In the fast-evolving proprietary trading space, Quant Tekel (formerly known as AscendX, and also stylized as QuantTekel or Quantekel) is steadily gaining attention for its innovative approach to funded trading accounts. Unlike many traditional prop firms, Quant Tekel prop firm emphasizes flexibility, accessibility, and trader-friendly terms, making it a rising competitor in 2025. This Quant Tekel review will explore the firm’s funding model, evaluation challenges, account options, fee structures, and platform features to help you decide whether this prop firm aligns with your trading goals.

Quant Tekel operates with a two-phase evaluation process—the Challenge and Verification—aimed at assessing a trader’s consistency and discipline before offering access to live-funded accounts. With funding potential up to $200,000, a generous profit split up to 90%, and no time limits on challenge phases, the firm positions itself as a more accessible gateway for aspiring traders.

Whether you’re an experienced trader or just entering the world of prop trading, this review will help you understand what sets Quant Tekel apart from the rest.

Table of Contents

Who is Quant Tekel?

Quant Tekel, formerly known as AscendX, is a proprietary trading firm offering traders the chance to manage funded accounts with up to $200,000 in capital, all without risking personal funds. Headquartered in London, United Kingdom, the firm has positioned itself as a modern, trader-centric prop firm, emphasizing flexible rules, no time limits, and a generous profit split of up to 90% for its top performers.

Founded to empower disciplined traders across the globe, Quant Tekel delivers a streamlined and accessible path to capital through a two-step evaluation model. The firm has quickly grown in popularity due to its transparent conditions, low entry cost, and trust-based operational structure.

Quant Tekel’s website and dashboard are built with a user-friendly interface, offering traders real-time metrics and clear tracking of progress. By lowering entry barriers and promoting consistent risk management, Quant Tekel has emerged as a credible alternative in the competitive world of prop trading.

Brokers That Are Used By Quant Tekel

Quant Tekel partners with Eightcap, a well-known and regulated Australian broker, to facilitate its trading operations. This partnership provides traders access to MetaTrader 4 and MetaTrader 5 platforms—two of the most widely used in the industry. Known for their speed, reliability, and intuitive interfaces, these platforms allow for efficient order execution and robust charting tools.

Eightcap is regulated by the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA), ensuring a level of trust and execution quality. Quant Tekel’s collaboration with Eightcap enables traders to benefit from tight spreads, fast execution, and access to a wide range of instruments including forex, indices, and commodities.

For those evaluating the trading environment at Quant Tekel prop firm, understanding the role of its broker partner is key to assessing the firm’s infrastructure and execution standards.

Who is the Director of Quant Tekel?

Scott, the Director of Quant Tekel, brings an impressive pedigree from the world of high finance. With a background that includes senior roles at Credit Suisse, Deutsche Bank, and Barclays, Scott has built a career across OTC derivatives, cash securities settlement, and position reconciliation. His extensive experience in sales, management, and business development uniquely positions him to lead Quant Tekel with strategic vision.

After his tenure in banking, Scott went on to found several commodity brokerages, driven by his belief that retail traders deserve the same opportunities as institutional investors. This belief ultimately led to the creation of Quant Tekel—his mission being to empower emerging traders and build a vibrant, supportive trading community. Through QT, Scott is focused on nurturing global talent and bridging the gap between retail and institutional trading environments.

Quant Tekel Scaling Plan & Funding Programs

Quant Tekel presents a robust prop trading model tailored for serious traders, combining a two-phase evaluation process with a high profit split and strategic scaling opportunities. The evaluation allows access to up to $200,000 in trading capital with a competitive 90% profit share, placing Quant Tekel among firms offering above-industry standards.

Traders who opt for an 80% profit split at payout become eligible for account scaling — increasing their account by 10% of the original capital. With consistent performance and company discretion, funding can scale up to $2,000,000, offering a growth pathway that rewards skill and risk control.

Quant Tekel’s system is structured to promote disciplined trading with clear criteria and community-based incentives, such as monthly competitions that further support talent recognition.

