FundedNext

FundedNext, the fastest growing proprietary trading firm, has gained massive popularity for their 15% Profit-share from the Demo Phase and $4 million scale-up to maximise the traders' profit.

FundedNext

FundedNext, the fastest growing proprietary trading firm, has gained massive popularity for their 15% Profit-share from the Demo Phase and $4 million scale-up to maximise the traders' profit.

About FundedNext

FundedNext is a proprietary trading firm launched in 2022. Headquartered in Dubai, UAE, with operational support in Bangladesh and India, this firm offers global traders strong funding opportunities with profit splits up to 95% and a $4 million scale-up plan.

In the ever-evolving proprietary trading industry, FundedNext has emerged as a prominent firm offering global traders access to significant capital with no personal financial risk. Backed by a structured funding approach and a growing international presence, FundedNext has positioned itself as a viable choice for both new and experienced traders in 2025. But how does it truly compare in today’s market? This FundedNext review takes a closer look at its evaluation models, funding options, platform access, and payout structures to determine whether it lives up to trader expectations.

FundedNext prop firm offers up to $200,000 in funded capital, with evaluation models designed to test trading discipline while maintaining flexibility. Traders can earn profit splits of up to 95%, and the firm supports bi-weekly withdrawals with multiple account types. With features like no maximum trading period and scaling potential to increase capital access, FundedNext presents a model worth considering in any comprehensive 2025 FundedNext review comparison for serious prop traders this year.

Who is FundedNext?

FundedNext is a forex prop firm officially launched in March 2022, with its headquarters based in the UAE and operational teams in Bangladesh and India. Despite being a relatively new entrant, the firm has quickly established itself as a credible player in the prop trading space, catering to a wide global trader base.

For those asking “when was FundedNext founded?”—the company began its journey in 2022, building its foundation under Next Ventures FZCO, registered in Dubai. This business structure ensures credibility and operational backing.

FundedNext’s location and global outreach are key factors behind its rapid growth. The platform offers access to funded accounts of up to $200,000, with the potential for scaling, allowing traders to grow their capital based on consistent performance.

One of the defining characteristics of FundedNext is its profit-sharing model, which allows traders to earn up to 95% of their profits. In addition, the firm supports bi-weekly payouts and emphasizes fast funding processes, positioning itself as a flexible alternative to traditional firms.

FundedNext traders can access both Evaluation and Express models, designed to match different trading styles and experience levels. For those seeking clarity on how FundedNext works, the structure is straightforward: traders undergo an evaluation phase to prove their skills and are rewarded with funded capital upon success.

For those seeking a deeper dive into the firm’s structure, community-sourced insights explore how its features compare with other leading forex prop firms in 2025. You’ll also find real user feedback under “FundedNext Reddit” discussions, where traders discuss platform performance, payouts, and customer service. Many of these insights align with third-party FundedNext reviews, confirming its legitimacy and operational quality.

With a growing number of funded traders, positive feedback, and community engagement, FundedNext continues to build momentum in 2025—solidifying its reputation as a top choice among forex prop traders worldwide.

Brokers That Are Used By FundedNext

FundedNext offers traders access to popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and Match-Trader, in partnership with brokers such as Eightcap and ThinkMarkets. If you’re asking “what broker does FundedNext use?”, these partners are currently the most recognized, offering tight spreads, fast execution speeds, and reliable order processing for funded traders.

These FundedNext broker partners are known for providing professional-grade trading environments with low latency and strong execution quality. By offering multiple brokerage choices, FundedNext enables traders to select a platform that best suits their strategy and trading conditions. While the firm doesn’t disclose specific liquidity partners, it emphasizes delivering a fast and reliable trading experience, which is often highlighted in FundedNext community discussions.

For those conducting a detailed FundedNext review, understanding its broker relationships is essential for assessing execution quality and overall trading performance.

Who is the CEO of FundedNext?

Syed Abdullah Jayed is the Founder and CEO of FundedNext, a rising prop trading firm that has quickly become a major name in the industry. He launched the company in March 2022, following the success of his earlier fintech venture, Next Ventures, founded in 2016.

If you’re searching for “Abdullah Jayed FundedNext,” you’ll find he is widely recognized for his vision of democratizing capital access and supporting global trading talent.

Under his leadership, FundedNext has expanded globally and introduced features that differentiate it from competitors—such as profit sharing during the evaluation phase, instant funding options, and access to educational resources.

