FXIFY

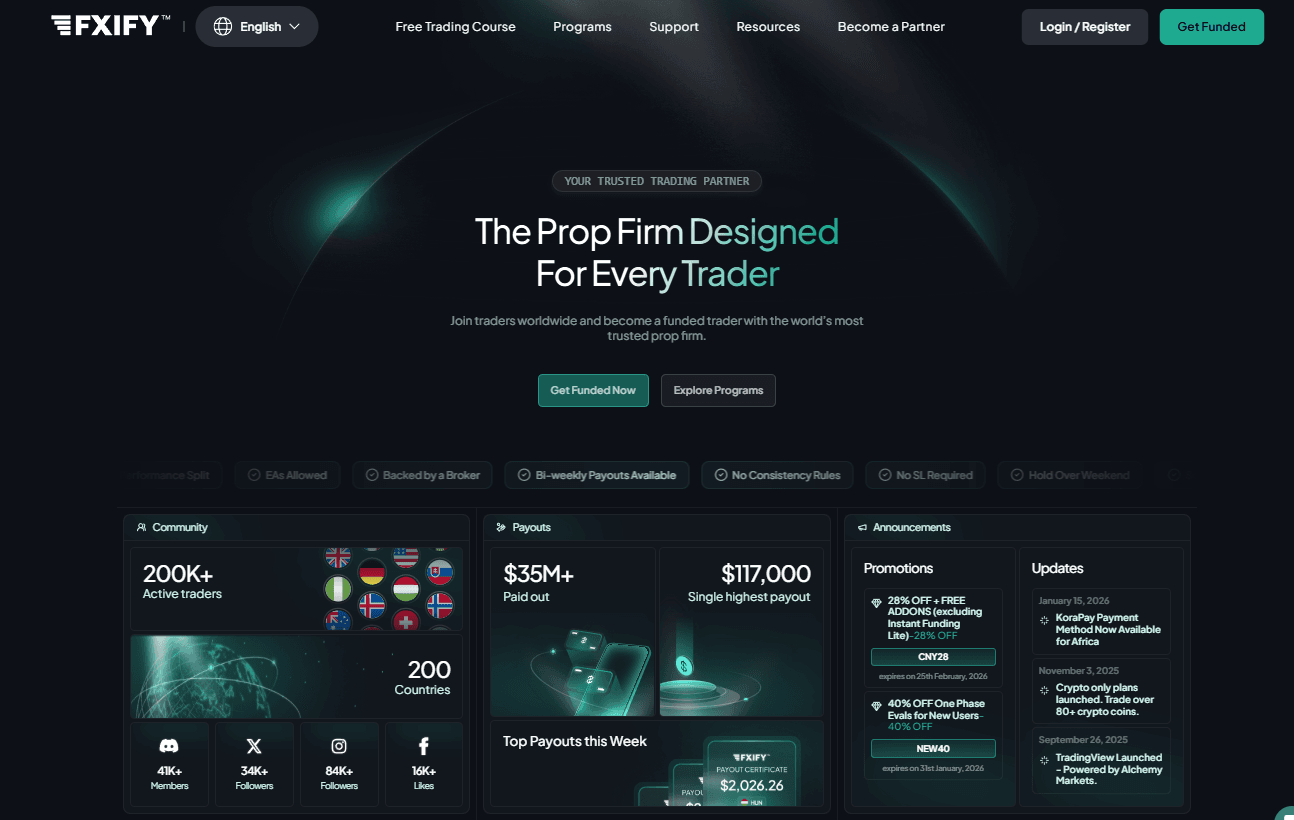

FXIFY is a modern prop firm offering up to $4,000,000 in trading capital. It provides a top-tier environment with real-time analytics, helping traders sharpen their skills. With customizable accounts, FXIFY suits both fast-paced and relaxed trading styles.

