Welcome to NEG Markets Review, where we’ll unveil all the expert analysis, pros and cons, and insider information so that all the prop traders across the globe can make informed decisions. NEG Markets LLC is a prominent proprietary forex trading firm recognized for its relentless dedication to excellence and innovation. Founded with the mission to revolutionize the forex trading industry, NEG Markets has consistently optimized its trading strategies to generate substantial profits for its talented traders.

That being said, let’s dive right into NEG Markets Review…

What sets NEG Markets apart from traditional forex trading firms is its proprietary trading model, which has been finely tuned over years of experience. Traders at NEG Markets benefit from direct access to cutting-edge trading infrastructure, secure and reliable connections to global liquidity providers, and advanced risk management systems. This approach maximizes profitability while minimizing market exposure, making NEG Markets a preferred choice for ambitious forex traders.

What sets NEG Markets apart from traditional forex trading firms is its proprietary trading model, which has been finely tuned over years of experience. Traders at NEG Markets benefit from direct access to cutting-edge trading infrastructure, secure and reliable connections to global liquidity providers, and advanced risk management systems. This approach maximizes profitability while minimizing market exposure, making NEG Markets a preferred choice for ambitious forex traders.

NEG Markets Review: Key Features & Services

Advanced Technology: The state-of-the-art trading platform provides lightning-fast execution and access to real-time market data, equipping traders with a competitive edge.

Expert Guidance: NEG Markets offers personalized mentorship and ongoing support from seasoned professionals to help traders navigate the challenges of the forex market.

Profit Sharing: The firm’s transparent and fair profit-sharing model rewards traders proportionately as they succeed, creating a mutually beneficial partnership.

Risk Management: Rigorous risk assessment protocols and extensive monitoring systems ensure prudent trading practices and long-term profitability.

Continuous Learning: Comprehensive educational programs, industry insights, and market research resources are readily accessible to traders, fostering continuous learning and professional development.

Regulatory Status: NEG Markets LLC operates under the legal entity NEG Markets LTD, based in St. Lucia. The content and services provided by the company are intended for general informational and educational purposes, and the firm emphasizes that leveraged products, including CFDs and FX trading, involve substantial risk.

Headquarters Address: NEG Markets LLC operates from St. Lucia, reflecting its commitment to providing secure and reliable trading solutions to traders worldwide.

Want to learn more about what sets NEG Markets apart than it’s competitors? Here, have a look: Discover What Sets NEG Markets Apart!

NEG Markets Review: CEO Chris Tarta

Chris Tarta brings a wealth of entrepreneurial experience to NEGmarkets LLC, having successfully ventured into multiple industries before focusing on Forex trading:

Chris Tarta brings a wealth of entrepreneurial experience to NEGmarkets LLC, having successfully ventured into multiple industries before focusing on Forex trading:

- Entrepreneurial Journey: Chris began his career by establishing and managing two full-service restaurants, each employing 45 individuals. After selling these businesses, he transitioned into real estate and Forex trading around eight years ago.

- Passion for Trading: With a deep passion for trading and team cultivation, Chris has dedicated himself to expanding sales teams in the real estate sector and now leads NEGmarkets LLC with a strong emphasis on client service and operational efficiency.

- Management Expertise: Drawing from his management experience in the restaurant business, coupled with skills honed in sales and trading, Chris is well-equipped to lead NEGmarkets LLC. His goal is to assist traders in achieving sustained success and profitability in the Forex industry.

NEG Markets Review: NEGmarkets LLC

NEGmarkets LLC, operating from St. Lucia, is committed to providing educational resources and information for general informational and educational purposes. The company specializes in leveraged products, including CFDs and FX trading, and adheres to regulatory guidelines to ensure transparency and compliance.

NEGmarkets LLC, operating from St. Lucia, is committed to providing educational resources and information for general informational and educational purposes. The company specializes in leveraged products, including CFDs and FX trading, and adheres to regulatory guidelines to ensure transparency and compliance.

Innovation and Industry Leadership

Under Chris Tarta’s leadership, NEGmarkets LLC has adopted an innovative approach to navigating global markets, positioning the company at the forefront of the industry. The firm continues to thrive under his guidance, delivering unparalleled value to clients and setting new standards for excellence in the financial sector.

Regulatory Compliance and Risk Disclosure

It’s important to note that leveraged products involve complex instruments with a substantial risk of financial loss. NEGmarkets LLC emphasizes transparency and compliance with regulatory standards to safeguard clients’ interests and ensure responsible trading practices.

