In the rapidly evolving proprietary trading space, Goat Funded Trader (GFT) is gaining attention for its trader-centric approach and flexible funding models. By offering capital to skilled traders without requiring them to risk personal funds, Goat Funded Trader positions itself as a compelling choice for both novice and experienced market participants. But how does it truly measure up in 2025? This Goat Funded Trader review aims to explore its funding structure, evaluation programs, payout model, and more—helping you determine whether this prop firm aligns with your trading goals.

Goat Funded Trader’s programs are designed around simplicity and accessibility. Traders can choose from a One-Phase Evaluation, a Two-Phase Challenge, or even a Direct Funding option, each tailored to different levels of trading experience and strategy. Evaluation accounts offer capital up to $200,000, with a profit split of up to 95%, and include scaling plans that reward consistent performance with increased capital. The Goat Funded Trader emphasizes no minimum trading days, instant funding options, and weekly payouts, making it one of the more flexible firms in the market today.

This Goat Funded Trader review will also break down the Goat Funded Trader’s account types, trading platforms, and policy framework to give you a comprehensive look at what sets this firm apart. Whether you’re looking to start small or scale into a larger portfolio, understanding how Goat Funded Trader operates is key before choosing it as your prop trading partner. So, if you’re still wondering what is Goat Funded Trader?, this review is here to give you the clarity you need.

Who is Goat Funded Trader?

Goat Funded Trader (GFT) is a U.S.-based proprietary trading firm that has positioned itself as a modern, flexible alternative in the prop trading industry. Founded to provide traders with real capital and real opportunities, the firm has built a reputation for its streamlined evaluation models, generous profit splits of up to 95%, and instant funding options—features that attract both beginner and advanced traders alike. GFT’s mission is to support skilled individuals by removing financial barriers and allowing them to scale up using the firm’s capital. If you’re looking for a well-balanced perspective on the firm, any thorough Goat Funded Trader review will mention these standout benefits.

While Goat Funded Trader doesn’t publicize a specific founding date on its website, its operations reflect a firm that embraces transparency, trader-first policies, and global accessibility. From its U.S. base, GFT serves a global clientele, offering account sizes up to $200,000, with the potential to scale further under performance-based growth models.

One of GFT’s distinguishing features is its non-restrictive evaluation environment—traders benefit from no minimum trading days, weekly payouts, and a wide choice of brokers including Eightcap, ThinkMarkets, and Purple Trading Seychelles. These elements combine to create a supportive, high-potential ecosystem that reflects the firm’s goal of democratizing access to proprietary capital. A well-informed Goat Funded Trader review would likely highlight these unique trader perks as key selling points.

With its blend of high payout potential, multiple funding pathways, and trader-oriented features, Goat Funded Trader is establishing itself as a credible and competitive force in today’s proprietary trading landscape. For those still on the fence, reading a recent Goat Funded Trader review can provide deeper insight into real user experiences.

Brokers That Are Used By Goat Funded Trader

Goat Funded Trader collaborates with several reputable brokers to provide traders with access to reliable and efficient trading infrastructure. As of 2025, GFT offers accounts through Eightcap, ThinkMarkets, and Purple Trading Seychelles—three well-established brokerage firms known for their robust execution and competitive trading conditions.

Each broker provides support for MetaTrader 4 and MetaTrader 5, two of the most widely used platforms in the trading industry. These platforms allow users to implement custom strategies, utilize expert advisors, and perform advanced technical analysis. The use of these platforms ensures that traders experience low latency, tight spreads, and a stable trading environment, all of which are crucial for effective risk management and execution precision.

By giving traders the option to select from multiple brokerage partners, Goat Funded Trader enhances platform flexibility and allows users to choose the execution model that best aligns with their trading style. This commitment to broker diversity reflects GFT’s focus on optimizing the trader experience across different strategies and market conditions.

Who is the CEO of Goat Funded Trader?

Edoardo Dalla Torre, also known as Edward XL, is the Founder and CEO of Goat Funded Trader, a proprietary trading firm established in May 2023. At just 25 years old, Edoardo has carved a niche for himself in the trading industry through resilience and innovation.

Originally from a small town in Italy, Edoardo’s early aspirations were in basketball. At 14, he was recruited to play in the United States, but financial constraints led him to return to Italy at 18. This experience ignited his determination to pursue a career that offered greater financial stability.