In 2025, Abdullah discussed FundedNext’s plans to explore brokerage services, a move noted across several industry reviews. His direction has helped build the company’s reputation as a legitimate and forward-thinking player in the space.

FundedNext Scaling Plan & Funding Programs

FundedNext offers a comprehensive suite of funding programs tailored to support traders with various risk profiles and trading styles. These programs not only provide access to substantial capital but also introduce a structured scaling plan that rewards consistent profitability. Unlike many proprietary firms, FundedNext is known for offering profit shares even during the evaluation phase, giving traders an edge from the start.

Traders can choose between Evaluation, Express, and Stellar models, each designed with unique rules, profit-sharing structures, and scaling potential. These funding models ensure that both aggressive and conservative traders can find a path that aligns with their approach.

The FundedNext scaling model enables traders to increase their account size by up to 40% every four months, contingent on meeting performance benchmarks like a 10% net gain and maintaining low drawdowns. With this model, traders can ultimately scale their accounts to $1 million, reinforcing FundedNext’s focus on long-term trader growth. For those exploring the firm’s growth potential, this structure is a highlight often praised in detailed FundedNext reviews of 2025.

Overview of FundedNext Funding Programs:

Key Takeaways:

- Structured Evaluation: FundedNext offers both multi-phase and one-phase funding models, giving traders the flexibility to choose the evaluation style that fits their trading discipline.

- Profit from Day One: Unlike most firms, FundedNext allows traders to earn up to 15% profit share during the evaluation phase.

- High Profit Splits: Profit sharing begins at 80–85% and can increase to 95% based on consistency and growth.

- Long-Term Growth: Scaling opportunities reach up to $4M, rewarding consistent performance.

FundedNext’s funding programs and scaling plan reflect a robust, growth-oriented structure that rewards traders for both skill and consistency. In addition to traditional evaluation models, FundedNext instant funding options are available in select challenges—offering faster access to capital for traders who want to skip multi-phase evaluations.

For traders looking to maximize capital access and retain high profit shares, FundedNext presents one of the most scalable and transparent opportunities in the proprietary trading space—an edge that’s consistently highlighted in every expert-led FundedNext review. While a full FundedNext free trial is not currently offered, the platform does provide detailed previews, trading resources, and occasional discounts that allow new users to explore the ecosystem at minimal cost.

FundedNext Review: How to Get Funded?

In this FundedNext review, we break down the process of how traders can obtain funding through one of the fastest-growing proprietary trading firms in the forex space. FundedNext offers three different funding models—two two-step evaluations and one one-step evaluation—each aimed at identifying disciplined traders who can consistently manage risk and generate profits. Understanding how to pass the FundedNext challenge starts with selecting the right model that suits your trading style and commitment level.

To get started, traders must complete the FundedNext sign-up process, which only takes a few minutes on the official platform. Once registered, users can access their FundedNext login dashboard through the main fundednext.com login page. From the FundedNext dashboard, traders can track evaluation progress, manage account settings, view performance metrics, and request payouts—all from a clean and responsive interface.

Whether you’re just signing up or actively trading, having direct access to the FundedNext login portal is essential to monitor your growth and manage your account effectively throughout the evaluation and funding journey.

