FTMO is the fastest growing prop firm in the trading industry. To be a funded trader with FTMO, you must 2-steps Assessment phases on both of their offered funding models. Let’s see what more they have in bag to offer for the global traders.

In the dynamic world of proprietary trading, FTMO has carved a strong reputation by offering traders the opportunity to manage substantial capital without risking their own funds. Known for its rigorous evaluation process, FTMO has become a go-to prop trading firm for aspiring and professional traders. But is it really worth it in 2025? This FTMO review aims to provide an in-depth look into their challenge process, account types, pros and cons, fees, and more, helping you decide if FTMO is the right prop firm for you.

FTMO’s evaluation process consists of two primary stages: the FTMO Challenge and the Verification phase. Traders are required to meet specific profit targets while adhering to strict risk management rules. The evaluation process ensures that only disciplined and skilled traders progress to manage real accounts with capital allocations that can go up to $200,000. However, through consistent performance and scaling plans, traders can gradually work towards reaching the FTMO max allocation, allowing them to manage larger accounts over time. With a profit split starting at 80%—and increasing to 90% for consistent performers—FTMO is designed to reward successful trading while offering pathways to maximize capital growth.

This FTMO review will also cover the firm’s account types, supported platforms, and additional features that make it stand out in the competitive world of prop trading. Whether you’re a seasoned trader or new to the industry, understanding how FTMO operates is essential before taking on the challenge.

Who are FTMO?

FTMO is a proprietary trading firm established in September 2015, with its main offices situated in Prague, Czech Republic. This dynamic firm provides traders with the unique opportunity to trade with substantial capital, offering balances of up to $2,000,000. What sets FTMO apart is their attractive profit-sharing model, allowing traders to retain up to 90% of their trading profits. For anyone seeking an in-depth FTMO review, these features highlight why it’s a top choice among prop firms.

One of the key strengths of FTMO lies in their strategic partnership with a prominent liquidity provider. This collaboration ensures access to institutional-grade data feeds and enables a direct market access execution model for traders operating on their live corporate accounts. This direct access to the markets empowers traders with a competitive edge and enhances their trading experience.

FTMO’s headquarters can be found at Opletalova 1417/25, 110 00 Prague, Czech Republic. This central location not only serves as the heart of their operations but also exemplifies their commitment to transparency and accessibility for traders around the world.

In summary, FTMO stands out as a leading proprietary trading firm, offering substantial capital, attractive profit-sharing arrangements, and cutting-edge market access. As noted in many FTMO reviews, their strategic partnerships and commitment to excellence have positioned them as a trusted platform for traders looking to elevate their trading endeavors.

Brokers That Are Used By FTMO

FTMO operates as a proprietary trading firm, providing traders access to popular platforms like MetaTrader 4, MetaTrader 5, cTrader, and DXtrade. These platforms are supported by trusted liquidity providers, ensuring competitive spreads, low latency, and minimal slippage. While FTMO does not publicly disclose the names of these liquidity providers, it emphasizes offering a reliable and efficient trading environment, similar to top-tier FTMO brokers known for their robust trading infrastructure.

Notably, in 2025, FTMO announced the acquisition of OANDA, a well-established retail FX and CFDs broker, marking a significant expansion in its trading infrastructure. This strategic move not only strengthens FTMO’s market position but also reflects the firm’s dedication to providing a seamless experience for traders. For those researching FTMO brokers or seeking an in-depth FTMO review, understanding its technical setup is crucial for evaluating the firm’s overall trading experience.

Who is the CEO of FTMO?

Otakar Suffner is the CEO of FTMO, hailing from Prague. He holds a master’s degree in Economics from a major Prague university and also studied at Seoul National University in South Korea. Otakar is a fitness enthusiast who dedicates 3-4 days a week to sports like fitness, calisthenics, and kickboxing.