FXIFY

FXIFY is a modern prop firm offering up to $4,000,000 in trading capital. It provides a top-tier environment with real-time analytics, helping traders sharpen their skills. With customizable accounts, FXIFY suits both fast-paced and relaxed trading styles.

About FXIFY

In the competitive landscape of proprietary trading, FXIFY has established itself as a firm that enables traders to manage capital without personal financial risk. Founded in May 2023 and headquartered in the United Kingdom, FXIFY is led by co-founders David Bhidey and Peter Brown. The company’s evaluation process is designed to identify skilled traders and provide them with funded accounts.

FXIFY offers several evaluation models, including One-phase, Two-phase, and Three-phase challenges, each tailored to different trading styles and levels of experience. Successful traders can access account sizes up to $400,000, with the potential to scale allocations to $4,000,000. The firm supports trading across forex, commodities, indices, stocks, and cryptocurrencies, encouraging diversification.

A standout feature is its profit-sharing model, which ranges from 80% to 90%, with certain crypto programs offering up to 100%. Combined with its scaling plan, FXIFY provides traders with the opportunity to grow their accounts significantly based on performance.

Who is FXIFY?

FXIFY operates under the legal name FXIFY Solutions Limited. Since its launch in 2023, the firm has positioned itself as a transparent and scalable prop trading company. It offers traders structured evaluation programs, flexible account sizes, and access to multiple asset classes.

The firm’s mission is to provide traders with institutional-grade trading conditions while maintaining clear rules and payout structures. With account sizes ranging from $5,000 to $400,000, and a scaling plan that can reach $4,000,000, FXIFY appeals to both new and experienced traders seeking growth opportunities.

Brokers That Are Used By FXIFY

FXIFY partners with FXPIG and Alchemy Markets to deliver its trading infrastructure. FXPIG is recognized for its liquidity and Straight Through Processing (STP) execution, while Alchemy Markets enhances accessibility through TradingView integration.

These broker relationships allow FXIFY traders to use platforms such as MT4, MT5, DXTrade, and TradingView, ensuring flexibility across different trading preferences. The partnerships also provide access to a wide range of instruments, including forex pairs, metals, indices, stocks, and cryptocurrencies, supported by competitive spreads and reliable execution.

Leadership at FXIFY

FXIFY is co-founded and managed by David Bhidey and Peter Brown, who bring extensive experience in trading and brokerage. Their leadership emphasizes transparency, trader support, and scalability, which has helped FXIFY quickly gain traction in the proprietary trading industry.

Under their guidance, FXIFY has introduced innovative programs like the Lightning Challenge and Instant Funding, while maintaining consistent payout structures and clear trading rules. This leadership approach has enabled the firm to grow rapidly, providing funded traders with millions in payouts and establishing FXIFY as a competitive choice in the prop trading space.

