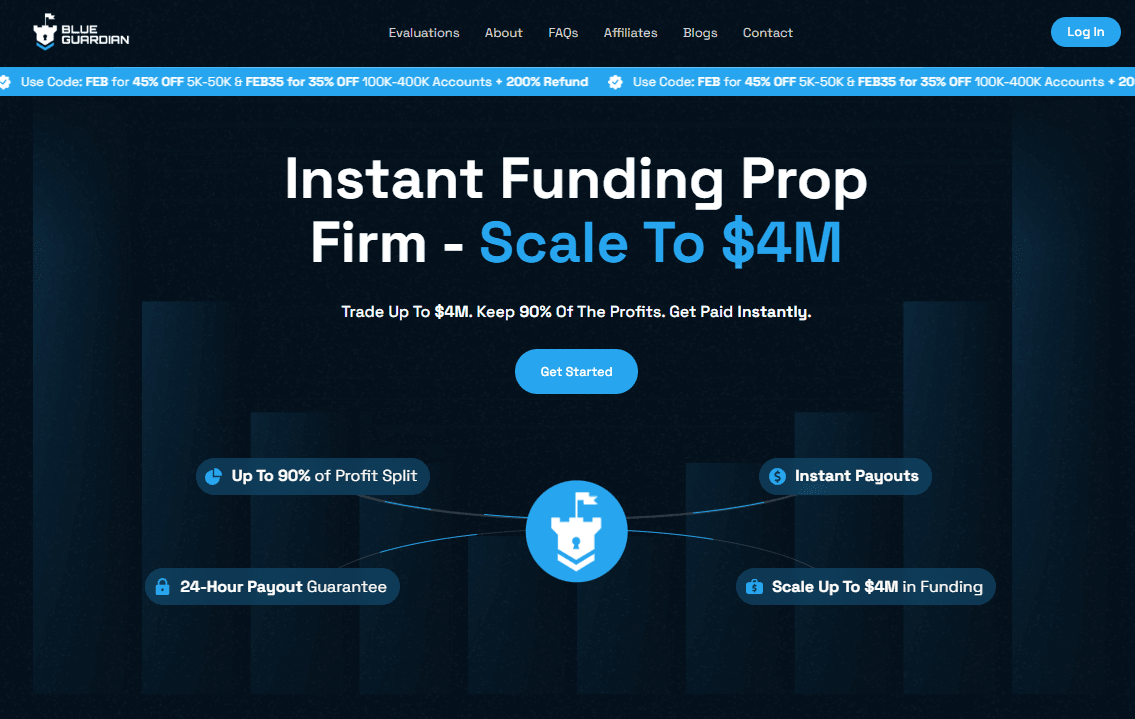

About Blue Guardian

Blue Guardian redefines the funding experience for traders with its user-friendly design, essential information, and state-of-the-art technology. Experience a best-in-class funding journey and embrace the innovative ideas of Blue Guardian.

Blue Guardian is a proprietary trading firm that provides traders with access to funded accounts, allowing them to trade with significant capital while following structured risk management guidelines. Established in 2021 with the goal of fostering disciplined trading, Blue Guardian has positioned itself as a competitive player in the proprietary trading industry.

One of the defining aspects of Blue Guardian is its profit-sharing structure, which enables traders to retain up to 90% of their earnings. The firm offers various account sizes and funding tiers, ranging from $5,000 to $400,000, with scaling opportunities into the millions. If you’re considering joining this firm, our Blue Guardian Review explores whether its funding opportunities align with your trading goals.

Additionally, Blue Guardian operates with a strong emphasis on transparency and trader support. It ensures direct market access execution and maintains a streamlined trading environment with institutional-grade trading conditions. Traders can access global financial markets, including forex, commodities, indices, metals, and cryptocurrencies, using platforms like MetaTrader 4, MetaTrader 5, DXTrade, MatchTrader, and TradeLocker.

With its structured evaluation process, competitive profit-sharing model, and robust trader support system, Blue Guardian Review highlights why this firm stands out as a viable choice for traders seeking a funded career. Committed to risk management and sustainability, the firm remains a reputable option in the proprietary trading space.

Who is Blue Guardian?