Overview of Quant Tekel Funding Programs

| Program | Key Features | Scaling & Profit Split | Who It’s For? |

| Quant Tekel Account | – Two-phase evaluation to access up to $200,000 in funding.- Industry-high 90% profit share.- Access to MT5 and DX Trade platforms. | – Select 80% payout to trigger scaling.- Scale account by 10% of original size at each payout.- Potential to reach $2,000,000 in capital. | Traders seeking high-profit potential, performance-based scaling, and a modern prop firm model. |

Key Takeaways:

- High Profit Share: Quant Tekel offers up to 90%, which stands out in the industry.

- Smart Scaling: Account growth of 10% per payout cycle makes it attractive for consistently profitable traders.

- Modern Infrastructure: Access to top-tier platforms and a competitive trading environment.

Overall, Quant Tekel’s funding and scaling plan is structured for growth-minded traders who can prove their consistency and seek long-term capital scaling opportunities.

Quant Tekel Review: How to Get Funded?

In this Quant Tekel review, we break down the process of how traders can secure funding through this London-based proprietary trading firm. Quant Tekel offers a two-phase evaluation process—designed to assess a trader’s consistency, profitability, and risk management before granting access to live-funded capital of up to $200,000.

1. The Challenge Phase

The first step toward getting funded is the Quant Tekel Challenge. This phase tests a trader’s discipline through specific objectives:

- Profit Target: Reach an 8% profit goal

- Maximum Daily Loss: Stay within a 5% daily loss limit

- Maximum Total Loss: Avoid exceeding 10% of total loss

- Minimum Trading Days: Trade at least 5 days

Unlike many firms, Quant Tekel imposes no time limit on the challenge, giving traders the freedom to perform at their own pace while respecting risk rules. Traders can track their performance and objectives directly via the Quant Tekel login dashboard, which offers real-time metrics and insights.

2. The Verification Phase

Once the Challenge is passed, traders enter the Verification stage. The rules remain similar, but the profit target is reduced to 4%, making this phase slightly more attainable. All other risk parameters stay the same to ensure consistency and disciplined trading behavior.

Quant Tekel MT5 download is available during both evaluation phases, giving traders access to a robust and professional-grade trading platform.

3. Live Funded Account & Profit Sharing

After successful completion of both phases, traders receive a live funded account. Quant Tekel offers an 80% profit split, which can be upgraded to 90% for consistent performance. There’s also a scaling plan that allows traders to increase their account size based on ongoing success.

Traders can join the Quant Tekel Discord community to share strategies, ask questions, and stay updated on the latest Quant Tekel competitions and performance incentives.

Note: Traders from Quant Tekel restricted countries should review the eligibility criteria before applying, as some regions may not be supported due to regulatory limitations.

Quant Tekel’s funding model is ideal for traders looking for flexibility, transparent rules, and a path to scaling capital without the pressure of time constraints.

Trading Instruments and Platforms at Quant Tekel

When evaluating Quant Tekel as a proprietary trading firm, it’s important to understand the range of trading instruments and platforms they offer. These components not only shape the trader’s experience but also reflect the firm’s infrastructure and technological commitment. In this Quant Tekel review, we dive into the available markets and platforms that empower traders during the evaluation and funded phases.

Trading Instruments at Quant Tekel

Quant Tekel provides access to a diverse portfolio of instruments across key asset classes. This breadth supports multiple trading strategies—from short-term scalping to long-term position trading. Traders at Quant Tekel can operate in the following markets:

- Forex: A wide selection of major, minor, and exotic currency pairs allows for ample opportunities in the most liquid market globally. This remains the core market for many proprietary traders.

- Indices: Traders can gain exposure to leading global economies through major indices such as the S&P 500, NASDAQ, and Dow Jones, enabling macroeconomic trading strategies.

- Commodities: Assets like gold, silver, and crude oil offer traders the ability to diversify their portfolios and hedge against currency movements or inflationary trends.