Edoardo turned to trading, dedicating himself to mastering the markets. His efforts culminated in securing over $1 million in capital, a milestone that propelled him to establish Goat Funded Trader. Under his leadership, the firm has expanded its operations, including a strategic migration to Hong Kong, and has distributed over $7 million in trader payouts. This success story has become a cornerstone of many authentic Goat Funded Trader review articles across the trading community.

Beyond trading, Edoardo is committed to innovation. He spearheaded the development of in-house technology for the Goat Funded Trader, moving away from third-party solutions to enhance security and control. Additionally, he founded the XL Trading Floor in the Canary Islands, providing a collaborative space for traders.

Edoardo’s journey from aspiring athlete to trading entrepreneur exemplifies determination and adaptability. His leadership continues to shape Goat Funded Trader into a prominent player in the proprietary trading industry, earning recognition in more than one trusted Goat Funded Trader review.

Goat Funded Trader Review: How to Get Funded?

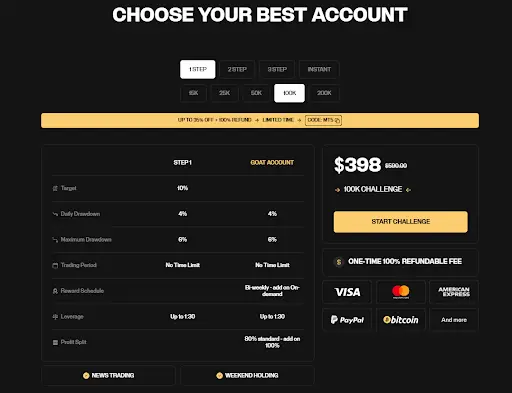

In this Goat Funded Trader review, we break down the process of how aspiring traders can get funded through one of the most flexible and accessible proprietary trading firms in the industry. Unlike traditional firms with rigid structures, Goat Funded Trader offers three distinct funding models: the One-Phase Challenge, Two-Phase Challenge, and Direct Funding, each designed to accommodate different trading styles and experience levels.

1. One-Phase Challenge

The One-Phase Challenge is designed for traders who want to skip lengthy evaluations. This program requires users to meet a 10% profit target with a 5% maximum daily drawdown and a 6% maximum total loss. There are no minimum trading days, allowing traders to complete the challenge at their own pace. Once the target is achieved without violating any rules, the trader is eligible for a funded account with access to weekly payouts and up to 95% profit share.

2. Two-Phase Challenge

The Two-Phase Challenge resembles more traditional prop firm evaluations. In Phase 1, traders must achieve a 10% profit target while staying within a 5% daily and 10% overall drawdown limit. Phase 2 reduces the profit target to 5%, allowing for a smoother transition into live funded trading. Similar to the One-Phase model, no minimum trading days apply, and traders benefit from faster funding after successfully completing both phases.

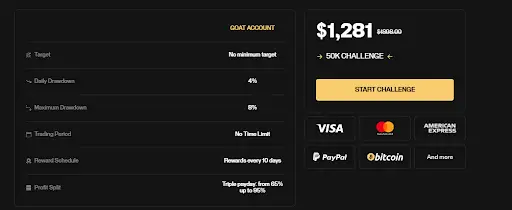

3. Direct Funding

For experienced traders looking to bypass evaluations, GFT’s Direct Funding option offers instant access to a live funded account. With account sizes ranging from $25,000 to $100,000, this model allows traders to start earning profits immediately, provided they adhere to risk parameters. The profit split remains up to 95%, with the same benefits of weekly payouts and scaling opportunities.

Each program at Goat Funded Trader includes free trial options, allowing traders to test the environment before committing. Additionally, users can select from multiple brokers—Eightcap, ThinkMarkets, and Purple Trading Seychelles—for platform flexibility. All programs are integrated with MetaTrader 4 and 5, ensuring traders can execute with precision and reliability. For those seeking a prop firm that prioritizes fast funding, generous profit splits, and low barriers to entry, this Goat Funded Trader review confirms that Goat Funded Trader provides a robust and accessible path to trading with real capital.

Goat Funded Trader Scaling Plan & Funding Programs

Goat Funded Trader offers a flexible and trader-focused approach to proprietary trading through its diverse funding programs and scaling models. With multiple pathways including the Challenge, Express, and Elite accounts, the firm caters to both conservative traders seeking structure and aggressive traders looking for fast-track funding.

The Challenge model features a traditional two-phase evaluation process, while the Express and Elite programs offer accelerated funding routes—some even with instant funding. Unlike traditional models, Goat allows news trading, weekend holds, and even crypto trading, giving traders wider strategy options and fewer restrictions.