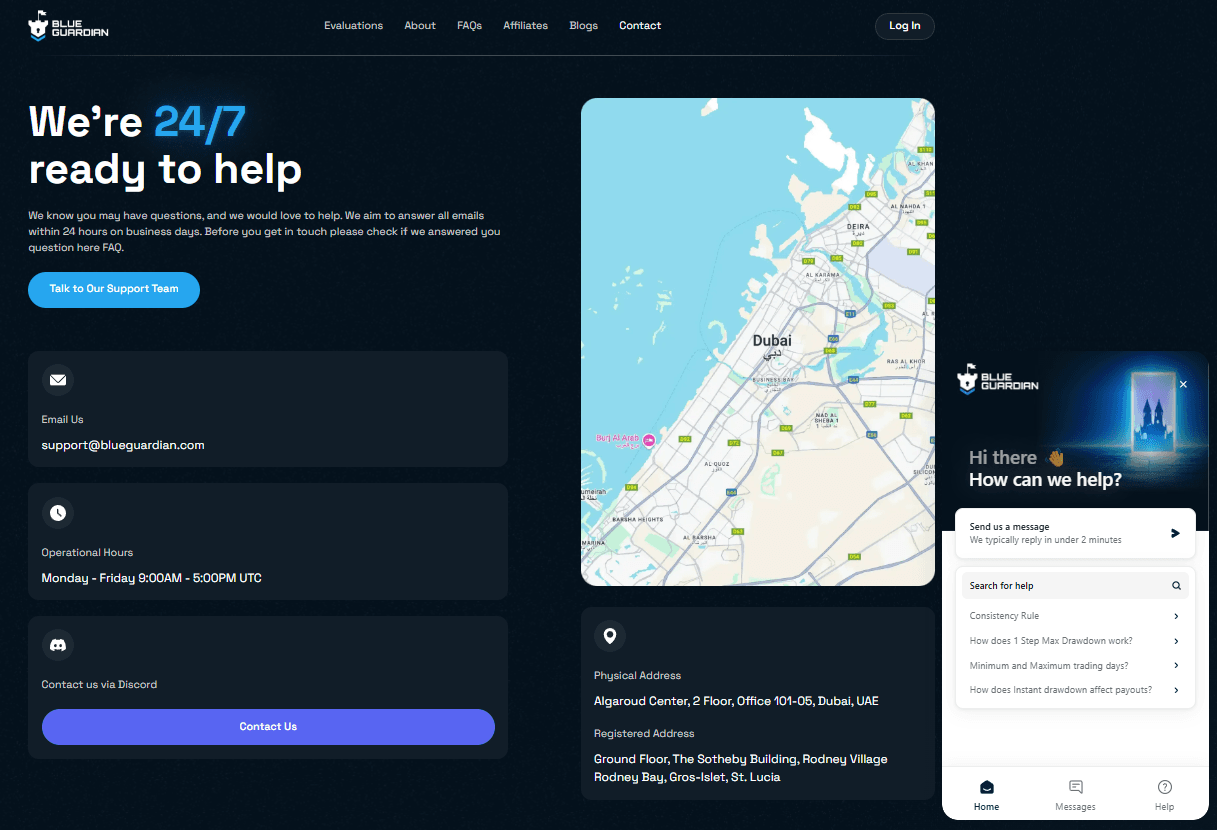

Blue Guardian is a proprietary trading firm founded in 2021, headquartered in Dubai Silicon Oasis, UAE, and legally registered in Saint Lucia. The firm provides traders with access to substantial capital through structured evaluation programs, offering funded trading accounts with balances reaching up to $400,000 and scaling opportunities up to $1.8M–$4M.

Unlike many prop firms, Blue Guardian promotes consistency by implementing flexible evaluation models, ensuring that only skilled traders gain access to live capital. Many traders looking for a reliable prop firm turn to detailed Blue Guardian reviews to assess its credibility, payout structure, and overall performance.

A key feature that sets Blue Guardian apart is its profit-sharing model, allowing traders to retain up to 90% of their profits. Additionally, the firm offers raw spreads, low commissions, and advanced trading platforms, ensuring optimal trading conditions. Blue Guardian supports trading in forex, commodities, indices, metals, and cryptocurrencies, catering to a wide range of traders.

With a strong focus on community engagement and trader development, Blue Guardian provides educational resources, mentorship programs, and the Guardian Shield feature—an automated tool designed to prevent excessive losses and promote responsible trading.

In summary, Blue Guardian is a rapidly growing prop firm that blends capital funding with structured risk management, offering a competitive environment for traders looking to scale their trading careers.

Brokers Used by Blue Guardian

Blue Guardian operates with a direct market access model, utilizing top-tier liquidity providers to ensure optimal trading conditions for its funded traders. The firm supports MetaTrader 4, MetaTrader 5, DXTrade, MatchTrader, and TradeLocker, five of the most widely used trading platforms in the forex and CFD markets. These platforms provide traders with advanced charting tools, automated trading capabilities, and seamless execution.