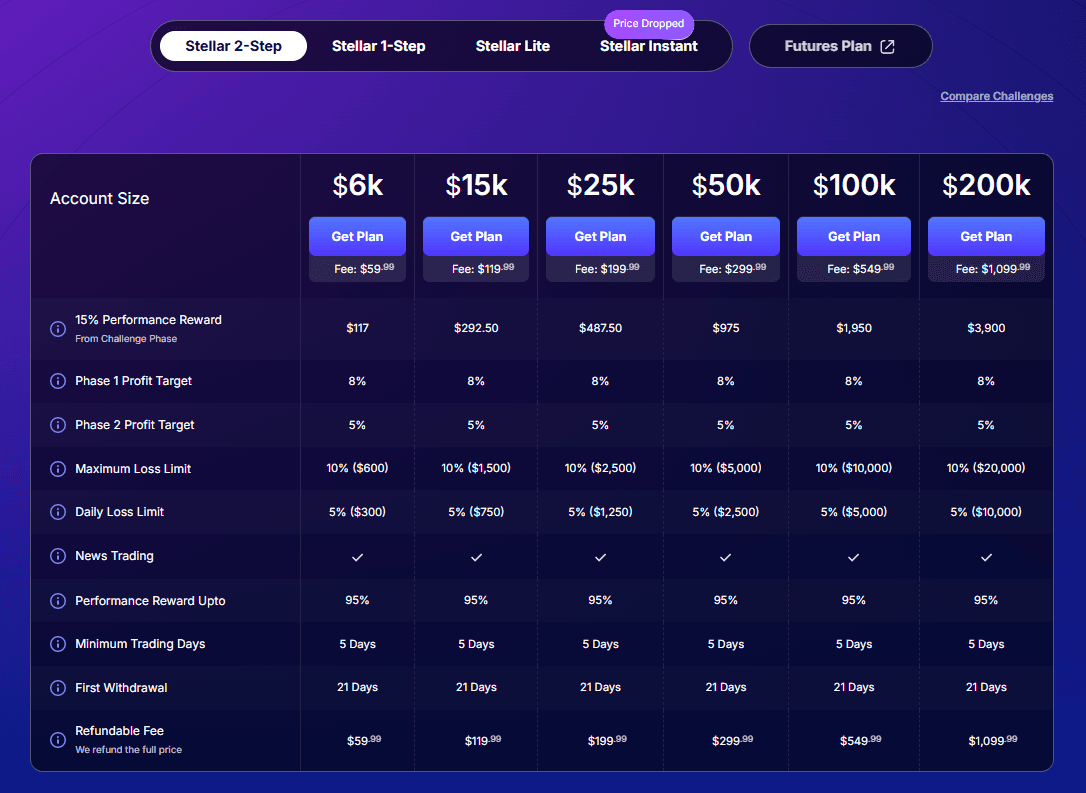

1. Two-Step Stellar Challenge

This is the flagship evaluation model. Traders can choose account sizes ranging from $6,000 up to $200,000, and even participate in the FundedNext 300k challenge through promotions or advanced scaling tiers. The process includes two evaluation phases, with clearly defined FundedNext challenge rules:

- Phase 1: Reach an 8% profit target without exceeding a 5% daily loss limit or a 10% total loss limit. Traders must trade a minimum of 5 days, but there is no maximum time limit.

- Phase 2: The profit target drops to 5%, with the same risk parameters and minimum trading day requirements.

2. One-Step Stellar Challenge & Stellar Lite

For traders seeking quicker access, FundedNext offers a one-step evaluation with tailored rules. The Stellar Lite is a budget-friendly alternative with lower fees but competitive terms. While the requirements are still rigorous, this model is preferred by traders who want to fast-track their funded journey and focus on how to pass the FundedNext challenge with minimal barriers.

FundedNext stands out with no maximum trading period, bi-weekly payouts, an adaptive scaling plan, news trading, and even weekend holding—features that provide unmatched flexibility. By prioritizing trader psychology, risk control, and offering multiple FundedNext challenges, the firm is not just a funding provider—it’s a growth platform for serious traders.

Trading Instruments and Platforms at FundedNext

Understanding the available trading instruments and platforms is critical when evaluating a prop firm. In this section of our FundedNext review, we examine the tools that traders can utilize to execute their strategies effectively within both the evaluation and funded stages. FundedNext offers a range of assets and trusted trading platforms, giving traders the flexibility they need to succeed in different market conditions.

Trading Instruments at FundedNext

FundedNext provides access to a diverse selection of trading instruments, allowing traders to engage across multiple asset classes. This supports portfolio diversification and the application of various trading styles. The key trading instruments include:

- Forex Pairs: Traders can access a wide array of major, minor, and exotic currency pairs, taking advantage of the liquidity and volatility of the global forex market.

- Commodities: FundedNext supports trading in precious metals like gold and silver, along with energy products such as crude oil—popular instruments for hedging and short-term speculation.

- Indices: Trade leading global indices including US30, NAS100, SPX500, and GER40, offering opportunities to capitalize on broader market movements in major economies.

- Cryptocurrencies: For traders drawn to digital markets, FundedNext enables trading on top cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), appealing to those who thrive in high-volatility conditions.

This wide range ensures that both conservative and aggressive trading styles are supported, empowering FundedNext traders with versatile opportunities. If you’re evaluating the firm’s instrument offerings, our detailed FundedNext review explores how these markets are integrated into the funding programs.