Many traders mention in their Goat Funded Trader review that the variety of programs and relaxed trading conditions make the firm stand out among competitors.

Traders who meet performance standards in any model become eligible for profit splits up to 95% and may qualify for scaling their account balances based on consistent returns. Additionally, the firm’s bi-weekly payouts through Deel make capital access swift and seamless.

If you’re looking for a prop firm with modern flexibility and a strong support system, most Goat Funded Trader review insights highlight this as a top-tier option.

Overview of Goat Funded Trader Funding Programs

| Program | Key Features | Scaling & Profit Split | Who It’s For? |

| Challenge Account | – Two-step evaluation process- Profit target: 8% Phase 1 / 5% Phase 2- Max daily loss: 4%, overall loss: 8%- Minimum 5 trading days per phase | – Profit split starts at 80% and can scale to 95% with consistent performance- Offers scaling via Elite upgrades | Traders who want to prove their discipline through structured evaluation and scale over time |

| Express Account | – One-step evaluation with no minimum trading days- Faster access to funding- Less restrictive trading rules | – Starts with 80% profit split- Faster scaling opportunities for aggressive and skilled traders | Experienced traders wanting fast-track funding without a two-phase challenge |

| Elite Account | – Instant funding after Express pass- No evaluation phase- Access to capital with risk-managed guidelines | – Profit split up to 95% from the start- Weekly payouts available | Confident, high-performance traders looking for immediate access to capital and top-tier profit sharing |

Key Takeaways:

- Multiple Entry Paths: Whether you prefer a structured challenge or immediate funding, Goat Funded Trader accommodates both.

- Aggressive Scaling Potential: Consistent traders can scale up and unlock higher profit splits over time.

- Fast Payouts: Deel integration ensures quick withdrawals, often within 48 hours.

- Strategy Flexibility: Goat stands out for allowing news trading, overnight positions, and crypto markets, making it ideal for diverse trading styles.

Trading Instruments and Platforms at Goat Funded Trader

Understanding the available trading instruments and platforms is essential when evaluating a proprietary trading firm. Goat Funded Trader (GFT) offers a comprehensive selection of asset classes and industry-standard platforms, enabling traders to implement a wide range of strategies with precision and flexibility. This section explores the key markets you can access and the platforms you’ll use to execute trades as a Goat Funded Trader client—something many readers look for when reading a detailed Goat Funded Trader review.

Trading Instruments at Goat Funded Trader

Goat Funded Trader provides access to a broad array of financial instruments, designed to accommodate various trading styles across major global markets. The instruments available include:

- Forex: Traders can participate in the highly liquid currency markets, including major, minor, and exotic currency pairs. This wide coverage supports both intraday scalping and long-term swing strategies.

- Indices: GFT offers a robust lineup of global indices such as the S&P 500, NASDAQ, DAX 40, and FTSE 100. These instruments are ideal for traders looking to capitalize on macroeconomic movements and sectoral trends.

- Commodities: Access to gold, silver, crude oil, and other essential commodities enables traders to diversify their portfolios and apply hedging strategies effectively.

- Cryptocurrencies: GFT supports trading in popular digital assets like Bitcoin, Ethereum, and other altcoins. This asset class offers significant volatility and profit potential for traders experienced in fast-moving markets.

This diverse mix of instruments provides traders with numerous opportunities for risk-adjusted returns and helps them construct strategies tailored to different market conditions. A well-rounded Goat Funded Trader review often highlights this flexibility as a major strength.

Trading Platforms at Goat Funded Trader

Goat Funded Trader supports the industry’s most recognized and trusted platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are compatible with GFT’s partnered brokers—Eightcap, ThinkMarkets, and Purple Trading Seychelles—ensuring a seamless execution environment.

- MetaTrader 4 (MT4): Renowned for its user-friendly interface, automated trading via Expert Advisors (EAs), and advanced charting tools, MT4 remains a favorite among forex and CFD traders.

- MetaTrader 5 (MT5): A more advanced version of MT4, MT5 supports additional asset classes and offers expanded timeframes, economic calendars, and depth of market (DOM) features, making it ideal for multi-asset trading.

These platforms provide low-latency execution, real-time analytics, and customizable trading environments, allowing GFT traders to manage trades with precision and control. Any in-depth Goat Funded Trader review will typically commend the firm’s choice of platforms for their reliability and performance.