His trading journey began nearly a decade ago with Futures and later shifted to Forex and CFDs, offering more flexibility in position sizing. Otakar’s trading philosophy centers around statistics and probabilities, allowing him to craft unique and data-driven trading strategies. His leadership and innovative approach have played a significant role in shaping FTMO’s growth, as noted in various FTMO reviews. His story demonstrates that success in trading doesn’t always require a traditional educational path.

FTMO Scaling Plan & Funding Programs

FTMO offers traders a structured pathway to access significant capital through its funding programs and scaling plans. The process begins with a two-phase evaluation: the FTMO Challenge and Verification. The FTMO Challenge price varies depending on the account size, ensuring options for traders with different budgets. Additionally, beginners can take advantage of the FTMO Free Trial to experience the evaluation process before committing financially. Once traders pass the evaluation and start managing a funded account, they can benefit from the FTMO Scaling Plan, which allows consistent performers to gradually increase their account balance over time, rewarding long-term success and disciplined trading.

Upon successful completion, traders are granted an FTMO funded account with virtual funds, allowing them to trade in a simulated environment without risking personal capital. As highlighted in many FTMO reviews, this approach provides a clear and strategic route for traders to grow their accounts while minimizing initial risks.

Overview of FTMO Funding Programs

| Program | Key Features | Scaling & Profit Split | Who It’s For? |

| FTMO Account | – Two-phase evaluation process: FTMO Challenge and Verification. – Profit targets: 10% in Phase 1 and 5% in Phase 2. – Risk parameters: 5% maximum daily loss and 10% maximum loss. – Leverage up to 1:100. | – Eligible for a 25% account balance increase every four months upon achieving a 10% net profit, processing at least two rewards, and maintaining a positive account balance. – Profit split starts at 80% and can increase to 90% upon meeting scaling criteria. – Account balance can scale up to a maximum initial balance of $2,000,000. | Traders seeking a structured evaluation process with clear profit targets and risk parameters, aiming for consistent growth and higher profit sharing. |

FTMO also offers various FTMO account types to suit different trading strategies and experience levels, ensuring flexibility for traders to choose the most suitable option for their goals.

Key Takeaways:

- Structured Evaluation: FTMO’s two-phase evaluation process ensures that traders demonstrate consistent profitability and sound risk management before accessing funded accounts.

- Scaling Opportunities: Traders can progressively increase their account balance by 25% every four months, provided they achieve a 10% net profit, process at least two rewards, and maintain a positive account balance. This structure allows account balances to grow up to a maximum initial balance of $2,000,000.

- Profit Sharing: The profit split starts at 80% for the trader and can increase to 90% upon meeting the scaling criteria, incentivizing consistent performance and account growth.

Overall, FTMO’s funding programs and scaling plans are designed to reward disciplined and profitable traders, offering a clear pathway to manage increased capital over time. Any thorough FTMO review will highlight how these structured programs, coupled with flexible FTMO account types, provide ambitious traders with opportunities to grow and succeed in the proprietary trading space.

FTMO Review: How to Get Funded?

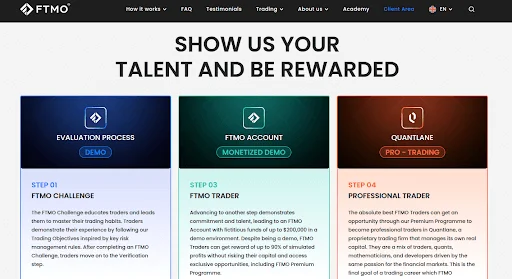

In this FTMO review, we explore the step-by-step process of how traders can secure funding from FTMO, one of the most reputable proprietary trading firms in the industry. FTMO’s funding process is designed to evaluate a trader’s skill, discipline, and risk management abilities through a two-step evaluation: the FTMO Challenge and the Verification phase. For a seamless experience, traders must ensure their FTMO login details are accurate, as access to the FTMO client area is crucial during the evaluation process.