To see how real traders are benefiting from this flexibility, check out the experiences of FundedNext traders in community discussions and reviews.

Trading Platforms at FundedNext

FundedNext supports some of the most reliable and widely used trading platforms, offering technical flexibility and an intuitive trading experience:

- MetaTrader 4 (MT4): A preferred FundedNext trading platform among forex traders for its user-friendly interface, robust execution, and compatibility with Expert Advisors (EAs) for automated trading. The FundedNext MT4 experience is smooth and stable, designed for traders who favor simplicity and high performance.

- MetaTrader 5 (MT5): A more advanced alternative to MT4, MT5 FundedNext includes expanded timeframes, depth of market (DOM) features, and is ideal for multi-asset trading with superior backtesting capabilities. Traders can download MT5 FundedNext directly from their dashboard to begin evaluating or live trading. The FundedNext MT5 download process is simple and secure via the official platform.

- cTrader: Available to traders in specific models, cTrader provides advanced charting, level II pricing, and automation through cAlgo, offering high-speed execution with a clean UI.

- Match-Trader: FundedNext also supports Match-Trader, a modern platform with integrated account management, web-based access, and strong mobile compatibility.

In addition to these platforms, FundedNext app support for mobile devices ensures that traders can monitor and manage trades on the go. FundedNext also offers a demo environment for practice and onboarding purposes. Whether it’s through a FundedNext demo account or simulation during onboarding, new users can explore the platform risk-free. This is especially valuable for those preparing for evaluations or looking to sharpen their skills before going live.

While FundedNext copy trading and trade copier tools are not officially supported in evaluation phases due to the platform’s original-trade requirements, the firm continues to evaluate trader-focused solutions. Most traders execute trades manually or through self-developed strategies, as copy trading at FundedNext is currently restricted to maintain fairness and evaluation integrity.

FundedNext gives traders the freedom to choose a platform that aligns with their technical needs and trading preferences. Whether it’s the simplicity of MT4, the extended capabilities of MT5, the modern edge of cTrader, or the flexibility of Match-Trader, the firm ensures compatibility with today’s top trading tools. You can find platform comparisons and user feedback in our complete FundedNext Review for a better understanding of what suits your trading approach.

FundedNext Trading Conditions: Spreads, Fees, and Rules

When evaluating FundedNext as a prop trading firm, understanding its trading conditions is essential. FundedNext provides an environment designed to mirror real market dynamics while encouraging traders to perform consistently within defined risk parameters. This section of our FundedNext review dives into its spreads, commissions, leverage, and trading rules—the key pillars of any successful evaluation model.

Spreads

FundedNext offers competitive raw spreads across all major asset classes by partnering with Tier-1 liquidity providers. Traders benefit from tight pricing on forex pairs, indices, commodities, and cryptocurrencies. These FundedNext spreads are among the most competitive in the industry, especially for active traders and scalpers.

For instance:

- EUR/USD often features a spread starting around 0.0 to 0.3 pips.

- XAU/USD (Gold) has an average spread of 0.13 to 0.18, depending on market volatility.

- US30 and NAS100 typically carry spreads ranging between 1.5 to 3.0 points, offering strong value for index traders.

- Cryptocurrencies like BTC/USD and ETH/USD have variable spreads, influenced by underlying liquidity and market hours.

These low-cost FundedNext trading conditions make it especially appealing for scalpers and day traders who require efficient order execution. Traders reading a detailed FundedNext review on spread competitiveness will find these figures stand out in comparison to other firms in the industry.

Fees

FundedNext’s fee model varies based on the platform and account type selected, but all are clearly disclosed upfront:

- Forex trading incurs a commission of $3 per lot (per side) on Raw Spread accounts.

- Indices, commodities, and crypto usually come with zero commission, embedded within slightly wider spreads on Standard accounts.

- There are no hidden fees, and traders are not charged for inactivity, data feeds, or platform usage.

This transparent pricing structure is often praised in real-world FundedNext reviews, as it ensures traders can forecast costs and build strategies without worrying about hidden overhead.