By offering a wide selection of instruments and powerful trading platforms, Goat Funded Trader ensures that traders—regardless of their preferred market or strategy—have the tools and infrastructure to succeed in both evaluation and live funded trading phases. Whether you’re comparing firms or diving into a Goat Funded Trader review, this combination of flexibility, technology, and market access stands out as a core advantage.

Goat Funded Trader Trading Conditions: Spreads, Fees, and Rules

When evaluating any comprehensive Goat Funded Trader review, one of the most important aspects to consider is its trading conditions. These define not only the trader’s cost structure but also the operational environment within which all strategies must function. Goat Funded Trader positions itself as a trader-friendly firm with flexible rules, cost-efficient trading conditions, and wide asset availability—making it an increasingly popular choice among prop trading aspirants.

Spreads

Goat Funded Trader offers raw spreads starting from 0.0 pips, which is a highly attractive feature for scalpers and intraday traders who rely on tight pricing. This structure ensures direct market access, and traders benefit from institutional-level liquidity through its partner broker, Eightcap, a regulated and reputable trading provider.

While exact average spreads aren’t disclosed for every asset on their public-facing pages, traders can generally expect industry-standard spreads across major pairs like EUR/USD, USD/JPY, and GBP/USD. Given the raw spread access, transaction costs are minimized—particularly helpful for high-frequency and short-term strategies. However, users should still account for commission fees when evaluating total costs in any detailed Goat Funded Trader review.

Fees

Goat Funded Trader uses a commission-based model for its trading accounts, particularly on raw spread setups. The standard commission fee is approximately $3 per side ($6 round-turn) per lot on forex pairs, similar to what most ECN brokers and professional trading environments charge.

There are no additional hidden costs or platform fees. Moreover, traders benefit from free access to MetaTrader 4 and 5 platforms, which eliminates the need for any recurring software licensing charges. Cryptocurrencies, indices, and commodities are also tradable, and while explicit commission details for each asset class aren’t broken down, all trades executed under the raw spread environment are typically subject to a per-lot commission model. For traders comparing options, this low-fee structure stands out in many Goat Funded Trader review discussions.

Leverage

Goat Funded Trader offers leverage up to 1:100 across most account types, providing enough flexibility for traders to scale their positions without introducing excessive risk. This level of leverage applies to forex, while indices, commodities, and cryptocurrencies may have adjusted leverage caps based on volatility and instrument behavior.

Unlike firms with restrictive or tiered leverage systems, Goat Funded Trader provides uniform leverage access even during evaluation phases, allowing traders to implement their strategies without needing to adjust lot sizes or margin usage extensively. This balanced leverage approach is often highlighted positively in a typical Goat Funded Trader review.

Trading Rules

Goat Funded Trader maintains a clear and trader-centric set of rules that emphasize risk management and strategy consistency, which are core to the overall goat funded trader rules that make the platform stand out:

- Daily Drawdown Limit: 5%

- Overall Drawdown Limit: 10%

- Profit Target: 8% (for most 2-phase challenges), which is lower than many competitors, making it easier to qualify under the flexible goat funded trader rules.

- Minimum Trading Days: 3 (for 2-phase evaluations), allowing traders to pass challenges more quickly if targets are met—this is also attractive for those looking to join the goat funded trader competition.

- Weekend Holding & News Trading: Allowed, adding flexibility for swing traders and event-driven strategies, which are often highlighted in the goat funded trader competition guidelines.

- Expert Advisors (EAs): Permitted, provided they do not exploit server latency or involve arbitrage tactics.

These rules make Goat Funded Trader suitable for a wide variety of trading styles—including discretionary, algorithmic, and fundamental traders. The firm focuses on providing a realistic but trader-friendly challenge structure, designed to balance discipline with freedom, which is also reflected in the goat funded trader payout method and the transparent goat funded trader payout proof shared by successful traders. If you’re seeking a firm that values flexibility and fairness, nearly every in-depth Goat Funded Trader review supports its suitability for modern traders.

In summary, this breakdown reflects what most experienced traders look for when reading a well-rounded Goat Funded Trader review—solid trading conditions, transparent fees, strong leverage options, and fair rules.oat funded trader payout method and the transparent goat funded trader payout proof shared by successful traders.

Subscription and Payment Methods at Goat Funded Trader

In this Goat Funded Trader review, it’s important to explore the subscription model and payment options available for aspiring traders. Unlike traditional prop firms that stick to a single evaluation route, Goat Funded Trader provides multiple program types—each with its own pricing and terms. This includes Challenge, Express, and Elite models, each designed to accommodate different experience levels and funding needs. Whether you’re a disciplined trader preferring a step-by-step model or an aggressive strategist seeking instant funding, Goat offers a plan that fits.