1. FTMO Challenge

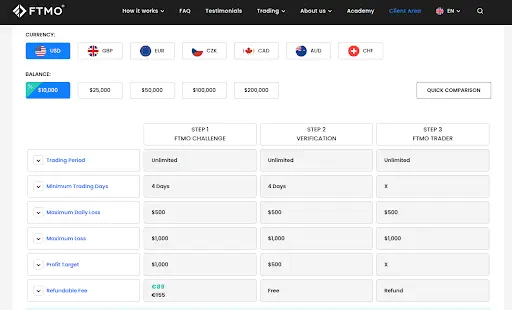

The first step in getting funded is the FTMO Challenge. This phase is crafted to assess whether a trader can meet specific profit targets while adhering to strict risk management rules. The key objectives include:

- Profit Target: Achieve a 10% profit target within a set timeframe.

- Maximum Daily Loss: Avoid losing more than 5% of the account balance in a single day.

- Overall Maximum Loss: Keep the total loss within 10% of the initial balance.

- Minimum Trading Days: Trade for at least 4 days to demonstrate consistency.

This phase is designed to mimic real-market conditions, ensuring that traders can perform consistently while managing risk effectively. Traders should be aware of FTMO challenge rules to avoid disqualification, as violating risk parameters can result in an FTMO access invalid or prohibited notification.

2. Verification Phase

After successfully passing the FTMO Challenge, traders move on to the Verification phase. The conditions remain largely the same, but the profit target is reduced to 5%, making it a bit more attainable. This stage ensures that traders can maintain consistent profitability while adhering to the same strict risk guidelines.

3. FTMO Account and Profit Sharing

Upon completing both phases, traders are granted an FTMO Account with virtual funds. Although it’s a simulated environment, traders can earn real profits. FTMO offers an 80% profit share, with the potential to scale up to 90% for consistently profitable traders. For those looking to save on initial costs, searching for an FTMO discount code can offer potential savings during the Challenge sign-up process.

This FTMO review highlights that getting funded requires strategic planning, consistent execution, and robust risk management. For those who can successfully navigate these steps, FTMO provides a lucrative opportunity to trade with significant capital while enjoying attractive profit-sharing benefits. Always ensure your FTMO log in details are correct for uninterrupted access throughout your trading journey.

Trading Instruments and Platforms at FTMO

When considering FTMO, it’s essential to understand the variety of trading instruments and platforms available. This diversity allows traders to implement a wide range of strategies while participating in the FTMO Challenge or funded account phase. This FTMO review will highlight the key instruments and platforms that set FTMO apart.

Trading Instruments at FTMO

FTMO provides access to a broad spectrum of financial instruments across multiple asset classes, ensuring traders can diversify their portfolios and strategies. The key trading instruments include:

- Forex: Major, minor, and exotic currency pairs are available for trading, offering opportunities in the highly liquid forex market.

- Indices: Trade global indices such as the S&P 500, NASDAQ, DAX, and FTSE, which represent major global economies. Notably, FTMO also allows trading on the popular US30 index, providing exposure to the performance of 30 significant U.S. companies.

- Commodities: Instruments like gold, silver, oil, and other essential commodities are accessible for diversification and hedging strategies.

- Stocks: Selected stocks from various global markets, enabling exposure to different sectors and industries.

- Cryptocurrencies: Popular digital assets like Bitcoin, Ethereum, and Litecoin, catering to traders interested in volatile crypto markets.

This wide selection supports a comprehensive trading approach, ensuring that both beginner and advanced traders can find suitable markets to engage with. For those interested in trading indices like FTMO US30, understanding the available instruments is key to optimizing strategies. For anyone conducting an FTMO review, this diverse range of instruments is crucial to consider.

Trading Platforms at FTMO

FTMO supports multiple advanced trading platforms, providing flexibility and advanced tools for executing trading strategies. The platforms include:

- MetaTrader 4 (MT4): Known for its reliability and user-friendly interface, MT4 is ideal for forex and CFD trading. It supports Expert Advisors (EAs) for automated strategies and offers comprehensive charting tools.

- MetaTrader 5 (MT5): The successor to MT4, MT5 includes additional features like more timeframes, advanced analytical tools, and an economic calendar, perfect for multi-asset trading.