Leverage

FundedNext leverage caters to both conservative and aggressive traders, depending on their chosen trading strategy and evaluation model:

- Forex: Up to 1:100

- Commodities & Indices: Typically around 1:40

- Crypto: Up to 1:2, to reduce risk exposure during volatility

The specific leverage available may vary depending on the challenge model or account type (Standard vs Raw), but it is always clearly displayed before purchasing a challenge. This flexible leverage structure gives traders room to adjust risk while maintaining discipline.

Trading Rules

FundedNext rules are enforced to promote disciplined and sustainable trading—key for long-term success:

- Daily Loss Limit: Maximum 5% of the initial balance per day

- Overall Loss Limit: 10% total maximum drawdown

- Profit Targets: Varies by challenge—10% in Phase 1 and 5% in Phase 2 of the two-step evaluation, or 8% in Phase 1 for Stellar Challenge

- Minimum Trading Days: 5 days per phase to demonstrate consistency

- News Trading & Weekend Holding: Allowed, depending on the model (notably in Stellar Challenge)

These FundedNext trading rules are enforced through an automated risk engine, promoting accountability and rewarding traders who practice effective risk management. Following these FundedNext rules is essential to pass evaluations and maintain a funded account successfully.

Subscription and Payment Methods at FundedNext

Understanding the subscription process and payment methods at FundedNext is crucial for traders considering their proprietary trading programs. FundedNext offers various account types with associated fees, multiple payment options, and clear policies on withdrawals and refunds. For those comparing prop firms, this aspect is often highlighted in a comprehensive FundedNext review, as it reflects the firm’s transparency and ease of access. This section provides an in-depth look into these aspects to help you make an informed decision.

Subscription Options and Associated Fees

FundedNext provides several funding programs tailored to different trading objectives and risk appetites. Each program has specific account sizes with corresponding fees. The fees cover participation in the evaluation phases and are refundable upon successful completion of the challenge.

For example, the fee for a $100,000 account in any of the funding programs is $549. These fees are designed to be accessible, allowing traders to select a plan that aligns with their financial goals and trading strategies

Available Payment Methods

FundedNext offers a variety of secure and convenient payment methods to accommodate traders worldwide. This flexibility ensures that traders can choose the most suitable option for their needs. Whether you’re enrolling in a challenge or upgrading your account, the platform supports multiple FundedNext payment methods, including major credit/debit cards, cryptocurrencies, and select local gateways depending on your region.

This diverse range of FundedNext payment methods ensures that traders can fund their accounts conveniently and securely, making the process of starting your trading journey smooth from the very beginning. Additionally, FundedNext prices for various challenges are clearly displayed on the platform, allowing traders to compare models and choose one that fits their budget and goals.

Withdrawal Policies

FundedNext has a streamlined withdrawal process to ensure traders can access their profits efficiently. After meeting the necessary requirements, traders can request withdrawals through their account dashboard. The steps include navigating to the “Payout” section, initiating a payout request, and confirming the request via an OTP sent to the registered email.

FundedNext payout methods are designed for speed and accessibility, with the firm aiming to process payouts within 24–48 hours. Supported FundedNext payout options include crypto (such as USDT and BTC), bank transfers, and other verified channels used during deposit. This efficient system underlines their commitment to prompt and secure FundedNext withdrawals.

As traders progress and grow their capital, they may also qualify for the FundedNext max allocation through the firm’s scaling plan—allowing account sizes to increase significantly over time, further boosting potential profits and payouts.

Refund Policy

FundedNext offers a refund option under specific conditions. If trading has not been initiated within 14 days of registering, traders are eligible for a refund. This policy allows traders to evaluate the platform and services before making a full commitment.

Additionally, upon successfully meeting the requirements and achieving a payout from the FundedNext account, traders will receive a reward bonus equivalent to their initial registration fee. This bonus is processed along with the first payout, providing an added incentive for successful trading.

FundedNext’s subscription options, diverse payment methods, efficient withdrawal processes, and clear refund policies are designed to provide traders with a supportive and transparent trading environment. These policies are frequently noted as key advantages in any trusted FundedNext review, especially when evaluating trader-focused flexibility and payout efficiency.

FundedNext vs. FTMO vs. BrightFunded: A Comparative Overview

In today’s prop trading landscape, FundedNext, FTMO, and BrightFunded represent three competitive choices for traders looking to access capital and build sustainable trading careers. Each offers distinctive funding models, risk parameters, and growth opportunities. This comparative breakdown highlights the core features that define each firm, helping traders assess which platform aligns best with their trading strategies.