Subscription Options and Associated Fees

Goat Funded Trader operates on a one-time fee model, which varies depending on the type of funding program and the chosen account size. These fees are non-refundable in most cases, unlike some competitors, but the firm compensates by offering higher profit splits, instant funding, and a diverse account structure.

Below is a breakdown of available account sizes and associated costs for the Challenge program:

| Account Size (USD) | Fee (USD) | Refundable |

| $10,000 | $95 | No |

| $25,000 | $155 | No |

| $50,000 | $275 | No |

| $100,000 | $375 | No |

| $200,000 | $650 | No |

Note: These fees apply to the two-phase Challenge account, where traders must complete evaluation phases before accessing funded capital.

Meanwhile, the Express model features higher fees but grants faster or even instant access to funding. It’s particularly popular among experienced traders who want to bypass the multi-step process.

Available Payment Methods

Goat Funded Trader supports global payment accessibility, offering a range of payment options to accommodate traders from different regions. Payments are processed through Stripe, Deel, and other platforms, ensuring speed and reliability.

| Payment Method | Availability | Processing Time |

| Credit/Debit Cards | Worldwide via Stripe | Instant |

| Cryptocurrency (BTC, ETH, USDT) | Global | Within minutes |

| Wise/Bank Transfers | Selected countries | 1–3 business days |

| Deel | Global | Within 24–48 hours |

Goat’s support for crypto payments makes it a standout choice for traders looking for privacy and fast international transfers.

Withdrawal Policies

Goat Funded Trader provides a bi-weekly payout structure, one of the fastest in the industry. Traders are eligible for withdrawals every two weeks, with no minimum profit thresholds. All withdrawals are handled through Deel, providing options like PayPal, Wise, ACH, and crypto.

Payouts are typically processed within 24 to 48 hours, and the firm emphasizes transparency and prompt communication throughout the withdrawal process.

Refund Policy

Unlike FTMO, Goat Funded Trader does not offer refundable fees, even upon successful completion of the challenge. However, this policy is offset by features such as:

- Higher profit splits up to 95%

- Instant funding in Express/Elite models

- No restrictions on trading styles, such as news trading, holding over weekends, and using EAs

As noted in more than one detailed Goat Funded Trader review, this no-refund model may not suit everyone, but for traders who prioritize speed and flexibility, Goat Funded Trader provides strong value.

Payment Proof

Goat Funded Trader has established a structured and transparent payout system for its funded traders. Depending on the chosen funding model, traders can access their earnings through various schedules:

- Bi-weekly payouts: Available for most models, allowing withdrawals every 14 days after placing the first trade.

- Triple Payday: Specific to the Instant Funding Standard Account, enabling reward requests on the 5th, 15th, and 25th of each month.

- On-demand payouts: Traders can opt for an early withdrawal with a 40% profit split, with the remaining 60% available in subsequent cycles.

Payouts are processed within 72 business hours, and to reinforce their commitment, Goat Funded Trader offers a $250 bonus if this timeframe is exceeded, barring delays due to pending KYC verification or incomplete information.

For those seeking tangible evidence of payments, Goat Funded Trader’s Discord channel serves as a platform where traders frequently share payout certificates and testimonials, providing transparency and building trust within the trading community. Many traders highlight this in their personal Goat Funded Trader review, especially praising the speed and clarity of the firm’s payout process.

This payout reliability is a recurring theme in nearly every detailed Goat Funded Trader review, making it a key factor that draws new traders to test the firm’s evaluation programs.

Goat funded trader vs. thePropTrade vs. BrightFunded: A Comparative Overview

In the evolving landscape of proprietary trading, firms like the Goat Funded Trader, ThePropTrade, and BrightFunded offer unique opportunities for traders seeking funded accounts. This comparative overview provides insights into their offerings to assist traders in making informed decisions.