FXIFY Scaling Plan & Funding Programs

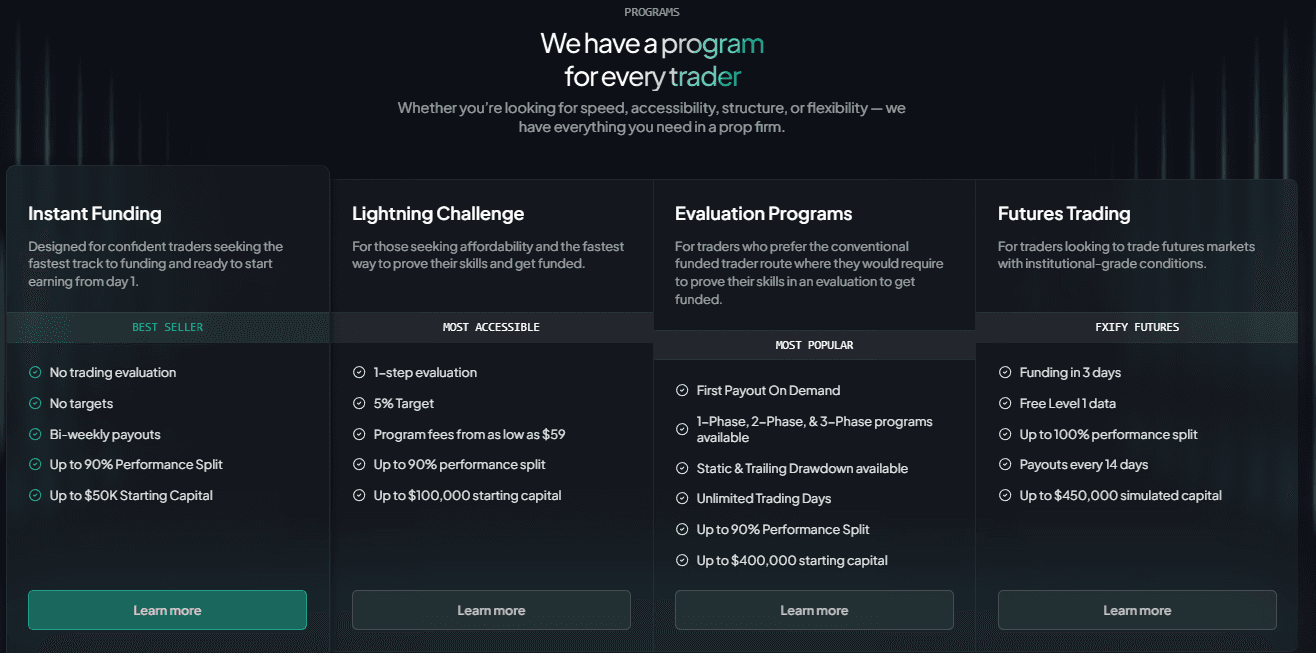

FXIFY offers a comprehensive suite of funding programs and a structured scaling plan designed to support traders in expanding their trading capital and maximizing profitability. The firm provides four distinct funding programs: Two-phase Evaluation, One-phase Evaluation, Three-phase Evaluation, and Instant Funding.

Overview of FXIFY Funding Programs:

Key Takeaways

- Structured Evaluation: FXIFY’s challenges ensure traders demonstrate consistent profitability and sound risk management before accessing funded accounts.

- Scaling Opportunities: Accounts can grow by 25% every three months, up to $4M, if traders achieve 10% net profit with at least two profitable months.

- Profit Sharing: Profit splits start at 80% and can increase to 90% (or 100% in crypto programs).

FXIFY Review: How to Get Funded from Start to Finish

Getting funded with FXIFY is a straightforward process designed to support traders at every experience level. Whether you’re a seasoned professional or an ambitious beginner, FXIFY offers multiple programs to match your trading style. Here’s a step-by-step guide on how to get started and secure funding.

1. Create an Account

Visit the official FXIFY website and click on “Start Challenge” or “Get Funded.” Register with your name, email, and password. Once logged in, you can access your dashboard, select a funding program, and manage account settings.

2. Choose a Funding Program

FXIFY offers four main funding options, each with different risk profiles and profit targets:

