In the dynamic world of proprietary trading, Funding Pips has established itself as a firm offering traders the opportunity to manage substantial capital without risking their own funds. Known for its structured evaluation processes, Funding Pips has become a notable choice for both aspiring and professional traders. But is it the right prop firm for you in 2025? This comprehensive Funding Pips review aims to provide an in-depth look into their evaluation programs, account types, profit splits, and more, helping you decide if Funding Pips aligns with your trading goals.

Funding Pips offers multiple evaluation models designed to assess traders’ skills and risk management abilities. Traders are required to meet specific profit targets while adhering to defined risk parameters. Successful completion of these evaluations grants access to funded accounts with sizes up to $100,000.

Through consistent performance and adherence to their scaling plans, traders can work towards managing larger accounts over time. With profit splits ranging from 70% to 90%, Funding Pips is structured to reward successful trading while providing avenues for capital growth.

This detailed Funding Pips review will also cover the firm’s account types, supported platforms, and additional features that distinguish it in the competitive world of prop trading. Whether you’re an experienced trader or new to the industry, understanding how Funding Pips operates is essential before embarking on their evaluation process.

Table of Contents

Who is Funding Pips?

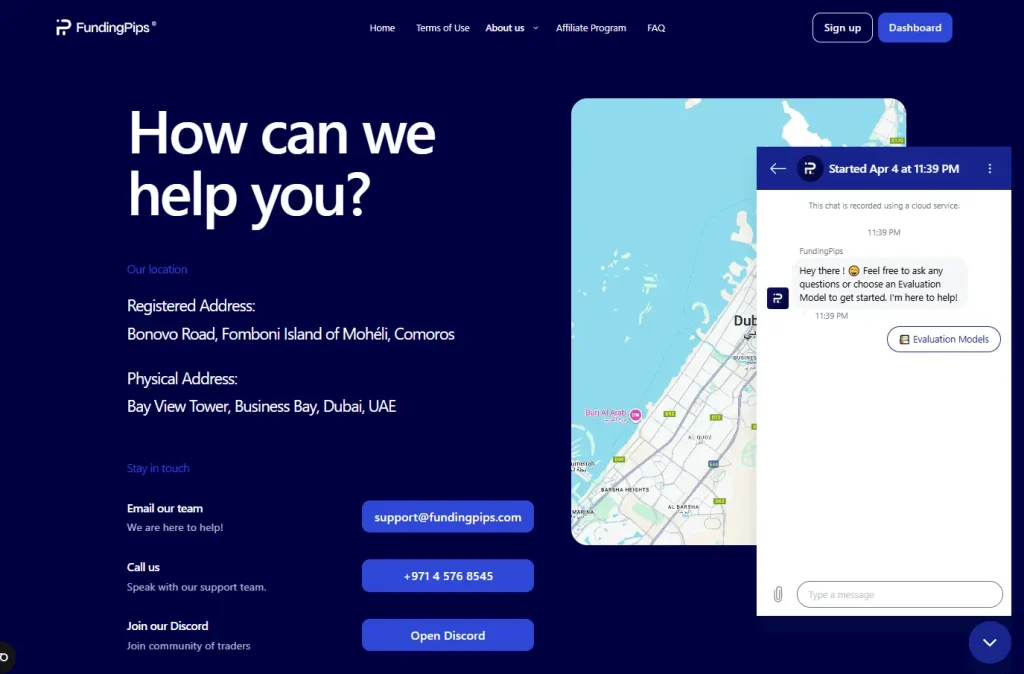

Established in August 2022, Funding Pips is a proprietary trading firm headquartered in Dubai, United Arab Emirates, with its official Funding Pips location listed as Bay View Tower, Business Bay, Dubai. The firm offers traders the opportunity to manage account sizes ranging from $5,000 up to $100,000 through various evaluation programs.

Funding Pips provides a profit-sharing model, allowing traders to retain between 60% and 100% of their profits, depending on the chosen evaluation program and trading performance. Traders also benefit from a low Funding Pips commission structure, maximizing profitability across all account sizes.

The firm has cultivated an active trader community through platforms like Funding Pips Discord, where users exchange strategies, results, and support. Discussions on Funding Pips Reddit also offer insights into trader experiences, making it easier for potential users to evaluate the firm’s offerings from a peer perspective.

With its expanding ecosystem, Funding Pips has also launched a dedicated Funding Pips app, allowing traders to manage their accounts, track progress, and receive updates conveniently from their mobile devices.