Comparative Overview: Goat Funded Trader vs. ThePropTrade vs. BrightFunded

| Feature | Goat Funded Trader | ThePropTrade | BrightFunded |

| Initial Capital | $5,000 – $200,000 | $5,000 – $100,000 | Not specified |

| Evaluation Process | One-step, two-step, and three-step options with profit targets of 6%–10% depending on the program. | Two-phase evaluation: Phase 1 requires an 8% profit target within 30 days; Phase 2 requires a 5% profit target within 60 days. | Two-phase evaluation: 8% profit target in Phase 1 and 5% in Phase 2. |

| Profit Split | 80% standard, with an option to increase up to 100%. | Starts at 80%, with scaling up to 90%. | Not specified. |

| Scaling Plan | Not specified. | Offers a scale-up plan up to $5 million with consistent performance. | Not specified. |

| Tradable Instruments | Forex, commodities, indices, stocks, cryptocurrencies. | Forex, metals, oils, indices, and cryptocurrencies. | Not specified. |

| Trading Platforms | MetaTrader 5. | MetaTrader 5. | Not specified. |

| Maximum Drawdown | 6%–10%, depending on the program. | 10% maximum overall drawdown. | 10% maximum total drawdown. |

| Daily Loss Limit | 4%. | 5%. | 5%. |

| Minimum Trading Days | None. | 3 days. | Not specified. |

| Maximum Trading Days | No time limit. | Unlimited. | Not specified. |

| News Trading Allowed | Yes. | Not specified. | Not specified. |

| Weekend Holding Allowed | Yes. | Not specified. | Not specified. |

| Leverage | Up to 1:30. | Up to 1:50 for Forex, metals, oils, and indices; 1:2 for cryptocurrencies. | Not specified. |

Key Takeaways

- A recent and detailed Goat Funded Trader review highlights that the firm offers flexible evaluation options with the potential for a 100% profit split, catering to traders seeking customizable paths to funding.

- ThePropTrade provides a structured evaluation process with a clear scaling plan, appealing to traders aiming for substantial growth.

- BrightFunded presents a straightforward two-phase evaluation with defined profit targets and drawdown limits, suitable for traders who prefer clear objectives.

Each firm has its unique strengths, and traders should consider their individual trading styles, risk tolerance, and growth objectives when choosing the firm that best aligns with their professional goals.

Goat Funded Trader Trader Community and Support

Goat Funded Trader is steadily building a robust ecosystem tailored to support the growth and performance of proprietary traders. While the firm is relatively newer compared to long-established prop trading firms, it has made notable strides in creating a responsive support system and a connected community environment. Whether you’re a first-time prop trader or a seasoned market participant, understanding the Goat Funded Trader’s community and support services is essential to evaluating its long-term value.

Educational Resources & Learning Support

Goat Funded Trader does not currently offer a centralized education hub like some competitors; however, they make up for it by providing guidelines, FAQs, and support documents across their website and trader dashboard. The firm clearly outlines its evaluation rules, trading parameters, and account features, ensuring that traders understand the framework before participating.

Though structured trading courses or webinars are not prominently available, the firm makes an effort to clarify common concerns through an extensive Knowledge Base, covering topics such as:

How the challenge works:

- Payout systems and scaling plans

- Allowed trading strategies

- Risk rules and compliance

Additionally, Goat Funded Trader maintains a blog section where they share helpful insights, updates, and trading-related content. This can serve as a supplementary learning resource for traders looking to stay informed and refine their approach.

Traders are encouraged to become self-reliant by thoroughly reviewing these materials. While there is room for growth in formal education, the provided documents help traders become operationally prepared and compliant with the firm’s expectations.

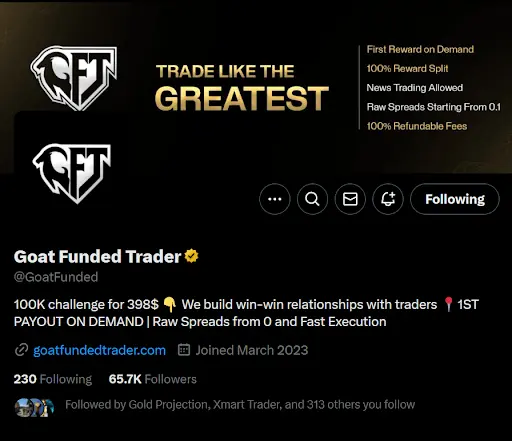

Community Engagement & Social Presence

Goat Funded Trader maintains an active presence on social media platforms, where they regularly post updates, success stories, motivational content, and giveaways. Their Instagram, X (Twitter), and YouTube are updated frequently, fostering a growing sense of community among followers.