While Blue Guardian does not publicly disclose its partnered broker, it ensures that all trading accounts operate with raw spreads, low commissions, and fast execution speeds. This setup is designed to provide institutional-grade trading conditions, minimizing slippage and optimizing trade execution.

By integrating with well-established platforms and liquidity providers, Blue Guardian maintains a transparent and efficient trading environment, allowing traders to focus on their strategies without concerns about execution quality or pricing discrepancies.

Blue Guardian Review: Funding Programs & Scaling Plans

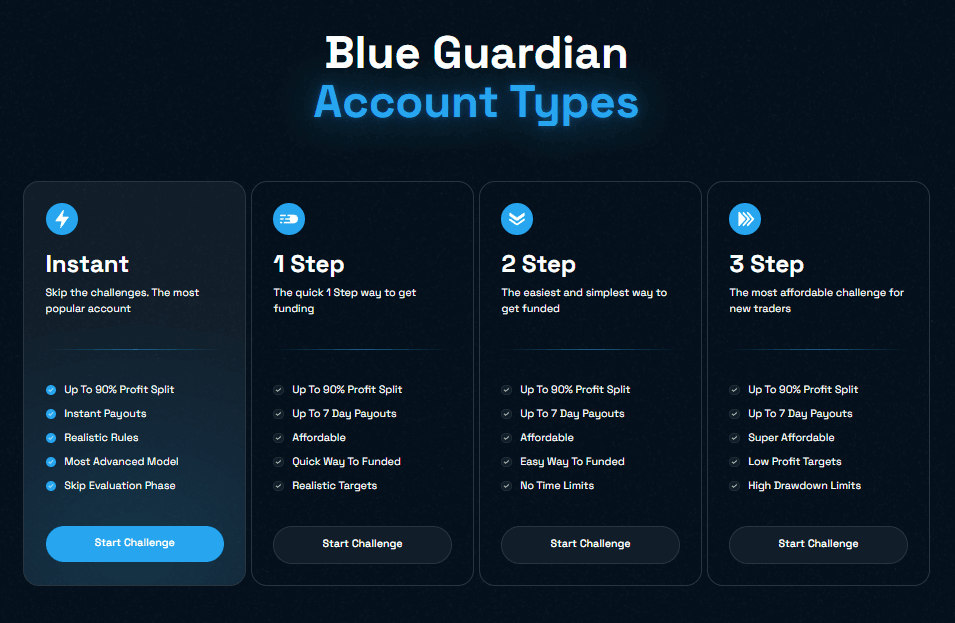

Blue Guardian offers a variety of funding programs tailored to traders of different experience levels and risk preferences. Their funding options range from structured evaluations to instant funding, providing traders with the flexibility to choose a plan that suits their trading strategy. Blue Guardian’s instant funding rules outline the specific requirements traders must meet to qualify for direct capital access, ensuring a fair and transparent process.

Blue Guardian Capital is designed to support traders by offering competitive profit splits, a trader-friendly scaling plan, and diverse funding options that help traders grow their accounts progressively. For those looking for insights before joining, a detailed Blue Guardian review highlights these key features and how they compare to other prop firms in the industry.

Overview of Blue Guardian Funding Programs:

Scaling Plan

Blue Guardian provides a structured scaling plan for traders who demonstrate consistent profitability. After achieving a 12% profit over three months (with at least two profitable months), traders can increase their account balance by 30% of the initial capital. This dynamic scaling plan is often highlighted as a key advantage, allowing traders to systematically grow their accounts while maintaining favorable profit splits.

How to Get Funded with Blue Guardian?

Getting funded with Blue Guardian involves a structured process designed to assess a trader’s skill, discipline, and risk management. The firm offers multiple funding programs, including evaluation-based challenges and instant funding options, catering to different trader preferences. A detailed Blue Guardian funding review highlights the various options available for traders. Here’s how traders can secure funding with Blue Guardian:

1. Sign Up & Verify Your Account

Traders begin by registering on the Blue Guardian website and completing the verification process. This step ensures compliance with regulatory requirements and confirms eligibility. Once registered, traders can access their accounts through the Blue Guardian login portal to manage profiles, track evaluations, and monitor funded accounts.

2. Choose a Funding Program

Blue Guardian offers several funding models, each with distinct rules and profit targets:

- 2-Step Standard Evaluation – Two-phase challenge with an 8% profit target in Phase 1 and 4% in Phase 2.

- 2-Step Pro Evaluation – Similar to the Standard Evaluation but with modified conditions.