- cTrader: A modern platform offering advanced charting, one-click trading, and algorithmic trading through cAlgo. It’s well-suited for both beginner and experienced traders.

- DXtrade: This cloud-based platform provides customizable interfaces and access to various asset classes. It supports advanced order types and risk management tools.

FTMO’s commitment to offering multiple platforms ensures that traders can select the one that best fits their style and strategy. Each platform is equipped with features to support in-depth market analysis and efficient trade execution.

Overall, FTMO’s extensive selection of trading instruments and platforms enhances the trading experience, providing flexibility and comprehensive tools to help traders succeed in passing the FTMO Challenge and beyond. This FTMO review confirms that the firm’s robust offering of platforms and instruments is well-suited for traders aiming for long-term success. If you’re comparing prop firms to find the best fit for your trading goals, be sure to check out our comprehensive prop firm reviews — it’s a helpful resource to see how FTMO stacks up against other major players in the industry.

FTMO Trading Conditions: Spreads, Fees, and Rules

When analyzing the FTMO review, understanding their trading conditions is essential. FTMO offers traders a structured environment designed to emulate real-market scenarios, helping traders adapt and thrive within their prop trading model.

Spreads

FTMO provides competitive spreads across various instruments, ensuring cost-effective trading for its users. For major forex pairs like EUR/USD, the spread is approximately 0.4 pips, contributing to FTMO spreads being among the most attractive in the industry. Indices such as the US100 have spreads around 2.20 points, while commodities like XAU/USD (Gold) feature spreads near 0.08 points. Cryptocurrencies, including BTC/USD, exhibit spreads of about 28.10 points.

These tight FTMO spreads can enhance trading efficiency, particularly for strategies sensitive to transaction costs. By maintaining low spreads, FTMO supports traders in maximizing profitability while minimizing trading expenses.

Fees

FTMO’s fee structure varies by asset class:

- Forex: A commission of $3 per lot is applied.

- Commodities: Gold incurs a commission of $1.98 per lot, and Silver $1.20 per lot.

- Indices and Cryptocurrencies: No commissions are charged, as FTMO absorbs these costs.

- Stocks: Commissions depend on contract size, number of lots, instrument price, and a percentage commission.

This transparent fee structure allows traders to anticipate costs accurately and tailor their strategies accordingly.

FTMO Leverage

FTMO offers flexible leverage options to accommodate various trading styles. For forex, the standard FTMO leverage is up to 1:100, allowing traders to maximize their positions while maintaining effective risk management. For indices and commodities, the leverage can vary, ensuring that traders have access to appropriate margin requirements. Understanding FTMO leverage is crucial for traders aiming to optimize their strategies while adhering to the firm’s risk parameters.

Trading Rules

FTMO enforces specific rules to promote disciplined trading:

- Maximum Daily Loss: Traders must not exceed a 5% loss of the initial account balance in a single day.

- Maximum Overall Loss: A cumulative loss limit of 10% of the initial account balance is imposed.

- Profit Target: During the FTMO Challenge phase, traders are required to achieve a 10% profit target.

- Minimum Trading Days: A minimum of 4 trading days ensures consistent trading activity.

These rules are designed to encourage effective risk management and consistent performance.

By understanding the key aspects of this FTMO review, traders can better align their strategies with FTMO’s expectations and enhance their chances of passing the challenge.

Subscription and Payment Methods at FTMO

In this FTMO review, understanding the subscription process and payment methods is crucial for traders considering the challenge. FTMO operates with a one-time fee structure, offering various subscription options based on account size and objectives. Payment flexibility is ensured through multiple methods, making it convenient for traders worldwide. The following sections will delve deeper into subscription options, associated fees, payment methods, withdrawal policies, and the refund process.