In summary, Funding Pips is a modern proprietary trading firm offering traders the opportunity to manage substantial capital with a competitive profit-sharing model. Their strategic partnerships, transparent policies, and commitment to providing favorable trading conditions have positioned them as a standout option for those seeking funded trading opportunities. This Funding Pips review highlights the firm’s reputation for flexibility, innovation, and strong community support.

Brokers That Are Used By Funding Pips

Funding Pips, a proprietary trading firm, has historically partnered with several brokers to provide access to trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Notably, they collaborated with BlackBull Markets, a respected brokerage, as a key Funding Pips broker partner.

In February 2024, the firm encountered challenges when MetaQuotes, the developer of MT4/MT5, abruptly halted services due to the presence of active U.S. accounts. This development led to the termination of their partnership with BlackBull Markets, temporarily affecting the firm’s platform offerings.

To adapt, Funding Pips explored other trading platforms such as TradeLocker and cTrader, aiming to ensure uninterrupted trading access. However, some users experienced unannounced transitions between platforms, which led to mixed reactions regarding platform stability.

This portion of the Funding Pips review emphasizes the firm’s adaptability in navigating regulatory disruptions while maintaining a commitment to providing reliable platform access for its traders.

Who is the CEO of Funding Pips?

Khaled Ayesh is the Founder and CEO of Funding Pips, a proprietary trading firm created to transform the trading evaluation landscape.

Born and raised in Amman, Jordan, Khaled moved to Germany at 17 to pursue higher education. Initially focused on Mechanical Engineering, he later transitioned to Finance at SRH Hochschule Berlin, where he discovered a deep interest in trading.

In October 2022, Khaled launched Funding Pips, bringing his trading insights and academic background into a firm built around transparency, weekly payouts, and trader satisfaction. Under his leadership, Funding Pips introduced weekly withdrawal options and maintained a track record of zero payout denials—a key differentiator in the prop firm space.

Khaled’s innovative vision and leadership continue to shape the firm’s direction and credibility, making him a prominent figure often referenced in Funding Pips CEO searches and community discussions.

Funding Pips Scaling Plan & Funding Programs

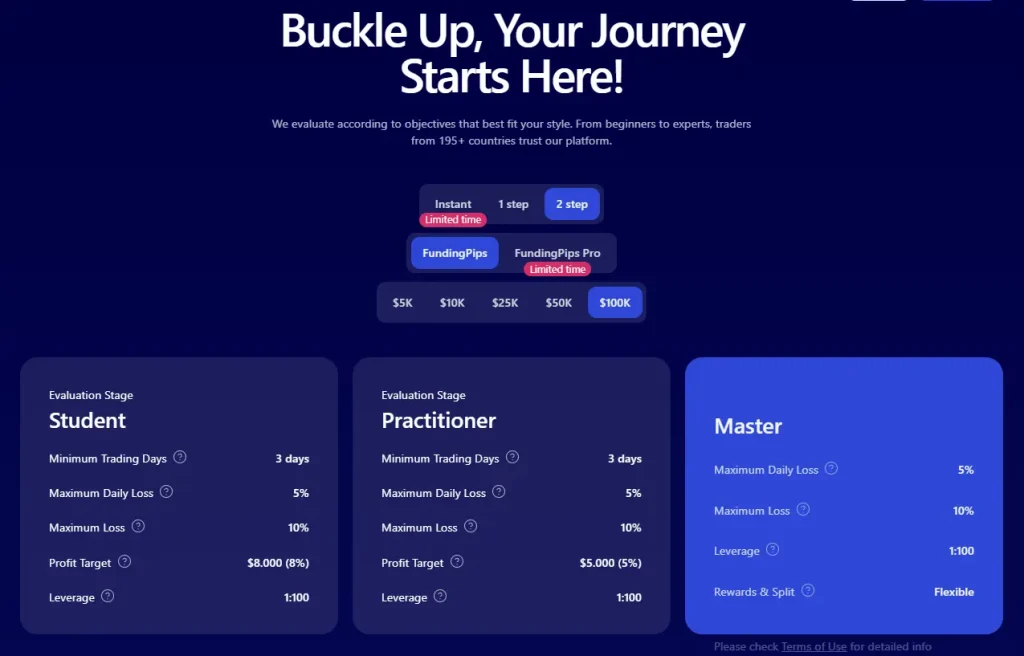

Funding Pips offers multiple evaluation programs and a structured scaling plan, providing traders with an opportunity to manage significant capital and grow their accounts over time. Unlike many other prop firms, Funding Pips offers four different funding programs, catering to traders with varying experience levels and risk preferences.