NEG Markets Review: Challenges

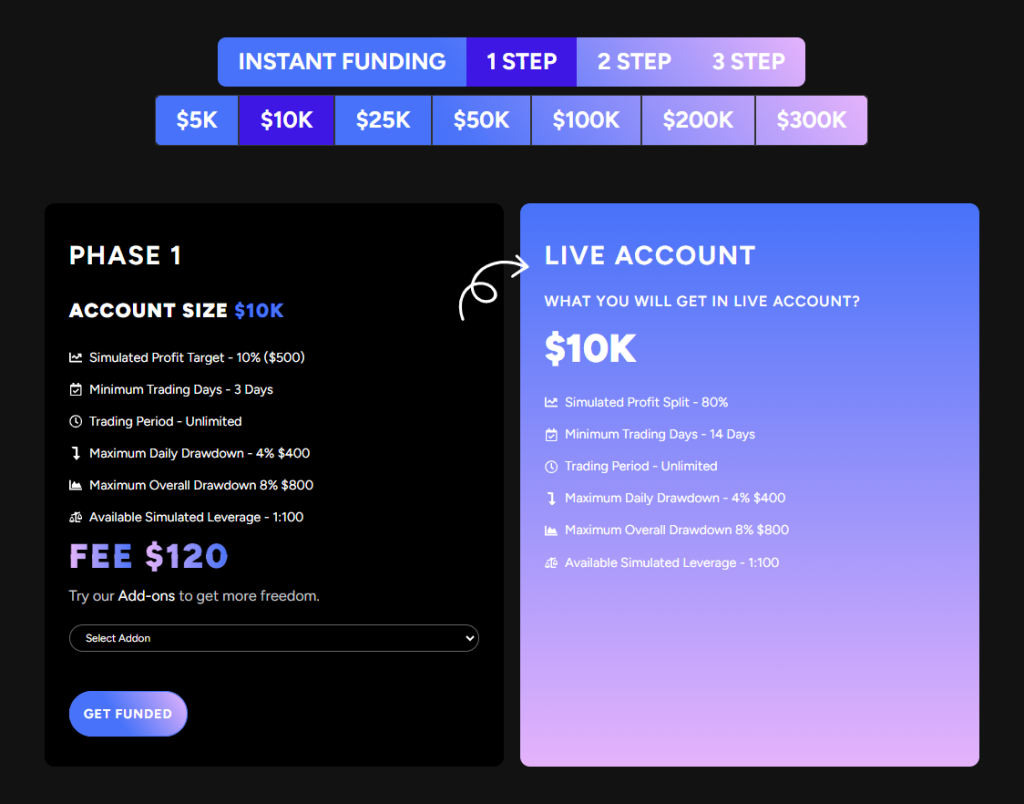

NEG Markets LLC offers a structured funding process (Trading challenge) with multiple phases and account options tailored to meet the needs of diverse traders.

1-Step Process

| Account Sizes | Simulated Profit Split | Minimum Trading Days | Maximum Daily Drawdown | Maximum Overall Drawdown | Available Simulated Leverage |

| $5K, $10K, $25K, $50K, $100K, $200K, $300K | 60% (increases monthly) | 14 Days | No daily limit | 8% | 02:40 |

2-Step Process

Phase 1

| Account

Size |

Simulated Profit Target | Minimum Trading Days | Trading Period | Maximum Daily Drawdown | Maximum Overall Drawdown | Available Simulated Leverage | Fee |

| $10K | 8% ($800) | 3 Days | Unlimited | 5% ($500) | 10% ($1000) | 02:40 | $100 |

Phase 2

| Account Size | Simulated Profit Target | Minimum Trading Days | Trading Period | Maximum Daily Drawdown | Maximum Overall Drawdown | Available Simulated Leverage |

| $10K | 5% ($500) | 3 Days | Unlimited | 5% ($500) | 10% ($1000) | 02:40 |

Live Account

| Account Size | Simulated Profit Split | Minimum Trading Days | Trading Period | Maximum Daily Drawdown | Maximum Overall Drawdown | Available Simulated Leverage |

| $10K | 80% | 14 Days | Unlimited | 5% ($500) | 10% ($1000) | 02:40 |

3-Step Process

Phase 1

| Account Size | Profit Target | Minimum Trading Days | Trading Period | Maximum Daily Drawdown | Maximum Overall Drawdown | Available Simulated Leverage | Fee |

| $10K | 6% ($600) | 3 Days | Unlimited | 4% ($400) | 10% ($1000) | 02:40 | $70 |