Additionally, Goat Funded Trader hosts a dedicated Discord server, which has become a central hub for trader interaction. This Goat Funded Trader Discord server is not only a place to connect but also an extension of their Goat Funded Trader affiliate ecosystem, offering valuable networking opportunities. Inside the server, users can:

- Discuss trading strategies

- Ask questions and get real-time feedback

- Share challenge progress and account milestones

- Engage directly with moderators and staff

This platform serves not just as a communication tool but as a peer-learning environment, where traders at different stages of the evaluation or funding process can learn from each other and stay motivated.

Many members also share their Goat Funded Trader customer reviews inside the Discord, adding transparency and boosting trust among the community.

While the Discord community is optional, it’s highly recommended for those who thrive in collaborative spaces and want to remain closely connected to the Goat Funded Trader Discord and the Goat Funded Trader affiliate community.

Trader Support Team

Goat Funded Trader offers fast and reliable customer support, with a strong emphasis on direct communication and timely resolution. The firm can be contacted via:

- Live Chat on their official website (usually available during working hours)

- Email Support, typically responding within 24 hours

- Contact Form Submissions for escalated issues

The support team is known to be professional, knowledgeable, and quick to assist, particularly with questions around account setups, payouts, and rule clarifications. While support is not offered 24/7, the operational hours are clearly communicated, and users often receive replies the same day.

Unlike firms that rely heavily on automated bots or delayed ticket systems, Goat Funded Trader appears committed to maintaining a human-first approach to support, which is often praised in online reviews and trader feedback forums.

Knowledge Base & Self-Service Tools

The Goat Funded Trader website features a well-organized FAQ and Help Center, which addresses a wide variety of trader concerns. Topics range from “What happens if I hit the drawdown limit?” to “When can I request my first payout?”

This self-service hub is essential for quickly resolving operational questions without needing to contact support directly. It also reinforces trader autonomy—something valued highly in the prop trading space.

Community Initiatives & Giveaways

Goat Funded Trader regularly organizes social media giveaways, trading competitions, and discount promotions, aimed at increasing community involvement and rewarding loyal users. These initiatives not only boost trader morale but also create a fun, engaging atmosphere that sets the brand apart from more rigid firms. Users can often find Goat Funded Trader discount code, Goat Funded Trader coupon code, and Goat Funded Trader promo code during these events, helping them access exciting offers.

For example, recent giveaways have included free challenge accounts, funding vouchers, and exclusive Discord perks, encouraging traders to stay active both in the market and in the community. Traders frequently take advantage of the Goat Funded Trader 50 off, Goat Funded Trader 50 off coupon code, and special Goat Funded Trader coupon releases to enhance their funded trading journey.

Goat Funded Trader’s community and support structure is growing in scope and strength, driven by real-time communication, social connectivity, and practical help resources. While the firm may not yet offer formal courses or multilingual support like more established players, it provides everything essential to navigate the funded trading journey successfully—with an eye toward continuous improvement and community engagement.

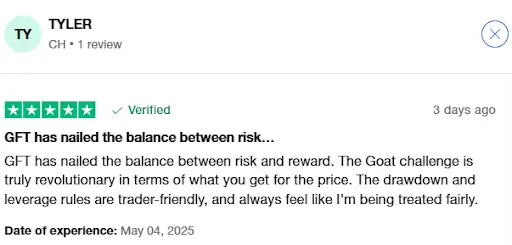

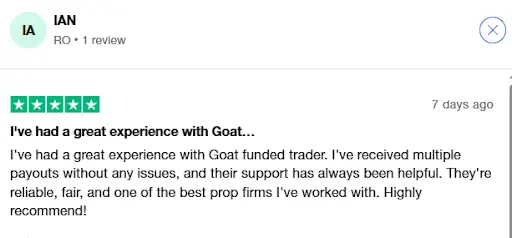

Traders Opinion

Goat Funded Trader enjoys strong positive feedback from traders, earning an impressive 4.1-star rating on Trustpilot, as reflected in many goat funded trader Trustpilot reviews. Many users highlight the firm’s transparent rules, efficient payout process, and responsive customer support as key strengths, making people wonder “is Goat Funded Trader trusted?“.

Traders often commend the company for creating a smooth and fair funding experience, which strengthens its reputation against doubts like “goat funded trader scam or legit“. Also, several goat funded trader opiniones across communities suggest the firm is a trusted option for serious prop trading enthusiasts. While the goat funded trader location may not be widely discussed, most traders focus more on the legitimacy and trust factor, which continues to be positively echoed through goat funded trader legit discussions.