Once traders successfully complete their chosen evaluation, they gain access to a funded account where they can trade without risking personal capital. Additionally, Funding Pips’ scaling plan allows traders to increase their capital allocation based on consistent performance. A comprehensive funding pips review would highlight this flexibility as a key advantage for long-term traders aiming to grow with the firm.

Overview of Funding Pips Funding Programs

| Program | Key Features | Scaling & Profit Split | Who It’s For? |

| Two-Step Pro Evaluation | – Two-phase evaluation process.- Profit targets: 8% in Phase 1, 5% in Phase 2.- Drawdown limits: 5% daily, 10% overall.- Leverage up to 1:100. | – Eligible for account scaling based on performance.- Profit split starts at 80% and increases to 100% with scaling. | Traders looking for a structured challenge with clear profit targets and a generous scaling plan. |

| Two-Step Evaluation | – Similar to Pro Evaluation but with slightly different rules.- Profit targets: 10% in Phase 1, 5% in Phase 2.- No maximum trading days.- Equity-based drawdown model. | – Profit split starts at 60% and scales up to 100%.- Scaling plan available for high performers. | Traders wanting a balanced challenge with flexible rules and growth opportunities. |

| One-Step Evaluation | – Single-phase challenge with 10% profit target.- No maximum trading days.- No scaling plan. | – Profit split starts at 75%.- No scaling option. | Traders who prefer a simpler evaluation without a second verification phase. |

| Zero Program | – Instant funding, no evaluation required.- Requires a consistency score for withdrawals.- No scaling plan.- Weekend holding is restricted. | – Profit split starts at 70%.- No scaling option. | Traders who want immediate capital without completing an evaluation. |

Key Takeaways:

- Diverse Evaluation Options: Funding Pips provides multiple funding paths, allowing traders to select the model that best suits their trading style and experience level.

- Scaling Plan for Growth: Eligible traders can scale their accounts over time, with profit splits increasing up to 100%. The profit split Funding Pips offers is designed to reward consistent performance, giving traders greater earning potential as they grow.

- Flexibility & Instant Funding: The Zero Program enables traders to start trading without an evaluation, while the One-Step and Two-Step programs provide structured growth paths.

Funding Pips’ funding programs and scaling plans offer traders a structured yet flexible approach to proprietary trading, making it a competitive choice in the prop trading industry.

Funding Pips Review: How to Get Funded?

In this funding pips review, we explore the process by which traders can secure funding from Funding Pips, a proprietary trading firm offering multiple evaluation programs tailored to assess a trader’s skill, consistency, and risk management abilities. Funding Pips provides various pathways to funding, including One-step, Two-step, and Three-step evaluation processes, each designed to accommodate different trading styles and experience levels.

1. One-step Evaluation

The One-step Evaluation is designed for traders seeking a swift path to a funded account. In this phase, traders must achieve a 10% profit target without exceeding a 4% daily loss or a 6% maximum loss. There is no maximum time limit to complete this challenge, allowing traders to proceed at their own pace.

To get started, traders can [Funding Pips create Account] easily through the official website. For returning users, the [Funding Pips login] process provides quick and secure access to their dashboard. Traders can also explore the [Funding Pips app download] option for convenient mobile access.

Upon successful completion, traders are eligible for an 80% profit split, with the potential to increase to 100% upon reaching the maximum scaling plan, known as the “Hot Seat.” Additionally, traders have the flexibility to hold trades overnight and over weekends, accommodating a variety of trading strategies.

2. Two-step Evaluation

The Two-step Evaluation is a standard process that requires traders to complete two phases:

Phase 1: Achieve an 8% profit target while adhering to a 5% daily loss and a 10% maximum loss.

Phase 2: Attain a 5% profit target under the same loss limits as Phase 1.

Both phases have no maximum trading day requirements, allowing traders to progress at their own pace. Upon successful completion, traders receive a funded account with a profit split ranging from 60% to 100%, depending on withdrawal frequency.

3. Three-step Evaluation

The Three-step Evaluation is structured to test a trader’s skill, consistency, and risk management over an extended period. Specific details regarding profit targets and loss limits for each phase are not publicly disclosed. This evaluation is ideal for traders seeking a more rigorous assessment process.

4. Instant Funding Program

For those seeking immediate access to capital, Funding Pips offers an Instant Funding Program. This option allows traders to start with a funded account without undergoing the evaluation phases. However, it comes with specific conditions, such as reduced leverage and potential payout restrictions.