Phase 2 & 3

| Account Size | Profit Target | Minimum Trading Days | Trading Period | Maximum Daily Drawdown | Maximum Overall Drawdown | Available Simulated Leverage |

| $10K | 6% ($600) | 3 Days | Unlimited | 4% ($400) | 10% ($1000) | 02:40 |

Live Account

| Account Size | Simulated Profit Split | Minimum Trading Days | Trading Period | Maximum Daily Drawdown | Maximum Overall Drawdown | Available Simulated Leverage |

| $10K | 80% | 14 Days | Unlimited | 4% ($400) | 10% ($1000) | 02:40 |

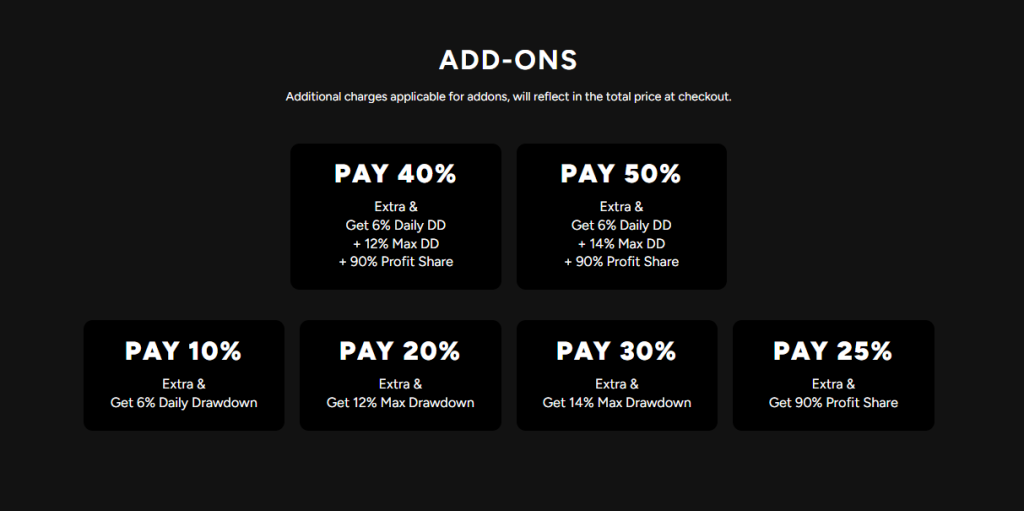

Add-ons

Additional charges apply for add-ons, enhancing flexibility:

Additional charges apply for add-ons, enhancing flexibility:

- PAY 40% Extra: 6% Daily Drawdown, 12% Maximum Drawdown, 90% Profit Share.

- PAY 50% Extra: 6% Daily Drawdown, 14% Maximum Drawdown, 90% Profit Share.

- PAY 10% Extra: 6% Daily Drawdown.

- PAY 20% Extra: 12% Maximum Drawdown.

- PAY 30% Extra: 14% Maximum Drawdown.

- PAY 25% Extra: 90% Profit Share.

This structured approach with varying account sizes and add-on options allows traders to customize their trading experience according to their preferences and risk tolerance levels.

NEG Markets Review: Trading Instruments

At NEGmarkets LLC, traders have access to a wide range of trading instruments through our advanced platform. We offer simulated trading opportunities across major and minor forex pairs, commodities, and indices, ensuring a comprehensive trading experience. Please note that cryptocurrency trading is currently excluded from our simulated trading offerings.

Forex

Our forex selection includes major and minor currency pairs, providing ample opportunities for traders to explore global currency markets.

Commodities

Traders can engage in simulated trading of various commodities, allowing them to speculate on market movements in precious metals, energies, and agricultural products.

Indices

We offer simulated trading on a diverse range of global indices, enabling traders to trade on the performance of major stock indices from around the world.

NEG Markets Review: Trading Fees

NEGmarkets LLC maintains a transparent fee structure to support our traders’ profitability:

- Forex: Competitive fee of 3 USD per lot traded.

- Commodities and Indices: Commission structure varies based on contract size and instrument, ensuring fair pricing across different asset classes.

Comparison with Other Proprietary Trading Firms

NEGmarkets LLC distinguishes itself from other prop trading firms through its robust simulated trading offerings across forex, commodities, and indices. While cryptocurrency trading is excluded from simulated trading, our focus on major and minor forex pairs, alongside commodities and indices, provides traders with a diversified portfolio of trading instruments.

Customer Commitment at NEGmarkets LLC

At NEGmarkets LLC, we prioritize our traders’ success with our Star Customer Promise. We are committed to providing unparalleled support, guidance, and resources to help you achieve your financial goals with confidence and reliability.

Fast-Track Success with NEGmarkets Capital

Accelerate your journey to financial independence with NEGmarkets Capital. We understand the importance of timely rewards, offering real fund payouts in as little as one day. Our streamlined process ensures that your efforts are quickly rewarded, allowing you to capitalize on your trading successes efficiently.