While FTMO remains a trusted name for structured evaluations and consistent scaling, FundedNext has emerged as a trader-first firm offering unique benefits like profit-sharing during evaluation phases. On the other hand, BrightFunded emphasizes simplicity and high profitability with minimal restrictions, catering to a wider range of trading styles. For a deeper comparison of these firms, a detailed FundedNext review can provide greater insight into how it stacks up against industry leaders in terms of flexibility, payout structure, and trader support.

Key Notes:

- FundedNext is ideal for traders who value flexible model options, early profit-sharing, and a high scaling ceiling up to $1M.

- FTMO offers a time-tested evaluation structure and reputation, suitable for those who prioritize discipline and long-term consistency.

- BrightFunded provides high profit retention (up to 95%) and lower restrictions, appealing to traders seeking more control and fewer constraints.

This comparison highlights how each firm delivers a unique funding experience. Depending on individual preferences—whether it’s early profitability, structured scalability, or freedom in trading conditions—traders can choose the prop firm that best suits their professional growth objectives.

FundedNext Trader Community and Support

FundedNext places a strong emphasis on trader support and community engagement, helping create a nurturing environment for growth, education, and success. With a well-rounded ecosystem that includes educational content, direct support, and a social presence, FundedNext empowers traders beyond just funding capital. As noted in more than one FundedNext review, the firm’s dedication to building a supportive trader community is a key factor that sets it apart from more traditional prop trading models.

Educational Resources and Trader Development

FundedNext is committed to fostering trader education through a structured learning ecosystem. Their in-house educational hub provides articles, guides, and video content that cover:

- Trading Psychology: Emphasizing emotional control and mindset discipline

- Risk Management Principles: Helping traders build sustainable systems

- Platform Navigation: Tutorials for MT4/MT5, cTrader, and Match-Trader

- Strategic Planning: Encouraging methodical and rule-based trading

The company also hosts live webinars and sessions led by trading experts, particularly useful for beginners trying to grasp core trading concepts. These resources are frequently updated to ensure traders are equipped with the latest market insights and methodologies. Many of these learning tools are frequently highlighted in detailed FundedNext review feedback, especially for their value to new and intermediate traders.

Active Trader Community

FundedNext maintains an engaged online community across multiple channels, offering real-time communication and collaboration opportunities:

- Telegram Group: Their official community hosts thousands of active members, where traders share charts, discuss strategies, and provide peer support.

- YouTube Channel: FundedNext regularly uploads market breakdowns, educational walkthroughs, and motivational content aimed at helping traders stay informed and inspired. Winners of past FundedNext competitions are often featured here, highlighting their performance and growth journey.

- Instagram, X (Twitter), Facebook, and Discord: These platforms are used to announce trader achievements, offer trading tips, and publish news related to account upgrades, new challenge models, and the latest updates on the FundedNext competition leaderboard. The FundedNext Discord channel, in particular, is growing as a hub for faster discussions and trader networking.

This vibrant social presence fosters a strong sense of community, giving traders the space to learn from one another and stay connected. It’s a feature often emphasized in more community-focused FundedNext review articles, where trader engagement plays a significant role in long-term development.

Responsive Trader Support Team

FundedNext’s dedicated support team is available 24/7 via live chat and email, ensuring that trader queries are addressed promptly and efficiently. Whether it’s a technical issue, account query, or challenge-related question, their support is recognized for being quick, polite, and solution-oriented.

- Live Chat Support: Available directly through the FundedNext website

- Email Support: Responsive and typically resolves issues within a few hours

Traders frequently praise the team’s efficiency in solving problems ranging from login issues to payment clarifications.

Knowledge Base & Help Center

FundedNext offers a well-organized Help Center covering common questions regarding evaluation models, payout cycles, account rules, and platform settings. This self-service portal is a valuable asset for traders seeking clarity without waiting on direct support. It also includes information on FundedNext certificates, which are provided to funded traders upon successful completion of evaluation phases or competitions—helping them showcase their verified trading journey.

Why It Matters

A reliable community and support system are essential components of success in proprietary trading. FundedNext’s focus on education, responsiveness, and community building provides traders with the confidence and knowledge needed to navigate their funded journey. As highlighted across numerous FundedNext reviews, the human support and peer environment significantly enhance the trader experience—making it more than just a funding platform.