- Cryptocurrencies: For those seeking volatility and innovation, Quant Tekel supports trading on popular digital assets including Bitcoin and Ethereum, catering to the growing demand for crypto market access.

This broad spectrum ensures that both conservative and high-risk traders have access to relevant instruments based on their strategies and risk appetite.

Trading Platforms at Quant Tekel

Quant Tekel utilizes the industry-standard MetaTrader 5 (MT5) platform, a powerful and versatile tool suitable for all trader levels. MT5 stands out for its:

- Advanced charting tools

- Integrated economic calendar

- Fast order execution

- Multi-asset capability

- Algorithmic trading via Expert Advisors (EAs)

The platform’s robust infrastructure enables seamless access to Quant Tekel’s supported instruments, ensuring low latency and stable execution, which is crucial during volatile market conditions. MT5 is available across desktop, web, and mobile, giving traders flexibility and control wherever they trade.

Quant Tekel’s decision to center its trading around MT5 showcases a commitment to reliability and professional-grade tools. For any trader seeking to pass the evaluation or manage a live funded account, these trading resources provide the technical foundation for consistent performance.

Quant Tekel Trading Conditions: Spreads, Fees, and Rules

Quant Tekel offers a robust and trader-friendly environment, emphasizing transparency, competitive trading conditions, and disciplined risk management. Their trading conditions are structured to support both novice and experienced traders aiming for consistent profitability.

Spreads and Fee Structure

Quant Tekel provides competitive spreads across various instruments, including forex, commodities, indices, and cryptocurrencies. Traders can choose between raw spreads with a commission or variable spreads with no commission, catering to different trading strategies and preferences. For raw spread accounts, a commission of $2 per lot per side (totaling $4 per round trip) is applied across all instruments .

Additionally, Quant Tekel offers swap-free trading as standard, eliminating overnight fees and making it suitable for traders who hold positions for extended periods .

Leverage Options

Quant Tekel provides tailored leverage options to balance trading flexibility with risk management:

- Forex: Up to 1:50

- Indices & Oil: Up to 1:20

- Metals: Up to 1:15

- Cryptocurrencies: 1:1

These leverage settings are designed to accommodate various trading styles while maintaining prudent risk exposure .

Risk Management and Trading Rules

Quant Tekel enforces strict risk management protocols to ensure disciplined trading and account protection. These Quant Tekel rules apply across all evaluation models:

- Daily Drawdown Limit: Fixed at 4% of the initial account balance.

- Overall Drawdown Limit: Varies between 6% to 10%, depending on the evaluation model chosen.

- Profit Targets: Set according to the specific evaluation phase, with clear objectives to assess trading proficiency.

These rules are integral to Quant Tekel’s evaluation process, promoting consistency and effective risk management among traders. It’s also worth noting that the Quant Tekel Classic vs Advanced models may have slight variations in these rule sets, particularly in drawdown limits and target requirements, depending on the trader’s chosen path.

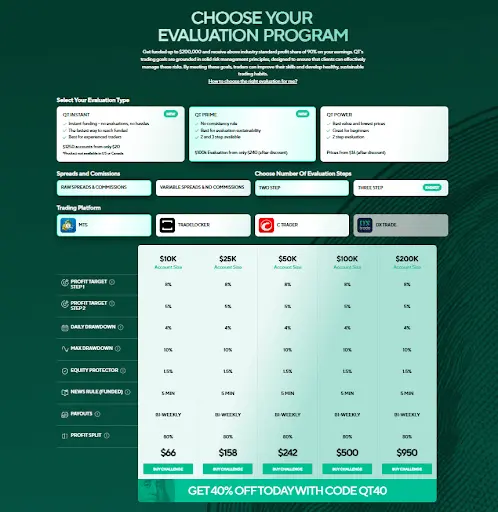

Evaluation Models

Quant Tekel offers multiple evaluation pathways to accommodate different trader preferences:

- QT PRIME: Available in both 2-Step and 3-Step formats, allowing traders to select a structure that aligns with their trading style.