- Two-Phase Evaluation

- Phase 1: 10% profit target

- Phase 2: 5% profit target

- Risk Limits: 5% daily loss, 10% total loss

- Leverage: Up to 1:30

- Time Limit: No maximum, 5-day minimum per phase

- Profit Split: Starts at 80%, can increase to 90%

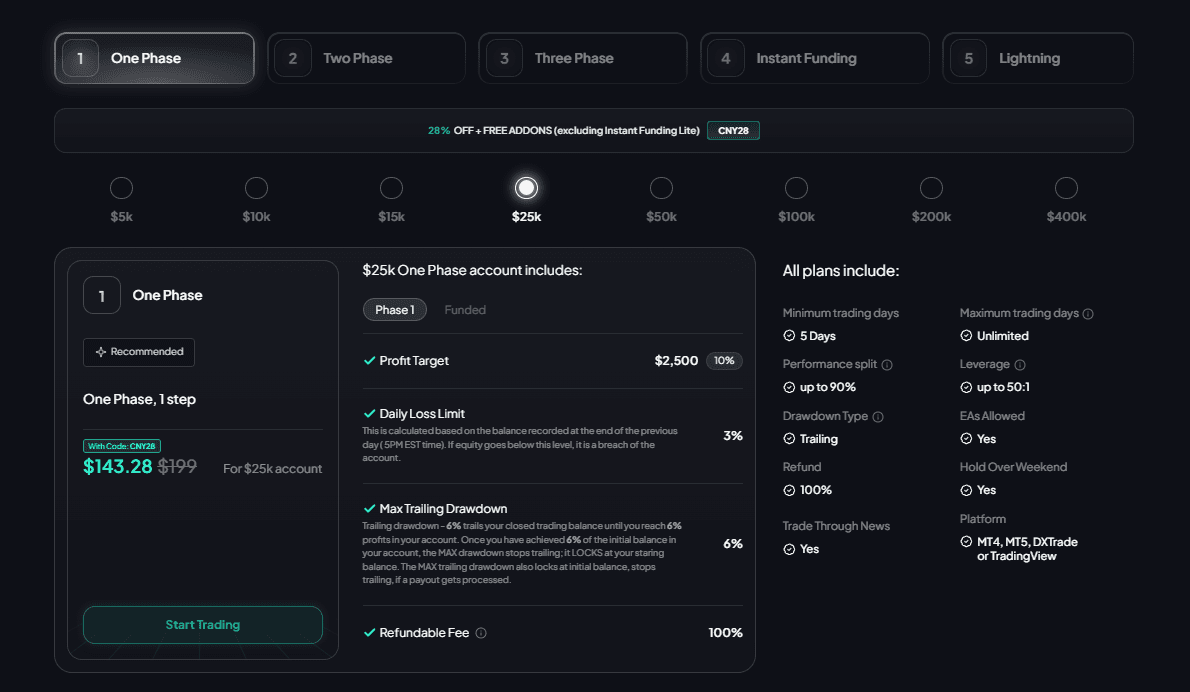

- One-Phase Evaluation

- Profit Target: 10%

- Risk Limits: 5% daily loss, 6% trailing drawdown

- Time Limit: No maximum, 5-day minimum

- Leverage: Up to 1:30

- Profit Split: Starts at 80%, scalable to 90%

- Three-Phase Evaluation

- Phase 1: 8% profit target

- Phase 2: 5% profit target

- Phase 3: 4% profit target

- Risk Limits: 5% daily loss, 5% total loss

- Leverage: Up to 1:30

- Time Limit: No maximum, 5-day minimum per phase

- Profit Split: Starts at 80%, eligible for scaling up to $4M

- Instant Funding Program

- Immediate access to funded accounts (Lite requires 10 trading days; Standard has no minimum)

- Risk Limits: 5% daily loss, 10% total loss

- Leverage: Up to 1:30

- Profit Split: Starts at 80%

3. Pay the Challenge Fee

Each program requires a one-time, refundable fee based on account size ($5,000–$400,000). Once paid, your evaluation account is activated immediately.

4. Complete the Evaluation (If Required)

Trade according to program rules. No time pressure, but a minimum of 5 trading days is required. Maintain risk management to hit profit targets without breaching drawdown limits.

5. Get Funded

After passing all required phases, you’ll receive a live funded account. Profit splits start at 80% and can increase to 90% for consistent performers.

6. Scale Your Account

FXIFY’s scaling plan increases account balance by 25% every 3 months if you achieve:

- 10% net profit

- At least 2 profitable months out of 3

Accounts can grow up to $4,000,000, rewarding consistent results and strong risk management.

Trading Instruments and Platforms at FXIFY

FXIFY offers traders access to a diverse array of trading instruments and platforms, accommodating various trading strategies and preferences.

FXIFY Trading Instruments

Traders at FXIFY can engage with multiple asset classes, including:

- Forex (FX): Major, minor, and exotic currency pairs.