Subscription Options and Associated Fees

FTMO offers flexible subscription options tailored to different trading account sizes and objectives. The one-time fees, also known as FTMO challenge costs, vary based on the chosen account size, covering participation in both the FTMO Challenge and Verification stages. Importantly, these fees are refundable upon successful challenge completion and your first profit withdrawal.

| Account Size | Challenge Fee (EUR) | Refundable |

| €10,000 | €155 | Yes |

| €25,000 | €250 | Yes |

| €50,000 | €345 | Yes |

| €100,000 | €540 | Yes |

| €200,000 | €1,080 | Yes |

For instance, the FTMO 10k challenge fee is €155, while the FTMO 100k challenge fee is €540. Understanding these FTMO prices is essential for traders to evaluate the initial investment required and align it with their trading strategies. The FTMO pricing model ensures clarity and transparency, helping traders choose the best plan based on their financial and trading goals.

Available Payment Methods

FTMO offers a variety of secure and convenient payment methods, ensuring flexibility for traders worldwide. Whether you prefer traditional banking or digital solutions, FTMO provides multiple options for a smooth and hassle-free subscription process. Additionally, the same flexibility applies to FTMO withdrawal methods, ensuring traders can access their profits conveniently.

| Payment Method | Availability | Processing Time |

| Bank Transfer | Worldwide | 1-3 business days |

| Debit/Credit Card | Visa, MasterCard, Amex | Instant |

| Skrill | Selected Countries | Instant |

| Cryptocurrency | Bitcoin, Ethereum, USDT | Within a few hours |

This diverse range of payment methods ensures that every trader can choose the most suitable option for their needs, enhancing convenience when paying FTMO challenge prices.

Withdrawal Policies

FTMO ensures a seamless and efficient withdrawal process for its traders. After successfully completing the Challenge and Verification stages, traders on funded accounts can request profit withdrawals once a month. The standard profit split starts at 80% and can increase to 90% through FTMO’s Scaling Plan. This flexible approach to profit sharing is frequently highlighted in detailed FTMO reviews as a major benefit for traders.

Withdrawals are processed quickly, typically within 1-2 business days after submission. FTMO supports multiple withdrawal methods, including bank transfers and digital wallets, ensuring global accessibility. The firm’s commitment to transparency and efficiency makes it easier for traders to access their earnings without delays.

Refund Policy

FTMO offers a transparent and trader-friendly refund policy designed to reward successful traders.

- The one-time fee paid for the FTMO Challenge is fully refundable upon successful completion of both the Challenge and Verification stages.

- The refund is processed after traders qualify and receive their first profit split from the funded account.

- However, if a trader fails to pass either stage, the fee is non-refundable.

This policy not only encourages disciplined and strategic trading but also provides a fair incentive for traders who meet FTMO’s objectives. For anyone exploring prop firm options, an FTMO review often highlights this refund structure as a key advantage that sets FTMO apart from other competitors.

Payment Proof

FTMO disburses payouts to traders every two weeks, ensuring a consistent and reliable payment schedule. There are no profit thresholds or withdrawal requirements, allowing traders to request their earnings with ease. Many traders have shared positive experiences regarding the FTMO payout process, highlighting its efficiency and transparency.

To further build trust, FTMO provides sample evidence of payments, including withdrawal certificates and completion certificates, reinforcing their commitment to timely and secure trader compensation. This straightforward approach to FTMO payouts has been well-received within the trading community.

FTMO vs. The5ers vs. Blue Guardian Capital: A Comparative Overview

In the competitive landscape of proprietary trading firms, FTMO, The5ers, and Blue Guardian Capital have established themselves as prominent options for traders seeking funding and support. This FTMO review provides a detailed look into their offerings to assist traders in making informed decisions about the best prop firm to join in 2025.