Profit Sharing and Payouts

Funding Pips offers competitive profit-sharing arrangements:

- Profit Split: Traders can earn between 60% to 100% of their profits, depending on the chosen evaluation program and withdrawal frequency.

- Payout Frequency: Traders can request their first payout after 5 trading days, with subsequent payouts available every 5 trading days.

In summary, this comprehensive funding pips review highlights the firm’s commitment to offering traders flexible evaluation programs, competitive profit splits, and accommodating trading conditions. Whether you’re a beginner looking for a fast-track route or an experienced trader seeking a more structured challenge, Funding Pips provides multiple pathways tailored to diverse needs in the proprietary trading space.

Trading Instruments and Platforms at Funding Pips

When evaluating Funding Pips, it’s crucial to understand the variety of trading instruments and platforms they offer. This diversity enables traders to implement a broad range of strategies during both the evaluation phases and the funded account period. A well-rounded funding pips review often highlights this aspect as a key strength of the firm.

Trading Instruments at Funding Pips

Funding Pips provides access to a wide array of financial instruments across multiple asset classes, allowing traders to diversify their portfolios effectively. The key trading instruments include:

- Forex: Major, minor, and exotic currency pairs are available, offering opportunities in the highly liquid forex market.

- Indices: Trade global indices, providing exposure to major global economies.

- Commodities: Instruments like gold, silver, oil, and other essential commodities are accessible for diversification and hedging strategies.

- Cryptocurrencies: Popular digital assets are available, catering to traders interested in the volatile crypto markets.

This extensive selection supports a comprehensive trading approach, ensuring that both novice and experienced traders can find suitable markets to engage with. For those reading a funding pips review, this range of assets often stands out as a major benefit.

Trading Platforms at Funding Pips

Funding Pips supports multiple advanced trading platforms, providing flexibility and sophisticated tools for executing trading strategies. The platforms include:

- cTrader: Recognized for its intuitive interface and advanced charting capabilities, suitable for traders seeking a dynamic trading experience.

- Match-Trader: A modern platform offering seamless trading experiences with customizable features, catering to various trading styles.

- TradeLocker: Provides a user-friendly environment with essential tools for efficient trading, appealing to those who prioritize simplicity and functionality.

Funding Pips’ commitment to offering multiple platforms ensures that traders can select the one that best fits their style and strategy. Each platform is equipped with features to support in-depth market analysis and efficient trade execution.

A detailed funding pips review would emphasize the firm’s robust selection of trading instruments and platforms, which enhances the overall trading experience. These offerings empower traders to confidently navigate the markets throughout their evaluation and beyond.

Funding Pips Trading Conditions: Spreads, Fees, and Rules

When evaluating Funding Pips, it’s crucial to understand their trading conditions, including spreads, fees, and trading rules, as these factors significantly impact a trader’s experience and profitability. Any detailed funding pips review will consider these elements key to understanding the firm’s appeal and functionality.

Spreads

Funding Pips aims to provide competitive spreads across a variety of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. While specific spread values are not detailed in the provided sources, the firm emphasizes offering conditions that cater to both novice and experienced traders. Competitive spreads are essential for cost-effective trading, particularly for strategies sensitive to transaction costs.

Fees

The fee structure at Funding Pips is designed to be transparent, allowing traders to anticipate costs accurately. However, explicit details regarding commissions per asset class are not specified in the available information. Traders are encouraged to review Funding Pips’ official materials or contact their support team to obtain precise information on any commissions or fees associated with trading various instruments.

Leverage

Funding Pips offers leverage up to 1:100, enabling traders to control larger positions with a relatively small amount of capital. This level of leverage can amplify both potential profits and losses, making effective risk management crucial. Understanding and utilizing Funding Pips leverage appropriately is vital for maintaining account health and achieving long-term trading success.

Trading Rules

Funding Pips enforces specific trading rules to promote disciplined and responsible trading:

- Maximum Daily Loss: Traders must not exceed a 5% loss of the initial account balance in a single day.

- Maximum Overall Loss: A cumulative loss limit of 10% of the initial account balance is imposed.

- Profit Targets: In the evaluation phases, traders are required to achieve profit targets of 8% in Phase 1 and 5% in Phase 2.

- Minimum Trading Days: A minimum of 3 trading days is required during each evaluation phase to ensure consistent trading activity.

- Stop-Loss Requirement: Traders must set a stop-loss on every position before opening a trade. A stop-loss must be placed within 30 seconds of executing a position. Failure to do so may result in automatic trade closure and multiple infractions can lead to account termination.