- 1-Step Evaluation – Single-phase challenge requiring a 10% profit target.

- 3-Step Evaluation – Three-phase evaluation with progressive profit targets (6% per phase).

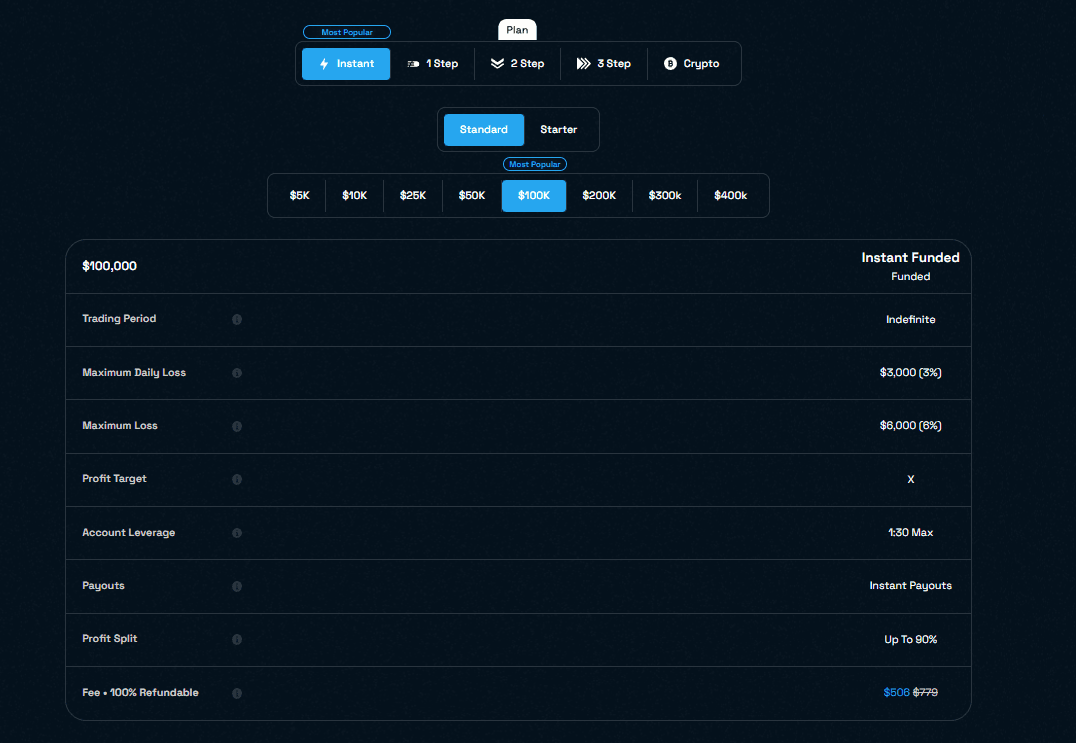

- Instant Funding – Traders receive a funded account immediately without going through an evaluation.

3. Pay the Program Fee

After selecting a funding program, traders pay the associated fee, which varies based on account size and evaluation type. Fees are non-refundable but remain competitive compared to industry standards.

4. Start Trading on Supported Platforms

Once payment is complete, traders receive credentials to access their trading platform. Blue Guardian supports MetaTrader 4, MetaTrader 5, DXTrade, MatchTrader, and TradeLocker. It is essential to follow program-specific trading conditions, including maximum drawdown limits and leverage rules.

5. Meet Profit Targets & Risk Rules

To pass the evaluation (if applicable), traders must achieve the required profit target while adhering to Blue Guardian’s risk management rules. Unlike some firms with strict time limits, Blue Guardian provides reasonable flexibility for traders to complete the challenge.

6. Get Funded & Trade a Live Account

Successful traders receive a fully funded live account and a profit-sharing agreement. Blue Guardian offers profit splits of up to 90%, rewarding traders who maintain consistency and discipline.

7. Withdraw Profits & Scale Up

Funded traders can withdraw profits regularly, with Blue Guardian supporting multiple payout methods. Additionally, traders who meet scaling requirements (e.g., 12% profit in three months with at least two profitable months) can increase their account balance by 30%, unlocking larger trading opportunities.

Blue Guardian Trading Platforms & Trading Instruments

Blue Guardian offers traders access to a diverse array of trading instruments across multiple asset classes, facilitated through advanced trading platforms designed to accommodate various trading styles. According to numerous Blue Guardian reviews, traders praise the advanced features and accessibility of these platforms.