Goat Funded Trader Review: Pros and Cons

Evaluating Goat Funded Trader’s strengths and limitations is key for traders looking to find the right proprietary trading partner. This balanced breakdown of pros and cons—backed by verified information—helps traders determine if Goat Funded Trader aligns with their trading goals, capital needs, and risk tolerance.

Below is a table that outlines the main advantages and drawbacks of trading with Goat Funded Trader:

| Pros | Cons |

| Multiple Funding Models: Goat Funded Trader offers various account types such as Challenge, Express, and Elite, giving traders flexibility in how they want to access funding. | Limited Educational Resources: Compared to top firms, Goat lacks a comprehensive trader education academy or frequent webinars. |

| Generous Profit Split: Traders can retain 80% to 95% of profits, with top performers accessing higher tiers through scaling opportunities. | No Free Retakes on All Accounts: Unlike some firms, not all challenge accounts offer free retries, especially in Express models. |

| Crypto, News, and Weekend Trading Allowed: The firm permits news trading, holding over weekends, and trading cryptocurrencies, which many other firms restrict. | Evaluation Fees Apply: All models require upfront evaluation fees, which may be a barrier for new or risk-averse traders. |

| Fast Payouts via Deel: Traders report quick and reliable payouts, with some receiving payments within 24 to 48 hours after request. | No Minimum Trading Days May Encourage Overtrading: The lack of minimum trading days, while flexible, may lead some traders to rush evaluations. |

Key Takeaways

- Goat Funded Trader’s flexibility, particularly with account types and trading conditions, appeals to both beginner and advanced traders.

- The high-profit split and trading freedom (news, crypto, overnight holds) are standout features.

- However, evaluation costs and the absence of structured learning tools may deter some.

- Traders should carefully match their strategy and discipline with Goat’s offering to determine if it’s the right fit.

Is Goat Funded Trader Worth It?

Goat Funded Trader is quickly gaining traction in the Forex Prop Firms world as a flexible and forward-thinking choice for serious traders. Offering funding options of up to $200,000, a one-phase evaluation process, and no minimum trading day requirements, this firm removes many of the roadblocks traditional prop firms impose.

What makes it stand out? Rapid payouts, scaling potential, and a crypto-friendly funding system make Goat Funded Trader especially attractive for agile, modern traders looking for autonomy and speed.

Although it’s newer to the scene than legacy firms, its transparent rules, budget-friendly pricing, and positive trader reviews show it’s a strong contender. If you’re a trader who values freedom, speed, and straightforward funding, Goat Funded Trader is definitely a firm to watch—and consider.

The Final Words

Goat Funded Trader is carving out a space as one of the most accessible and flexible prop firms in today’s market. With funding up to $200,000, a low 8% profit target, and no minimum trading day requirement in some challenges, the firm strikes a rare balance between opportunity and practicality. The ability to hold trades overnight, use expert advisors, and trade crypto and news events gives traders the freedom to operate with real strategic autonomy.

While still growing in reputation, Goat Funded Trader has shown a strong commitment to fast payouts, transparent operations, and supportive trader engagement. For ambitious traders seeking a firm that blends competitive conditions with community and support, this Goat Funded Trader review confirms that it is a worthy contender in the proprietary trading space.

If you’re ready to take your trading journey to the next level, Goat Funded Trader may be the platform to help you achieve it.

FAQs

What is Goat Funded Trader?

Traders can participate in various challenge programs, including One Phase, Two Phase, and Instant Funding, to demonstrate their trading skills. Upon passing these evaluations, they receive funded accounts and can earn profit splits of up to 95%.

Who is the CEO of Goat Funded Trader?

He founded the firm in 2022, and it operates with headquarters in the Canary Islands, Spain, and an additional branch in Hong Kong.

Is Goat Funded Trader trusted?

While the firm boasts a 4.1/5 rating on Trustpilot based on over 1,800 reviews, with many praising its customer support and trading conditions, there are also concerns about payout delays and unclear trading rules.

How long does Goat Funded Trader take to process payouts?

Traders become eligible for their first payout after three trading days from their first trade. Subsequent payouts are scheduled monthly, with an option for bi-weekly payouts through an add-on during challenge purchase.

Does Goat Funded Trader offer coupon codes or discounts?

Traders can find these offers on the firm’s website and through affiliate partners, allowing them to save on challenge fees.

What types of accounts does Goat Funded Trader provide?

Traders can choose from One Phase, Two Phase, or Instant Funding programs, each with specific rules and profit-sharing structures, to suit their trading preferences.