- News and Weekend Trading:

- For the 1-Step and 2-Step Models, trades can be held over weekends, but opening or closing trades within 5 minutes before and after high-impact news events on the affected currency is restricted unless the trade was executed 5 hours prior to the news.

- For the X Model, holding trades during news events and over weekends is prohibited.

- The Zero Model also prohibits weekend and news trading, with a 10-minute restricted window before and after high-impact news.

Violations of these rules can result in account penalties or closure.

These trading conditions and rules are structured to ensure that traders operate within defined risk parameters, fostering a disciplined environment. A comprehensive funding pips review would emphasize how these guidelines contribute to trader accountability and consistent performance throughout the evaluation and funding programs.

Subscription and Payment Methods at Funding Pips

Understanding the subscription process and payment methods at Funding Pips is crucial for traders looking to participate in the proprietary firm’s evaluation and funding process. Funding Pips operates with a one-time challenge fee, providing multiple account size options. The payment process is designed to be transparent and flexible, ensuring traders worldwide can conveniently participate.

A thorough funding pips review would note the ease and accessibility of their subscription model, making it straightforward for traders of all levels to get started.

Subscription Options and Associated Fees

Funding Pips offers various challenge account sizes, each with a corresponding one-time fee. These fees are refundable upon successful completion of the evaluation and the first profit withdrawal. Below is a breakdown of the available account sizes and their respective challenge fees:

| Account Size | Challenge Fee (EUR) | Refundable |

| €10,000 | €155 | Yes |

| €25,000 | €250 | Yes |

| €50,000 | €345 | Yes |

| €100,000 | €540 | Yes |

| €200,000 | €1,080 | Yes |

These one-time fees cover both the evaluation and verification phases, allowing traders to prove their trading skills before gaining access to a fully funded account. The Funding Pips pricing model ensures clarity and fairness, making it easier for traders to plan their investment.

Available Payment Methods

Funding Pips supports a variety of secure and efficient payment methods to accommodate traders globally. Below is a detailed overview of the available payment methods:

| Payment Method | Availability | Processing Time |

| Bank Transfer | Worldwide | 1-3 business days |

| Debit/Credit Card | Visa, MasterCard, Amex | Instant |

| Skrill | Selected Countries | Instant |

| Cryptocurrency | Bitcoin, Ethereum, USDT | Within a few hours |

These diverse options ensure that traders can select the most convenient payment method based on their preferences and location.

Withdrawal Policies

Funding Pips ensures a streamlined withdrawal process, enabling traders to receive their earned profits efficiently. After passing the Funding Pips evaluation, traders can request withdrawals from their funded accounts at specified intervals. The standard Funding Pips profit split begins at 80%, with opportunities to scale up based on trading performance through the Funding Pips scaling model.

- Withdrawal Processing Time: Typically processed within 1–2 business days after submission.

- Supported Withdrawal Methods: Bank transfers and digital wallets, ensuring global accessibility.

- Flexible Payouts: Traders can withdraw their profits as per the firm’s guidelines, enhancing financial flexibility and benefiting from the Funding Pips payout structure.

Any honest Funding Pips review would highlight the firm’s efficient and flexible approach to withdrawals, which sets them apart from many competitors. Additionally, users can manage their profits easily through the Funding Pips platform, which supports both beginner and advanced traders.

Refund Policy

Funding Pips offers a fair and transparent refund policy designed to reward successful traders:

- The challenge fee is fully refundable upon completion of the Funding Pips challenge and the first profit withdrawal.

- If a trader fails any stage of the challenge, the fee is non-refundable.

This refund structure encourages responsible trading while providing a fair incentive for those who successfully meet Funding Pips’ rules and objectives. A detailed Funding Pips review would certainly recognize this policy as a trader-friendly feature that enhances trust and accountability.

In addition to its standard offerings, Funding Pips stands out with features like the Funding Pips instant funding option and periodic Funding Pips competition events. For traders looking to get started, exploring the Funding Pips free trial and understanding the Funding Pips account price are great first steps. With a maximum Funding Pips max allocation set at competitive levels, the firm provides a clear path for growth and long-term success.

Payment Proof

Funding Pips processes payouts promptly and consistently, ensuring traders receive their earnings without unnecessary delays. Traders frequently share positive experiences regarding the firm’s efficient withdrawal system. To reinforce trust, the company provides proof of payments, including payout certificates and transaction records, highlighting its commitment to transparency and timely compensation.