Market Instruments

Traders with Blue Guardian can engage in trading the following asset classes:

- Forex (FX): A broad selection of currency pairs, including majors, minors, and exotics.

- Metals: Precious metals such as gold and silver.

- Indices: Major global stock indices.

- Cryptocurrencies: Popular digital currencies.

- Other Commodities: Various commodities for diversification.

Trading Platforms

Blue Guardian supports a range of powerful trading platforms designed to meet diverse trader needs:

- TradeLocker – Advanced charting tools and user-friendly interface.

- MatchTrader – Robust features and real-time analytics, supports algorithmic trading.

- MetaTrader 4 (MT4) & MetaTrader 5 (MT5) – Industry-standard platforms with customizable layouts and automated trading.

- DXTrade – Flexible platform with advanced order management.

Leverage and Commissions

Leverage ratios and commission structures vary depending on the funding program and asset class:

- Leverage:

- Forex: Up to 1:100 for evaluation programs; 1:30 for instant funding accounts.

- Metals & Indices: Up to 1:20 for evaluation programs; 1:10 for instant funding accounts.

- Cryptocurrencies: Up to 1:2 across all programs.

- Commissions:

- Forex & Metals: $5 per lot traded.

- Indices & Cryptocurrencies: No commission fees.

Blue Guardian Trading Conditions: Spreads, Fees, and Rules

Blue Guardian provides traders with a competitive trading environment, offering tight spreads, low commissions, and clear risk management rules to ensure a structured trading experience. Reviews highlight the firm’s commitment to transparency by eliminating hidden fees and maintaining fair trading conditions.

Spreads & Liquidity

Blue Guardian delivers institutional-grade liquidity, allowing for tight raw spreads on major forex pairs and other assets. Traders can expect:

- Forex Pairs: Major pairs like EUR/USD typically have raw spreads starting near 0.2–0.5 pips.

- Gold & Metals: XAU/USD spreads remain competitive, though they may widen during high volatility.

- Indices & Commodities: Major stock indices and commodities maintain low spreads for cost-efficient trading.

- Crypto: Variable spreads apply depending on market liquidity.

Commissions & Fees

Blue Guardian’s fee structure is designed to minimize trading costs:

- Forex & Metals: $5 per lot traded.

- Indices & Cryptocurrencies: Zero commission — traders only pay the spread.

- No recurring fees: Traders pay a one-time challenge fee for evaluations.

- No withdrawal fees: Profits are paid without deductions, except for third-party processing charges.

Risk Management Rules

Blue Guardian enforces industry-standard risk rules to maintain trader discipline:

- Daily Loss Limit: Typically 5% on evaluation accounts.

- Max Drawdown: 10% for evaluation programs.

- Trading Rules: Traders must adhere to program-specific guidelines, including leverage restrictions.

- News Trading & Holding Positions: Permitted, but subject to program rules.

No Hidden Costs

Once a trader is funded, there are no ongoing costs, inactivity fees, or platform fees. Blue Guardian aligns its interests with traders, ensuring profitability remains in the hands of the trader without unnecessary financial burdens.

Subscription and Payment Methods at Blue Guardian

Blue Guardian offers a variety of funding programs tailored to accommodate traders with diverse strategies and risk appetites. Understanding the subscription options, associated fees, available payment methods, withdrawal policies, and refund procedures is crucial for prospective participants.

Subscription Options and Associated Fees

Blue Guardian provides five distinct funding programs:

- 2-Step Standard Evaluation

- Phase 1: 8% profit target, max 4% daily loss, 8% max drawdown. Minimum of 3 trading days, no maximum time limit.

- Phase 2: 4% profit target under the same risk parameters.

- Pricing (verified):

- $10,000 account: $87

- $25,000 account: $187

- $50,000 account: $297

- $100,000 account: $497

- $200,000 account: $947

- Phase 1: 8% profit target, max 4% daily loss, 8% max drawdown. Minimum of 3 trading days, no maximum time limit.

- 2-Step Pro Evaluation – Similar structure to Standard but with slightly different conditions. Pricing details are not clearly published.

- 1-Step Evaluation – Single-phase challenge requiring a 10% profit target. Specific pricing varies by account size.

- 3-Step Evaluation – Three-phase challenge with progressive profit targets (6% per phase). Pricing details are not fully disclosed.

- Instant Funding – No evaluation required. Traders start with live capital immediately. Pricing depends on account size, but official fee details are limited.

Available Payment Methods

Blue Guardian accepts multiple payment methods to accommodate global traders:

- Credit/Debit Cards – Major cards supported.

- Cryptocurrencies – Accepted for payments.