| Feature | FTMO | The5ers | Blue Guardian Capital |

| Initial Capital | €10,000 – €200,000 | $5,000 – $100,000 | $10,000 – $200,000 |

| Evaluation Process | Two-step (Challenge and Verification) | Two-step (Evaluation and Bootcamp) | Two-phase evaluation |

| Profit Split | 80% (up to 90% with scaling) | 50% (up to 100% with scaling) | Up to 85% |

| Scaling Plan | 25% increase every 4 months upon achieving 10% profit | Up to $4,000,000 with consistent performance | Up to $1,800,000 with consistent performance |

| Tradable Instruments | Forex, commodities, indices, stocks, cryptocurrencies | Forex, metals, indices | Forex, cryptocurrencies, indices, commodities, gold |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, DXtrade | MetaTrader 5 | MetaTrader 4, MetaTrader 5 |

| Maximum Drawdown | 10% | 6% | Not specified |

| Daily Loss Limit | 5% | 5% | 4% |

| Minimum Trading Days | 10 | None | None |

| Maximum Trading Days | 30 (Challenge), 60 (Verification) | 180 | Unlimited |

| News Trading Allowed | No | Yes | Yes |

| Weekend Holding Allowed | No | Yes | Yes |

| Leverage | Up to 1:100 | Not specified | Not specified |

| Location | Czech Republic | Israel | United Kingdom |

| Year Established | 2015 | 2016 | 2020 |

| Trustpilot Rating | 4.9/5 | 4.7/5 | 4.8/5 |

Key Notes:

- FTMO offers a structured evaluation process with a competitive profit split and scaling plan, making it attractive for traders aiming for consistent growth.

- The5ers provides flexible funding options with an emphasis on risk management and the potential for significant account scaling, appealing to traders seeking long-term development.

- Blue Guardian Capital stands out with its high profit split and diverse tradable instruments, catering to traders looking for versatility and substantial profit retention.

In this FTMO review, it’s evident that each prop firm presents distinct advantages. Traders should consider their individual trading styles, risk tolerance, and growth objectives when choosing the firm that best aligns with their professional goals. If you’re still evaluating your options, be sure to check out our updated list of the best forex prop firms in 2025 to help you make a more informed decision.

FTMO Trader Community and Support

FTMO has cultivated a comprehensive ecosystem designed to support and enhance the trading experiences of its clients. This ecosystem encompasses a rich array of educational resources, active community engagement platforms, and dedicated support services, all aimed at fostering trader development and success. If you’re looking for an in-depth FTMO review, understanding these support systems is essential.

Educational Resources & Webinars

Central to FTMO’s commitment to trader education is the FTMO Academy. This platform offers a structured curriculum that delves into both fundamental and advanced trading concepts, including:

- Financial Markets: Understanding market structures and dynamics.

- Trading Instruments: Insights into various assets like forex, commodities, and indices.

- Trading Platforms: Guidance on effectively utilizing trading software.

- Analytical Methods: Comprehensive coverage of technical, fundamental, statistical, and sentiment analysis.

- Strategy Development: Assistance in crafting personalized trading strategies aligned with individual risk tolerance and objectives.

To complement these resources, FTMO provides performance coaching sessions, enabling traders to refine their skills and psychological approach to trading.

Community Engagement & Social Presence

FTMO fosters a vibrant community through multiple channels:

- Discord Server: An exclusive platform where traders can engage in real-time discussions, share insights, and collaborate on trading strategies.

- Facebook Groups: Dedicated communities such as the “FTMO Trader’s Community” facilitate idea exchange, support, and discussions about trading journeys.

- Social Media Presence: FTMO maintains active profiles on platforms like Facebook, X (formerly Twitter), and Instagram, regularly sharing updates, educational content, and success stories to keep the community informed and engaged.

FTMO’s strong community engagement and active social presence are often highlighted in FTMO reviews, showcasing their commitment to fostering a supportive and interactive trading environment.

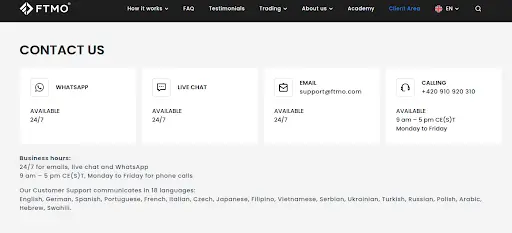

24/7 Trader Support & Success Team

Recognizing the dynamic nature of trading, FTMO offers round-the-clock customer support to ensure every trader’s needs are met. As highlighted in any detailed FTMO review, strong support systems are crucial for trader success.