By offering clear pricing, multiple payment methods, and a trader-friendly refund policy, Funding Pips ensures an accessible and seamless experience for traders worldwide. These features make it an appealing choice for those seeking a reliable proprietary trading firm.

Funding Pips vs. Other Prop Trading Firms: A Competitive Overview

To give traders a clearer understanding of how Funding Pips compares to other top proprietary trading firms, we’ve created a detailed comparison between Funding Pips, FXIFY, and Blue Guardian. This side-by-side overview highlights key differences in funding models, evaluation processes, profit splits, platform support, and overall trading conditions. Whether you’re researching your next prop firm or already diving into a funding pips review, this comparison will help you make a more informed decision based on your trading goals and preferences.

| Feature | Funding Pips | FXIFY | Blue Guardian |

| Initial Capital | Up to $400,000 | Up to $400,000 | Up to $400,000 |

| Evaluation Process | Two-step evaluation program | One-phase, two-phase, and three-phase challenges | One-step, two-step, and three-step challenges |

| Profit Split | Up to 100% | Up to 90% | Up to 90% |

| Scaling Plan | Not specified | Scale up to $4,000,000 | Up to $2,000,000 |

| Tradable Instruments | Forex, commodities, indices, cryptocurrencies | Forex, stocks, and more | Forex, commodities, indices, cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5 | Trading Platform 4, Trading Platform 5 | MetaTrader 5 |

| Maximum Drawdown | Not specified | Not specified | 6% max relative drawdown |

| Daily Loss Limit | Not specified | Not specified | 4% daily drawdown limit |

Key Notes:

- Funding Pips offers a two-step evaluation program with profit splits up to 100%. Traders have access to MetaTrader platforms and a variety of tradable instruments.

- FXIFY provides flexible evaluation processes with up to 90% profit splits and a scaling plan that allows traders to manage up to $4,000,000. The firm supports Trading Platform 4 and Trading Platform 5, offering a broad range of trading instruments.

- Blue Guardian features multiple challenge types with profit splits up to 90%. The firm allows news trading and weekend holding, offering leverage up to 1:100 on forex pairs.

Each proprietary trading firm presents unique advantages. Traders should assess their individual trading styles, risk tolerance, and goals carefully. As highlighted in this funding pips review, comparing these firms side by side is essential to finding the right fit for your trading journey.

Funding Pips Trader Community and Support

Funding Pips has cultivated a robust ecosystem aimed at enhancing the trading experience for its clients. This ecosystem encompasses a vibrant trader community, comprehensive educational resources, and dedicated support services, all designed to foster trader development and success. As noted in this funding pips review, the firm’s commitment to supporting its traders extends beyond funding—creating a well-rounded environment for growth.

Educational Resources

Funding Pips is committed to trader education, offering a variety of resources to enhance trading skills and knowledge. Their blog features articles such as “A Step-by-Step Guide to Forex Trading for Beginners,” providing foundational insights into forex trading. Additionally, the firm organizes community events like the “Community Championship,” fostering collaboration and healthy competition among traders. These initiatives are often highlighted in any thorough funding pips review, as they demonstrate the firm’s investment in trader growth and collective learning.

Community Engagement and Social Presence

Funding Pips fosters a vibrant community through multiple channels:

- Discord Server: An exclusive platform where traders engage in real-time discussions, share insights, and collaborate on strategies. With over 158,000 members, it reflects an active and engaged user base.

- Facebook Group: The “Funding Pips Trader’s Community” provides a space for traders to discuss topics, exchange ideas, and support each other’s trading journeys.

- Social Media Presence: Funding Pips maintains active profiles on platforms like Instagram and X (formerly Twitter), regularly sharing updates, educational content, and success stories to keep the community informed.

As emphasized in this funding pips review, the firm’s ability to nurture trader interaction and learning through its social presence is a strong differentiator in the prop trading space.

24/7 Customer Support

Recognizing the dynamic nature of trading, Funding Pips offers round-the-clock customer support to ensure traders’ needs are promptly addressed. Support is available in multiple languages, catering to a diverse global clientele. Traders can reach the support team through:

- Live Chat: Via the official website for immediate assistance

- Email: For detailed inquiries at [email protected]

- Phone: Direct support through +971 45768545

This support infrastructure is a standout in any funding pips review, as it reinforces the firm’s commitment to offering consistent, global trader assistance. For more details on rules, payouts, and account options, traders can refer to the official Funding Pips FAQ section.