- Metals: Precious metals such as gold and silver.

- Indices: Global indices representing major economies.

- Cryptocurrencies: Popular digital assets like Bitcoin and Ethereum.

- Stocks: Shares from various global markets.

This extensive selection enables traders to diversify their portfolios and implement a wide range of trading strategies.

FXIFY Trading Platforms

FXIFY supports several advanced trading platforms to cater to different trading styles:

- MetaTrader 4 (MT4): Renowned for its user-friendly interface and robust charting tools.

- MetaTrader 5 (MT5): Offers more timeframes, advanced analysis tools, and a built-in economic calendar.

- DXTrade: A modern, web-based platform with customizable interfaces, advanced order types, and strong risk management features.

- TradingView: Integrated via Alchemy Markets, offering advanced charting and social trading features.

These platforms provide flexibility and efficiency, allowing traders to execute their strategies effectively.

Leverage and Commissions

FXIFY leverage options are tailored to each asset class:

- Forex and Metals: Up to 1:30

- Indices: Up to 1:10

- Cryptocurrencies and Stocks: Up to 1:2

Commission structures vary based on the account type and trading instrument:

- Raw Spread Accounts: $6 per lot for Forex, Metals, and Indices

- All-In Accounts: Zero commissions for Forex, Metals, and Indices

- Cryptocurrencies: No commissions

- Stocks: 0.35% round turn

FXIFY’s comprehensive range of trading instruments and platforms, combined with flexible leverage and transparent pricing, positions it as a compelling choice for traders seeking a versatile and supportive trading environment.

FXIFY Trading Conditions: Spreads, Fees, and Rules

FXIFY, a proprietary trading firm, offers traders competitive trading conditions designed to enhance profitability and flexibility. These conditions encompass tight spreads, a transparent fee structure, and well-defined trading rules, all of which contribute to a professional trading environment explored in this Fxify review.

Spreads

FXIFY provides traders with access to raw spreads as low as 0.0 pips on major forex pairs and gold. This is achieved through partnerships with brokers such as FXPIG and Alchemy Markets. Tight spreads enable traders to enter and exit positions at favorable rates, enhancing execution — especially beneficial for scalpers and high-frequency traders.

Fees

FXIFY’s fee structure is straightforward and varies depending on account type and instrument:

- All-In Accounts: No commissions on forex, metals, indices, and crypto.

- Raw Spread Accounts: $6 per lot commission on forex, metals, indices.

- Crypto: No commissions.

- Stocks: 0.35% round turn.

This transparent pricing model allows traders to anticipate costs accurately and tailor strategies accordingly.

Trading Rules

FXIFY enforces specific rules to promote disciplined trading:

- Maximum Daily Loss: 5% of initial account balance.

- Maximum Overall Loss: 10% of initial account balance.

- Profit Targets: 10% in One-phase and Phase 1 of Two-phase; lower targets in later phases.

- Minimum Trading Days: 4–5 depending on program (Two-phase Classic requires 4, most others require 5).

- Instant Funding: Lite requires 10 minimum trading days; Standard has no minimum.

These rules encourage effective risk management and consistent performance. Structured guidelines help traders develop long-term sustainability, while Instant Funding provides clarity around risk limits and expectations.

By offering tight spreads, a clear fee structure, and strict trading rules, FXIFY creates a conducive environment for traders aiming to maximize profitability while maintaining control.

Subscription and Payment Methods at FXIFY

Understanding the subscription process and available payment methods is essential for traders considering FXIFY’s funding programs. FXIFY offers a transparent fee structure with evaluation options tailored to different account sizes and trading objectives.

Subscription Options and Associated Fees

FXIFY provides several evaluation programs, each designed to assess trading skills and discipline. Fees are one-time charges covering the entire evaluation process, refundable upon successful completion and first profit withdrawal.

Available Payment Methods

Withdrawal Policies

- Profit split starts at 80%, can increase to 90%.