Withdrawal Policies

Blue Guardian ensures smooth profit withdrawals:

- Payout Frequency: Bi-weekly (every 14 days).

- Minimum Withdrawal Amount: $150.

- Payout Methods: Riseworks or cryptocurrencies.

- Flexibility: Traders can retain profits in accounts to increase their max drawdown allowance.

Refund Policy

Blue Guardian generally does not offer refunds on challenge fees. Refunds are only possible in rare cases (e.g., duplicate payments). Traders should carefully review terms before purchasing.

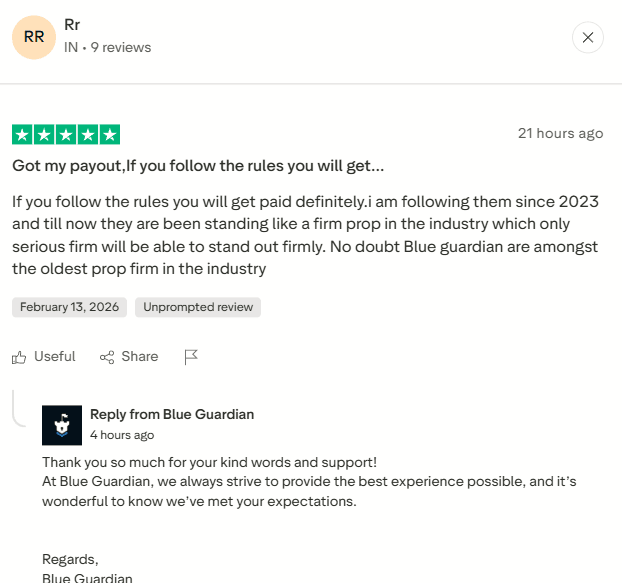

Payment Proof

Blue Guardian emphasizes transparency by sharing payout proofs. They regularly post verified payment evidence and trader testimonials on their Telegram channel and other community platforms.

Blue Guardian vs. FXIFY vs. FundedNext: A Comparative Overview

Prop trading firms offer traders a pathway to larger capital without personal financial risk, but the structures, funding programs, and trading conditions vary significantly across firms. Blue Guardian, FXIFY, and FundedNext are three prominent names in the industry, each catering to different trading styles and risk tolerances.

- Blue Guardian provides a structured evaluation process with bi-weekly payouts and competitive leverage for forex traders. Its profit targets are moderate (8% Phase 1, 4% Phase 2), and the scaling potential reaches up to $2M. Traders can get their challenge fees refunded after their fourth payout, which is a unique benefit for long-term participants.

- FXIFY emphasizes aggressive scaling, allowing traders to grow their accounts quickly. It offers high leverage and multiple trading instruments, but its evaluation process is strict, requiring traders to meet profit targets within a time limit.

- FundedNext is known for its refund policy, where traders receive their challenge fees back upon their first payout. It provides both evaluation and instant funding models, appealing to traders who want flexibility. While its payout structure is monthly, its strong trader resources and community support make it attractive.

Key Takeaways

- Blue Guardian is ideal for traders seeking structured challenges, steady scaling, and reliable bi-weekly payouts.

- FXIFY caters to aggressive traders aiming for rapid growth with high leverage.

- FundedNext appeals to traders who want early refunds, instant funding options, and a flexible trading environment.

Each firm serves a unique trader profile, so the right choice depends on personal risk appetite, trading strategy, and long-term growth goals.

Blue Guardian Trader Community and Support

Blue Guardian is committed to fostering a supportive environment for traders, offering resources and platforms to enhance their trading experience. This commitment is frequently highlighted in reviews and comparisons.

Educational Resources & Webinars

- Blue Guardian provides a trading blog covering topics such as technical analysis, risk management, trading psychology, and strategy development.

- They host webinars, workshops, and Q&A sessions, offering real-time insights.

- Funded traders often share interviews and success stories, which help new participants learn from practical experiences.

Community Engagement & Social Presence

- Blue Guardian maintains an active presence on YouTube, Twitter (X), LinkedIn, Discord, Telegram, and Instagram.

- They share market updates, strategy tips, and trader highlights.

- Traders also discuss experiences in Reddit threads, including payout proofs and trading rules.

24/7 Trader Support & Success Team

- Blue Guardian offers round-the-clock live chat, email, and phone support.

- Their Trader Success Team helps clarify rules, guide traders, and encourage disciplined strategies.

- Many reviews highlight their responsiveness and clear communication.

Knowledge Base & Help Center

- A detailed FAQ and knowledge base covers trading rules, drawdown limits, and payout procedures.