- Multilingual Support: Assistance is available in 18 languages, ensuring traders from diverse backgrounds can communicate effectively.

- Multiple Communication Channels: Traders can reach the support team via email, live chat, WhatsApp, and phone calls during business hours, ensuring timely and accessible assistance.

Knowledge Base & Help Center

FTMO’s comprehensive Help Center serves as a valuable resource for traders, offering detailed information on trading objectives, account management, and platform navigation. This repository of knowledge empowers traders to find answers to common questions and effectively resolve issues, promoting a smoother trading experience.

In addition to educational resources, traders can stay updated with the latest FTMO news through the Help Center, ensuring they are informed about important updates and changes. As highlighted in many FTMO reviews, the Help Center is a crucial support tool that enhances the overall trading journey by providing accessible and reliable information.

Community Initiatives & Giveaways

To further enrich the trader experience, FTMO organizes various community initiatives, including giveaways and challenges. These activities not only incentivize participation but also strengthen the sense of community among traders, fostering a collaborative and supportive environment. One notable initiative includes the FTMO Challenge Discount, which offers aspiring traders a more affordable entry point into the FTMO Challenge—encouraging broader participation and making professional trading more accessible to those eager to prove their skills.

Why It Matters

FTMO’s dedication to providing extensive educational resources, fostering community engagement, and offering unwavering support plays a pivotal role in trader development. As any honest FTMO review would highlight, these support systems equip traders with the necessary tools, knowledge, and guidance to navigate the complexities of trading, manage risks effectively, and work towards achieving consistent profitability.

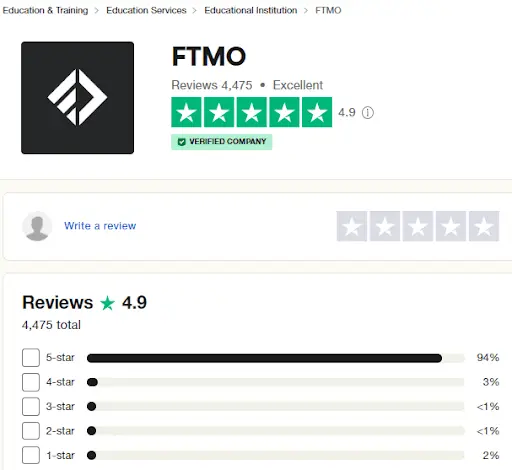

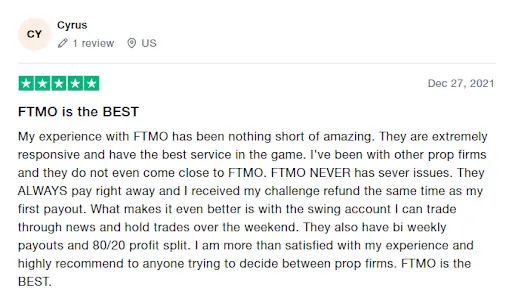

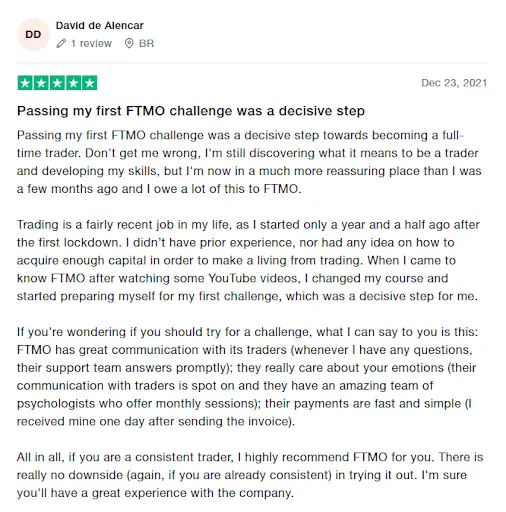

Traders Opinion

FTMO Trustpilot users from many walks of life have spoken positively on the company and given it a stellar rating of 4.9 stars out of a possible 5. If you have any questions or concerns, you can contact their prompt and helpful customer service team for answers.