- Withdrawals processed within 1–2 business days.

- Supported methods: bank transfers, wallets, crypto payments.

Refund Policy

- Evaluation fees refunded after passing and first payout.

- Non-refundable if trader fails evaluation.

- Instant Funding accounts not eligible for refunds.

Payment Proof

FXIFY provides payout evidence such as withdrawal certificates and completion certificates, reinforcing transparency and trust. Many traders report smooth and timely payouts.

FXIFY vs. Hantec Trader vs. Alpha Capital Group: A Comparative Overview

In the competitive landscape of proprietary trading firms, FXIFY, Hantec Trader, and Alpha Capital Group offer distinct opportunities for traders seeking funded accounts. Below is a comparative overview of their key features:

Key Notes

- FXIFY stands out with its high initial capital offering, flexible trading rules (weekend holding, EA trading, news trading), and a structured scaling plan up to $4M. Its broker partnerships (FXPIG and Alchemy Markets) provide access to multiple platforms including TradingView.

- Hantec Trader benefits from the backing of the Hantec Group, offering one-step and two-step evaluations with a focus on disciplined trading.

- Alpha Capital Group provides a substantial scaling plan up to $2M, with access to MT4/MT5 and a range of tradable instruments, making it attractive for traders seeking steady growth.

FXIFY Trader Community and Support

FXIFY has established a comprehensive support system and vibrant community to enhance the trading experience for its clients. By offering diverse educational resources, active community engagement platforms, and responsive customer support, FXIFY demonstrates its commitment to trader development and success. As highlighted in this Fxify review, these support features play a key role in creating a well-rounded and empowering environment for traders.

Educational Resources

FXIFY provides traders with a suite of educational materials designed to improve trading skills and market understanding. These resources cover:

- Market analysis techniques

- Risk management strategies

- Platform tutorials for MT4, MT5, DXTrade, and TradingView

- Guidance on evaluation rules and scaling plans

By equipping traders with this knowledge, FXIFY fosters informed decision-making and consistent performance.

Community Engagement

FXIFY maintains an active presence across Facebook, Instagram, TikTok, Telegram, Discord, and Twitter. These platforms serve as hubs for traders to:

- Share insights and strategies

- Discuss evaluation rules and trading conditions

- Stay updated on company news and promotions

This collaborative environment encourages camaraderie and collective learning, strengthening FXIFY’s trader community.

Customer Support

FXIFY provides dedicated customer support via:

- Live chat on the official website (fast response times, often within minutes)

- Email support during business hours (Monday–Friday)

Support agents are knowledgeable in evaluation rules, withdrawals, scaling plans, and technical issues. The FXIFY dashboard also integrates support resources, streamlining access to help.

Knowledge Base

FXIFY’s Knowledge Base is a well-organized hub covering:

- Evaluation rules and objectives

- Account setup and management

- Platform guidance for MT4/MT5

- Profit split and withdrawal processes

- Scaling plan requirements

- Troubleshooting and technical support

It includes FAQs on minimum trading days (4–5 depending on program), trailing drawdown, and refund eligibility. Updated regularly, it empowers traders to resolve queries independently.

Community Initiatives

FXIFY organizes trading challenges, promotional events, and seasonal offers. Examples include:

- Special Father’s Day promotions

- Referral and ambassador programs offering discounts

- Occasional discount codes (up to 40%) during campaigns

These initiatives incentivize participation, reward performance, and strengthen community bonds.

FXIFY Discount Code

FXIFY does not maintain permanent discount codes but has offered seasonal promotions and affiliate-based discounts. Traders may encounter limited-time offers (sometimes up to 40% off) during events, email campaigns, or through verified partners.

⚠️ Important: Not all third-party sites offering FXIFY discount codes are trustworthy. Always verify codes directly through FXIFY’s official site or authorized affiliates to avoid scams.