- This reduces reliance on direct support for common questions.

Community Initiatives & Giveaways

- Blue Guardian organizes giveaways, contests, and trader spotlights, sometimes offering free challenge accounts.

- Promotions and coupon codes provide discounts on challenge fees.

Why It Matters

Unlike many prop firms that focus only on funding, Blue Guardian invests in education, engagement, and trader success. This ensures traders receive not just capital but also the tools and knowledge for long-term growth.

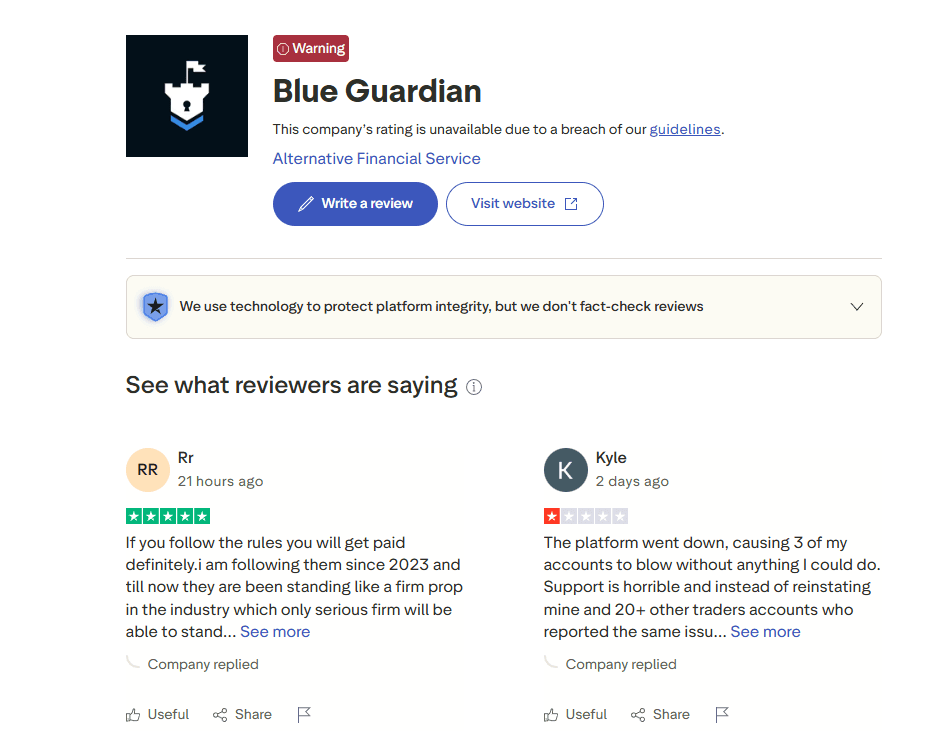

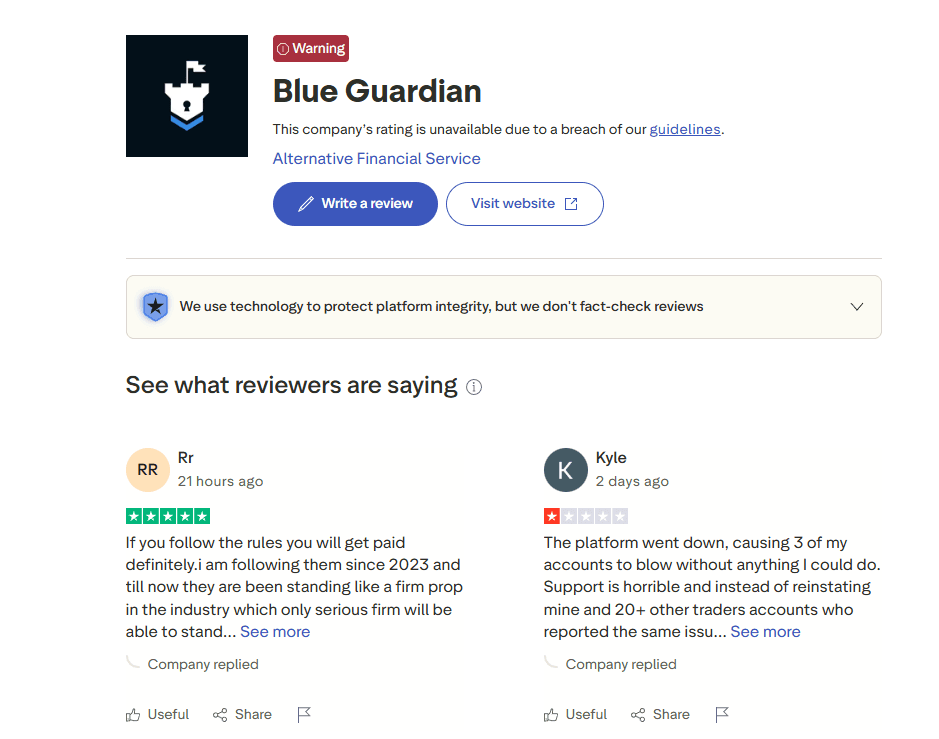

Trader’s Opinion

Traders have a positive opinion of Blue Guardian. The company has received high ratings and positive reviews on platforms like Trustpilot. Many traders specifically check Blue Guardian Trustpilot reviews to gauge real user experiences before joining. Clients appreciate the clear and prompt responses they receive from Blue Guardian, and the evaluation phase requirements are seen as reasonable.

Blue Guardian Review: Pros & Cons

As highlighted in this comprehensive Blue Guardian review, the firm is a proprietary trading company offering traders access to significant capital and a supportive trading environment. Below is a concise overview of its key strengths and potential limitations:

Key Takeaways

- Blue Guardian is suitable for traders seeking flexible evaluation timelines, substantial funding options, and generous profit-sharing arrangements.

- The firm’s allowance for diverse trading styles, including EAs and copy trading, caters to various strategies.

- Potential drawbacks include the multi-step evaluation process and the requirement to achieve four payouts before fee refunds, which may not align with all traders’ preferences.

- Overall, Blue Guardian offers a supportive environment with attractive financial incentives for disciplined and strategic traders.

Is Blue Guardian Worth It?

For dedicated traders seeking substantial capital and flexible trading conditions, Blue Guardian presents a compelling proposition. As highlighted in this Blue Guardian review, funding programs offer account sizes up to $400,000 and profit splits reaching 90%, allowing traders significant earning potential. The firm’s policy of no time limits during evaluation phases allows traders to progress at their own pace, reducing pressure and fostering a focus on consistent performance.

Additionally, Blue Guardian’s acceptance of various trading styles—including news trading, overnight, and weekend holding—provides the flexibility that many traders desire. However, it’s essential to consider the firm’s specific drawdown policies and leverage limitations, which may not align with all trading strategies. Overall, for disciplined traders who can operate within these parameters, Blue Guardian offers a robust platform for professional growth in the proprietary trading arena.