Additionally, those interested in long-term collaboration can explore FundedNext careers or even join the FundedNext affiliate program, which allows traders and influencers to earn commissions by promoting the firm’s offerings.

FundedNext Coupon Codes, Discounts & Promo Offers

Looking to save on your next FundedNext challenge? The good news is that FundedNext regularly offers discounts and promo deals for both new and existing traders. Whether you’re a beginner trying out the Stellar Lite challenge or a seasoned trader going for the $200K or $300K account, using a FundedNext coupon code can significantly lower your evaluation costs.

If you’re researching the platform’s pricing flexibility, the insights shared throughout this FundedNext review make it clear that frequent promotions are one of its most attractive features for new traders.

Latest FundedNext Offers and Discounts

- FundedNext discount code promotions are often released during special events like New Year, Black Friday, or company milestones.

- At times, users can find an exclusive FundedNext promo code offering up to 50% off on selected challenges.

- Limited-time FundedNext coupon code deals are promoted via email, influencers, or official social media channels.

How to Use a FundedNext Discount Code

Applying a coupon code for FundedNext is simple:

- Visit fundednext.com.

- Select your desired challenge (Evaluation, Express, or Stellar).

- On the checkout page, paste your FundedNext coupon or promo code in the “Enter Code” field.

- The FundedNext discount will be applied automatically before payment.

Where to Find Verified FundedNext Codes

- Official newsletters

- FundedNext’s Telegram, Instagram, or Discord accounts

- Partner blogs and YouTube trading communities

- Onboarding emails for new users

As discussed earlier in this FundedNext review, taking advantage of verified discount codes can be a smart way to minimize your upfront costs without compromising access to premium challenge models.

Please note: Not all FundedNext discount codes are active year-round. It’s best to check the official website or trusted partners for the most recent coupon FundedNext updates. Using unverified or expired codes may result in checkout errors.

Whether you’re searching for a FundedNext 50 discount code, code promo FundedNext, or simply want to use a discount code for FundedNext, make sure to verify the offer source and use it before it expires.

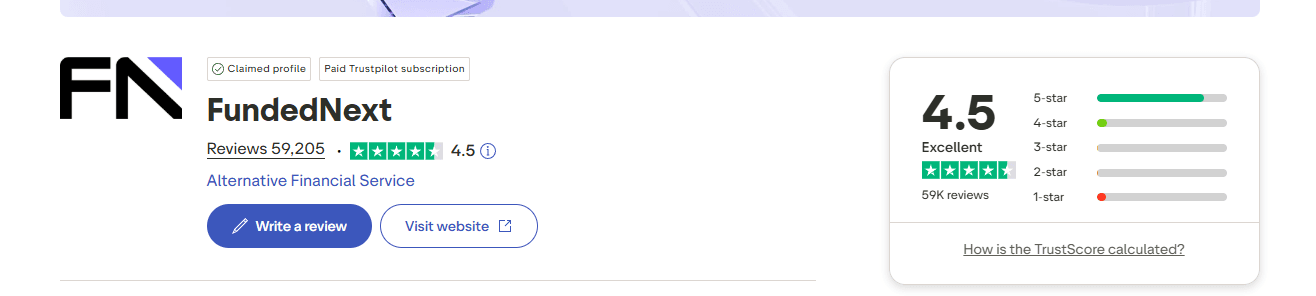

Traders Opinion

FundedNext has earned widespread praise from traders across the globe, reflected in its impressive 4.5-star rating on Trustpilot based on thousands of reviews. The FundedNext Trustpilot page highlights consistent positive feedback, with many traders commending the platform’s responsive customer support, fast payouts, and smooth onboarding process. The firm is often described as being transparent and fair, with clear rules and no hidden fees—traits that consistently stand out in trader testimonials.

A recurring highlight in user reviews is FundedNext’s commitment to timely profit payouts and flexible funding models, which give traders more control over their journey. As echoed in many authentic FundedNext review posts, the platform’s reputation for valuing trader satisfaction makes it a top-tier option in the proprietary trading space.

FundedNext Review: Pros and Cons

Evaluating the strengths and weaknesses of FundedNext is crucial for traders considering their proprietary trading program. Understanding these aspects helps align the firm’s offerings with individual trading goals and risk tolerance.

Keynotes:

- FundedNext’s model allows traders to access substantial capital without personal financial risk, making it an attractive option for skilled traders.