Knowledge Base and Help Center

Funding Pips offers a comprehensive Help Center, providing valuable insights on trading objectives, account management, and platform navigation. This resource empowers traders to resolve common issues independently, enhancing the overall trading experience.

Community Initiatives and Events

To further enrich the trader journey, Funding Pips hosts community initiatives, such as competitions and challenges. Events like the “Community Championship” encourage members to learn together, exchange ideas, and grow in a supportive environment.

Funding Pips’ dedication to offering extensive educational resources, nurturing a connected trader community, and delivering top-tier support plays a crucial role in trader development. These initiatives equip traders with the tools and confidence to navigate the markets, manage risks effectively, and pursue consistent profitability.

Funding Pips Discount Code

If you’re planning to join Funding Pips and want to reduce your challenge fees, it’s a good idea to look out for an active Funding Pips discount code or seasonal promotions. While Funding Pips doesn’t consistently advertise ongoing offers, they have been known to provide exclusive discounts during special events, collaborations, and through trusted affiliate partners.

As of now, there is no publicly listed Funding Pips coupon code on their official website, and no always-active offer is promoted across major platforms. However, traders may occasionally find a Funding Pips promo code during email campaigns, social media giveaways, or via verified ambassadors within the trading community.

Some users have reported receiving a Funding Pips promo code free through referral programs or limited-time offers, especially when signing up via influencers or trading forums. In rare cases, a Funding Pips discount coupon offering up to 20–30% off has been made available during holiday sales or launch events.

Before using any Funding Pips coupon or promo code, always ensure it’s sourced from Funding Pips’ official website or authorized partners. Not all third-party websites offering a Funding Pips discount code or coupon code are trustworthy—using an invalid or fake code could lead to payment issues or disqualification from promotions.

To stay updated on potential savings, consider subscribing to their newsletter or following Funding Pips on social media. You might just catch a valid Funding Pips discount that makes your next trading challenge more affordable.

Traders’ Opinions

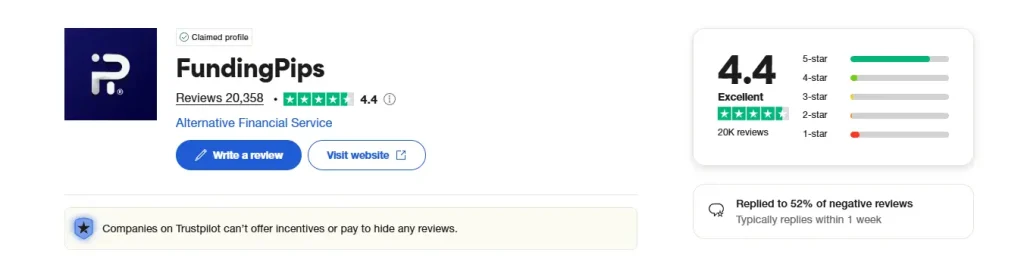

Funding Pips has received mixed reviews from its user base. On Funding pips Trustpilot, the firm holds an “Excellent” rating of 4.4 out of 5, based on 20K reviews. Approximately 81% of these are 5-star ratings, with traders commending the firm’s prompt payouts and supportive customer service. For instance, a user noted receiving their first payout within two business days, enhancing their confidence in the platform. Many have shared a positive funding pips review, highlighting the firm’s reliability and smooth onboarding process.

Conversely, some traders have reported concerns regarding delayed payments, account issues, and technical challenges such as severe slippage. These issues have led to frustrations, with users highlighting the need for improved communication and resolution processes. Reading more than one funding pips review, it becomes clear that while the platform has strong points, some users still urge caution due to these operational challenges.

Overall, while many traders appreciate Funding Pips’ offerings and support, others urge caution due to the reported operational challenges.

Funding Pips Review: Pros and Cons

Evaluating the strengths and weaknesses of Funding Pips is crucial for traders considering their proprietary trading program. A detailed funding pips review helps align the firm’s offerings with individual trading goals and risk tolerance.