Final Verdict

Blue Guardian has established itself as a reputable prop firm with flexible evaluation structures, competitive profit splits, and a strong commitment to trader success. As emphasized in this Blue Guardian review, the firm provides a transparent Blue Guardian payout system, diverse funding options, and risk-management-friendly policies, making it a solid choice for serious traders. If you are looking for a prop firm that balances opportunity with stability, Blue Guardian is definitely worth considering.

Restricted Countries

Traders from the following countries are not eligible to participate in Blue Guardian 's programs:

Blue Guardian FAQs

Common questions about Blue Guardian challenges and trading rules

Does Blue Guardian accept US clients?

No, Blue Guardian does not accept traders from the United States due to regulatory restrictions. Traders should review the firm’s terms or contact customer support for the latest updates on country eligibility.

No, Blue Guardian does not accept traders from the United States due to regulatory restrictions. Traders should review the firm’s terms or contact customer support for the latest updates on country eligibility.

Yes, Blue Guardian is a legitimate proprietary trading firm established in 2022, offering structured evaluation processes and funded trading accounts.

To become a funded trader, you must pass Blue Guardian’s two-step evaluation process. After selecting your preferred account size and signing up for the evaluation, you’ll trade on a demo account to meet specific profit targets and risk management criteria. Upon successful completion, you’ll receive a funded account.

Blue Guardian offers account sizes of $10,000, $25,000, $50,000, $100,000, and $200,000. Traders can choose an account size that aligns with their trading strategies and goals.

Funded traders receive an 85% profit split by default, with an option to boost it to 90% at checkout.

Traders are eligible for a payout 14 days from their first trade on the funded account and then again 14 days after the first trade following a withdrawal. Payouts are processed within 1-2 business days. Withdrawals can be made through Riseworks.io, allowing transfers to bank accounts and cryptocurrencies. The minimum withdrawal amount is $500 for Riseworks.io and $100 for crypto withdrawals.

If an account violates the rules or trading parameters during the evaluation, it becomes ineligible for funding. On a funded account, such violations lead to account closure and termination of the Trader Agreement. Some violations may not be automatically identified and will be verified during an account review by the risk team.