- The firm’s multiple evaluation models provide flexibility, but traders should carefully consider the associated risk management rules and ensure they align with their trading strategies.

- Prospective traders should evaluate the initial evaluation fees and be comfortable with the firm’s trading conditions before engaging with FundedNext.

These factors are frequently discussed in any well-rounded FundedNext review, helping traders make more informed decisions based on their individual goals and risk tolerance.

Is FundedNext Worth It?

FundedNext stands out in the proprietary trading space by offering traders up to $200,000 in funded capital, allowing individuals to trade without risking their own money. The firm’s model not only tackles the common issue of undercapitalization but also incentivizes performance through profit sharing of up to 95%, making it attractive for serious traders.

What sets FundedNext apart is its flexible funding models, including Evaluation, Express, and Stellar, each catering to different trader profiles and risk appetites. These diverse options empower traders to choose a funding path that aligns with their strategy and goals. As highlighted in more than one FundedNext review, this level of customization is a key advantage over many other prop firms.

Additionally, FundedNext provides instant funding opportunities, access to popular platforms like MT4, MT5, cTrader, and Match-Trader, and allows trading in forex, indices, crypto, commodities, and more. The transparent rules, reliable customer support, and positive trader feedback across platforms like Trustpilot further validate its reputation. A well-researched FundedNext review often emphasizes how these features make it stand out for traders looking for performance-based growth and flexibility.

The Final Words

FundedNext has emerged as a competitive force in the proprietary trading space, offering traders access to capital of up to $200,000 with potential scaling up to $1,000,000 through its structured plan that increases account size by 40% every four months. The firm stands out for its bi-weekly payouts, profit splits up to 95%, and multiple evaluation programs, including the popular Two-Step Stellar Challenge. With no maximum trading period, support for news and weekend trading, and access to trading psychologists, FundedNext demonstrates a deep commitment to trader success. As confirmed in this comprehensive FundedNext review, the firm proves to be a serious and rewarding option for dedicated traders aiming for long-term success.

Restricted Countries

Traders from the following countries are not eligible to participate in FundedNext's programs:

FundedNext FAQs

Common questions about FundedNext challenges and trading rules

Does FundedNext accept US clients?

Yes, FundedNext accepts US clients. Traders from the United States are allowed to participate in FundedNext’s funding programs. However, it is always recommended to check the latest terms and conditions on the official website, as client eligibility may vary depending on legal or regulatory updates.

Yes, FundedNext accepts US clients. Traders from the United States are allowed to participate in FundedNext’s funding programs. However, it is always recommended to check the latest terms and conditions on the official website, as client eligibility may vary depending on legal or regulatory updates.

No, FundedNext does not allow copy trading. FundedNext strictly prohibits the use of copy trading, account mirroring, trade copiers, or similar automation tools that duplicate trades across accounts. All trading activity must be original and executed by the trader assigned to the account.

Yes, FundedNext is a legitimate proprietary trading firm. Established in March 2022 and operating under Next Ventures FZCO in Dubai, UAE, FundedNext has gained trust within the trading community. It holds a strong reputation backed by positive reviews on platforms like Trustpilot and a growing global trader base.

No, FundedNext is not regulated by a financial authority. Like most proprietary trading firms, FundedNext is not a regulated broker. However, it operates transparently under a registered business entity (Next Ventures FZCO in Dubai) and partners with regulated third-party brokers for trade execution.

FundedNext partners with several top-tier brokers, including Eightcap, ThinkMarkets, IC Markets, and Purple Trading Seychelles. These brokers are known for tight spreads, fast execution, and reliability—creating a professional trading environment for FundedNext clients.

No, FundedNext is not a scam. It is a reputable and operational prop firm with thousands of active traders worldwide. FundedNext offers real payouts, transparent rules, and an official online presence. Reviews on Trustpilot and social platforms affirm the company’s legitimacy and trader satisfaction.

FundedNext was founded in March 2022. Since its launch, the firm has quickly grown into one of the leading names in the prop trading industry, offering funded accounts of up to $300,000 and supporting traders from more than 190 countries.

Yes, FundedNext competitions are legitimate. The firm occasionally hosts trading competitions and giveaways to engage its community. These competitions are publicly announced, follow clearly defined rules, and often reward top performers with funded accounts or cash prizes. Always refer to their official platforms for updates.