Traders’ Opinion

FXIFY holds a 4.1/5 Trustpilot rating from ~2,998 reviews, reflecting strong customer satisfaction.

Positive feedback highlights:

- Fast payouts (processed within 1–2 business days)

- Responsive customer support

- Clear evaluation rules

- Flexible trading conditions (EA use, weekend holding)

- Scaling opportunities up to $4M

Constructive feedback:

- Some traders note a learning curve around rules like trailing drawdown.

- Others emphasize the importance of carefully reading evaluation terms before starting.

Overall, FXIFY’s transparent communication and active engagement with traders demonstrate its commitment to continuous improvement.

FXIFY Review: Pros and Cons

Evaluating FXIFY’s proprietary trading program reveals several advantages and considerations that prospective traders should weigh carefully. As outlined in this Fxify review, the firm’s structure offers significant opportunities alongside specific requirements that may influence a trader’s decision.

Key Considerations

- Capital Access: FXIFY’s model allows traders to leverage substantial capital without risking personal funds.

- Evaluation Structure: Programs cater to different preferences but come with specific rules (profit targets, drawdowns, minimum days).

- Profit Sharing and Payouts: Generous splits and on-demand payouts, but traders must understand conditions like trailing drawdown and consistency rules.

As noted in this Fxify review, prospective traders should thoroughly review FXIFY’s program details to ensure alignment with their trading goals and risk tolerance.

Is FXIFY Worth It?

FXIFY offers traders funding from $25,000 to $400,000, with a scaling plan up to $4,000,000. It provides one-phase, two-phase, three-phase, and instant funding options, allowing flexibility in meeting profit targets and drawdown limits. Traders can use Expert Advisors (EAs), hold trades overnight and on weekends, and trade news events.

However, the one-phase challenge includes a trailing drawdown, and the three-phase option has a strict 5% maximum loss limit. A minimum of 4–5 trading days is required depending on the program. While FXIFY offers on-demand payouts processed within 1–2 business days, consistency rules apply in certain programs (Lightning, Instant Lite, 2-Step Classic).

As outlined in this Fxify review, the firm balances flexibility with structure, making it a strong choice for traders seeking capital — but it requires careful evaluation of its rules and trading conditions.

The Final Words

FXIFY has positioned itself as a competitive proprietary trading firm, offering traders access to funding up to $400,000, with a scaling plan that extends to $4 million. With flexible evaluation options, including one-phase and two-phase challenges, FXIFY caters to a variety of trading styles.

The firm provides generous profit splits, diverse tradable assets, and no restrictions on strategies like EA use or weekend holding. While certain risk parameters — such as the trailing drawdown and strict loss limits — require careful management, FXIFY remains an appealing choice for traders seeking capital.

As mentioned in this Fxify review, FXIFY’s balance of structure and flexibility makes it stand out in the competitive prop trading space. For those ready to prove their skills, FXIFY offers a structured path to grow and succeed in the prop trading industry.

At ForexPropFirms.com, we aim to uncover the best possible insights about prop firms and their latest updates — so traders like you can make confident, informed decisions.

Restricted Countries

Traders from the following countries are not eligible to participate in FXIFY's programs:

FXIFY FAQs

Common questions about FXIFY challenges and trading rules

Does FXIFY accept US clients?

No, FXIFY does not accept traders from the United States due to regulatory restrictions.

No, FXIFY does not accept traders from the United States due to regulatory restrictions.

Yes, FXIFY is a legit prop firm with a growing reputation, transparent rules, and timely payouts

Yes, news trading is allowed, but traders should follow the specific rules for each challenge.

No, FXIFY is not regulated, which is common for proprietary trading firms.

FXIFY was founded in 2023 and has quickly gained traction in the prop trading space.

Yes, FXIFY is a solid choice for skilled traders, offering flexible programs and up to 90% profit share.

Traders can earn up to 90% profit share, depending on the account type and performance.

Traders must complete one or two evaluation phases by hitting profit targets and avoiding rule violations.