| Pros | Cons |

| Access to Significant Capital: Funding Pips offers traders the opportunity to manage accounts up to $200,000, enabling substantial profit potential without risking personal funds. | Equity-Based Drawdown: The firm employs an equity-based drawdown model, which may not align with all trading strategies. |

| Flexible Evaluation Programs: Traders can choose from four unique funding programs—Two-step Pro Evaluation, Two-step Evaluation, One-step Evaluation, and Zero Program—catering to various experience levels and preferences. | Hedging Prohibited: Hedging strategies are not allowed, which may limit certain trading approaches. |

| Generous Profit Sharing: Profit splits range from 60% up to 100%, rewarding successful traders with a significant share of their earnings. | Consistency Score in Zero Program: The Zero Program includes a consistency score requirement, which may be challenging for some traders. |

| Diverse Asset Offering: Funding Pips supports trading across various instruments, including forex pairs, commodities, indices, and cryptocurrencies, allowing for diversified trading strategies. | Withdrawal Requirement: There is a 1% minimum withdrawal amount of the initial account balance, which may affect withdrawal flexibility. |

| No Maximum Trading Day Requirements: Traders are not bound by maximum trading day limits, providing flexibility in meeting profit targets. | Weekend Holding Restrictions in Zero Program: Weekend holding is not permitted in the Zero Program, which may impact certain trading styles. |

| Scaling Plan: The firm offers a scaling plan that allows traders to increase their account size based on consistent performance. | |

| Leverage up to 1:100: Traders can utilize leverage up to 1:100, enabling larger position sizes and potentially higher returns. | |

| Professional Trader Dashboard: A user-friendly dashboard enhances the trading experience by providing essential tools and analytics. | |

| Affordable Prices: The evaluation programs are priced competitively, making them accessible to a wide range of traders. |

Keynotes:

- Funding Pips’ model allows traders to leverage substantial capital without personal financial risk, making it an attractive option for skilled traders.

- The firm’s flexible evaluation programs and generous profit-sharing arrangements cater to traders with varying experience levels and performance records.

- Prospective traders should carefully consider the specific rules and restrictions, such as the prohibition on hedging and withdrawal requirements, to ensure they align with their trading strategies and goals.

Is Funding Pips Worth It?

Funding Pips presents a compelling option for traders seeking fast access to capital without navigating complex evaluation models. With a one-phase challenge, up to $200,000 in funding, and an 80% profit split, it appeals to experienced traders aiming to scale quickly. The firm offers tight spreads, no commission fees, and supports EAs and copy trading, making it versatile.

Additionally, no minimum trading days and instant funding options provide extra flexibility. While some users report issues like slippage and delayed payouts, the majority praise the firm for its efficiency and support. Reading a detailed funding pips review can provide better insight into these user experiences.For confident traders with proven strategies, Funding Pips can be a valuable opportunity in the prop trading space.

The Final Words

Funding Pips has emerged as a noteworthy name in the proprietary trading industry, offering traders access to capital up to $200,000 with a simplified evaluation model and instant funding options. With a focus on trader-friendly conditions—such as tight spreads, zero commissions, and flexible rules—the firm caters well to skilled traders seeking growth.

While not without occasional technical concerns, Funding Pips’ payouts, support, and scaling potential make it a credible option. If you’re considering joining, reading a recent funding pips review could help you make a well-informed decision based on trader feedback.

Frequently Asked Questions

1. What is Funding Pips?

Funding Pips is a proprietary trading firm established in 2022, headquartered in Dubai, United Arab Emirates. The firm offers traders the opportunity to manage funded accounts by successfully completing evaluation challenges. Traders can access a variety of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies.

2. Is Funding Pips legit?

Funding Pips operates as an unregulated proprietary trading firm. While it has garnered a significant user base and offers funded trading opportunities, potential clients should exercise due diligence and consider the lack of regulatory oversight when evaluating the firm’s legitimacy.

3. When was Funding Pips founded?

Funding Pips was founded in 2022.

4. Where is Funding Pips located?

4. Where is Funding Pips located?

Funding Pips is headquartered at Premises NO. 19948-001, IFZA Business Park, DDP, Dubai, United Arab Emirates.

5. Does Funding Pips accept US clients?

As of early 2024, Funding Pips has resumed accepting clients from the United States after migrating its services to the Match-Trader platform. This move was aimed at complying with regulatory requirements and expanding their client base.

6. Does Funding Pips use MT5?

Yes, in March 2025, Funding Pips reintroduced the MetaTrader 5 (MT5) platform to its offerings after obtaining a direct license from MetaQuotes. This allows traders to utilize the popular MT5 platform for their trading activities.

7. Is Funding Pips regulated?

No, Funding Pips operates as an unregulated entity. It does not hold a license from any recognized financial regulatory authority. Traders should be aware of the risks associated with engaging with unregulated firms.

8. What broker does Funding Pips use?

Funding Pips has partnered with Match-Trade Technologies, utilizing the Match-Trader platform to provide trading services to its clients. This transition occurred after discontinuing the use of MetaTrader platforms in early 2024.

for

for