The bulk of FTMO’s user base has nothing but admiration for the company’s transparency. Their support staff is there to help at every stage of the process, from the initial assessment through the funding and finally the payouts, should anyone have any questions.

FTMO Review: Pros and Cons

Evaluating the strengths and weaknesses of FTMO is essential for traders considering their proprietary trading program. Understanding these aspects helps align the firm’s offerings with individual trading goals and risk tolerance. A well-researched FTMO review can help traders determine whether this prop firm is the right fit for them.

| Pros | Cons |

| Access to Significant Capital: FTMO offers traders the opportunity to manage accounts up to $200,000, enabling substantial profit potential without risking personal funds. | Evaluation Fees: Participation requires upfront fees for the evaluation process, which may be considered high by some traders. |

| Generous Profit Sharing: Traders can retain 80% of their profits, with the possibility of increasing this to 90% for consistent performance. | Strict Evaluation Process: The two-phase evaluation, comprising the FTMO Challenge and Verification, demands adherence to specific trading objectives, which can be stringent. |

| Diverse Asset Offering: FTMO supports trading across various assets, including forex, commodities, indices, stocks, and cryptocurrencies, allowing for diversified trading strategies. | Risk Management Rules: Traders must comply with strict risk management parameters, such as daily and overall drawdown limits, which may limit certain trading styles. |

| Comprehensive Support and Resources: The firm offers 24/7 client support in 18 languages, access to performance coaches, and a suite of trading tools to enhance trader performance. | Trading Fees for Certain Symbols: Some instruments may incur additional trading fees, impacting overall profitability. |

Keynotes:

- FTMO’s model allows traders to leverage substantial capital without personal financial risk, making it an attractive option for skilled traders.

- The firm’s stringent evaluation process ensures that only disciplined and proficient traders manage their funds, maintaining high trading standards.

- Prospective traders should carefully consider the initial evaluation fees and ensure they are comfortable with the imposed risk management rules before engaging with FTMO.

Is FTMO Worth It?

FTMO has rapidly gained popularity in the proprietary trading industry by offering traders access to significant virtual capital—up to $200,000—without risking their own funds. This model effectively solves the common challenge of undercapitalization, enabling traders to focus on refining their strategies.

Beyond funding, FTMO demonstrates a strong commitment to trader development through its comprehensive educational platform, FTMO Academy, which equips traders with essential skills and insights for market success.

Moreover, FTMO’s recent acquisition of the globally recognized brokerage OANDA marks a significant milestone, signaling the firm’s strategic growth and strengthening its position in the financial sector. This move not only showcases FTMO’s ambition but also reinforces its credibility as a leading prop firm.

Overall, FTMO’s robust model, educational resources, and recent expansion efforts make it a compelling choice for aspiring and experienced traders alike. One standout feature enhancing the FTMO experience is the FTMO FX Blue Suite—a powerful analytics toolkit that helps traders track, analyze, and optimize their performance in real-time. For those seeking an honest FTMO review, these factors highlight why it’s considered a top option in the industry.

The Final Words

FTMO has solidified its reputation as one of the top proprietary trading firms, offering traders the opportunity to manage capital starting at $400,000 with the potential to scale up to $2 million through consistent and disciplined performance. With over 90 million trades processed and more than $29 million paid out to successful traders in a single year, FTMO clearly demonstrates its commitment to rewarding trading excellence. This ongoing dedication is also reflected in their FTMO Rewards Growth program, which highlights how traders can unlock larger capital allocations and exclusive benefits as they progress through the firm’s scaling plan.

The firm’s structured challenge, scaling plan, and educational resources make it a solid platform for serious traders looking to elevate their careers. While the challenge is demanding, the rewards are significant for those who can meet FTMO’s standards.

If you’re ready to prove your skills and pursue a scalable trading opportunity, this FTMO review confirms that FTMO stands as a credible and rewarding choice.