NEG Markets Review: Profit-Sharing Model

NEGmarkets LLC operates on a transparent profit-sharing model to align our interests with yours:

- Simulated Profit Split: Traders benefit from an attractive profit split of 80% on simulated trading accounts. This encourages profitability and rewards your trading performance effectively.

Additional Features

- Advanced Trading Technology: Our state-of-the-art trading platform provides fast execution and real-time market data, giving you a competitive edge in the market.

- Comprehensive Risk Management: We prioritize risk management with rigorous protocols and monitoring systems to safeguard your capital and ensure sustainable trading practices.

- Educational Resources: Access our comprehensive educational programs, market insights, and research materials to enhance your trading skills and knowledge continuously.

- Dedicated Customer Support: Our Star Customer Promise extends to our dedicated support team, available to assist you with any inquiries or assistance you may need throughout your trading journey.

NEG Markets Review: Regulatory Compliance

NEGmarkets LLC adheres to regulatory standards to ensure transparency and security for our traders. We operate within the framework of regulatory guidelines to uphold industry best practices and protect your trading interests.

Payout Processing and Trading Features

Payout Processing: NEGmarkets LLC prioritizes timely payouts to traders, aiming for a swift processing time of 12-48 hours through their platform RISE. Efforts are made to expedite the process, ensuring that traders receive their funds promptly. Payments requested on weekends or holidays are processed on the next business day.

Post-Payout Trading Access: Upon approval of a payout request, NEGmarkets LLC provides traders with a reset simulated trading demo account. This feature allows traders to continue refining their strategies and exploring market opportunities without interruption, enhancing their trading experience.

NEG Markets Review: Trading Platforms & Tools

Platform: NEGmarkets LLC offers a robust trading platform equipped with advanced features for seamless execution and real-time market data access. The platform is designed to provide traders with a competitive edge and enhance their trading efficiency.

Tools: Traders benefit from a suite of tools tailored to optimize trading strategies and manage risk effectively. These tools include comprehensive charting packages, technical analysis tools, and customizable trading indicators, empowering traders to make informed decisions.

NEG Markets Review: Risk Management

Emphasis on Risk Management: NEGmarkets LLC prioritizes risk management strategies to safeguard traders’ capital and minimize exposure to market fluctuations. Rigorous risk assessment protocols and monitoring systems are in place to promote prudent trading practices and long-term profitability.

NEG Markets Review: Customer Support

Customer Support: The firm is committed to providing exceptional customer support, offering assistance throughout the trading journey. Traders can access support via multiple channels, including email, live chat, and phone, ensuring prompt resolution of queries and issues.

Educational Resources: NEGmarkets LLC offers comprehensive educational resources, including tutorials, webinars, and market insights. These resources are designed to empower traders with knowledge and skills essential for navigating the forex market effectively.

NEG Markets Review: Additional Benefits

Innovative Features: The company continuously introduces innovative features and updates to enhance trading capabilities and user experience. These include access to new trading instruments, improved platform functionalities, and innovative trading strategies.

NEG Markets Review: Regulation & Conditions

New Era Global Markets operates under the regulatory oversight of reputable authorities, ensuring adherence to stringent financial standards and trader protection protocols. The firm is committed to maintaining transparency and compliance with applicable laws across all jurisdictions it serves.

Trading Conditions

New Era Global Markets offers competitive trading conditions designed to optimize profitability while mitigating risk. Traders benefit from tight spreads, competitive commissions, and flexible leverage options tailored to individual trading preferences. The platform supports a wide range of trading instruments, including major and minor forex pairs, commodities, and indices.

Client Feedback and Reviews

Feedback from traders at New Era Global Markets underscores high levels of satisfaction with the firm’s services and support. Positive reviews highlight the effectiveness of the proprietary trading model, reliable execution speeds, and comprehensive educational resources. Clients commend the firm for its commitment to trader success and responsive customer service.

Company Values and Mission

New Era Global Markets is driven by a mission to revolutionize the forex proprietary trading industry through innovation and excellence. The firm prioritizes integrity, professionalism, and client-centricity in all aspects of its operations. By providing traders with advanced tools, mentorship, and a supportive trading environment, New Era Global Markets aims to empower traders to achieve sustained profitability and growth.

Future Outlook and Developments

Looking ahead, New Era Global Markets is dedicated to continuous improvement and expansion. Plans include enhancing technological capabilities, introducing new trading products, and expanding its global footprint. The firm remains committed to upholding its reputation as a leader in the forex prop trading industry and delivering exceptional value to its growing client base.

for

for