- QT INSTANT: Designed for traders seeking immediate access to funded accounts, with specific rules to maintain account integrity .

Each model is crafted to assess various aspects of a trader’s skill set, ensuring a comprehensive evaluation process.

Quant Tekel’s trading conditions are meticulously designed to foster a professional trading environment. With competitive spreads, flexible fee structures, tailored leverage options, and stringent risk management rules, traders are well-equipped to pursue consistent profitability within a structured and supportive framework.

Subscription and Payment Methods at Quant Tekel

In this Quant Tekel review, gaining a clear understanding of the subscription structure and supported payment methods is crucial for traders looking to access funded accounts. Quant Tekel stands out in the proprietary trading space by offering a one-time evaluation fee structure tied to its multiple-step evaluation challenges. Unlike firms with recurring monthly subscriptions, Quant Tekel provides lifetime access to its trading challenge for a single upfront cost, making it an accessible entry point for aspiring funded traders. This section offers a deep dive into subscription plans, associated costs, accepted payment methods, refund terms, withdrawal policies, and overall payment transparency.

Subscription Options and Associated Fees

Quant Tekel offers traders the flexibility to choose from 1-step, 2-step, or 3-step evaluations, each with varying pricing based on the account size and chosen challenge format. The evaluation fee covers access to the challenge and is non-recurring, meaning traders pay once to attempt the funded account challenge.

Below is a summary of the Quant Tekel evaluation fees based on account size. All fees are displayed in USD, and the amount is payable only once per challenge:

| Account Size | Challenge Fee (USD) | Refundable |

| $10,000 | $99 | Yes |

| $25,000 | $149 | Yes |

| $50,000 | $249 | Yes |

| $100,000 | $399 | Yes |

| $200,000 | $749 | Yes |

For example, the Quant Tekel 100k evaluation fee is $399, while the 50k account costs $249. These fees apply whether traders opt for the 1-step, 2-step, or 3-step path. A key advantage is that the fee is fully refundable if the trader successfully completes the challenge and qualifies for a funded account with a first payout. This transparent and performance-based refund policy creates a strong incentive structure aligned with trader success.

Available Payment Methods

Quant Tekel supports a broad range of payment methods, ensuring accessibility for global traders. Whether a trader prefers traditional banking channels, cryptocurrencies, or fintech wallets, Quant Tekel has optimized the process for speed and reliability. Here’s a breakdown of available payment methods:

| Payment Method | Availability | Processing Time |

| Credit/Debit Card | Worldwide (Visa, MasterCard, Amex) | Instant |

| Cryptocurrency | Bitcoin, Ethereum, USDT | Within a few hours |

| Wise | Selected Countries | 1–2 business days |

| Revolut | Selected Countries | 1–2 business days |

| Skrill | Selected Countries | Instant |

This diverse range of options accommodates traders across regions and financial systems. Crypto users, in particular, benefit from fast processing times, with most crypto payments verified and activated within a few hours. Additionally, platforms like Wise and Revolut offer traders from select regions low-fee transfer options with reasonable confirmation times.

Withdrawal Policies

Quant Tekel maintains a trader-friendly withdrawal policy, focusing on speed, accessibility, and transparency. Once a trader qualifies and starts trading a funded account, profits are typically shared on a bi-weekly basis. Withdrawals can be initiated twice a month, and traders enjoy a profit split of up to 90% depending on their evaluation path and overall performance.

Withdrawals are processed using the same payment methods offered during registration, including crypto, Skrill, Wise, and bank cards. Processing times vary but are generally completed within 1–2 business days of approval, reflecting Quant Tekel’s commitment to efficient financial operations.

Refund Policy

Quant Tekel offers a clear and objective refund policy tied to trader performance:

- The evaluation fee is fully refundable upon passing the challenge and receiving the first profit split from a funded account.

- Refunds are automated and added to the trader’s first withdrawal.

- No refund is issued if the trader fails to meet the challenge objectives or violates risk rules.

This policy reinforces Quant Tekel’s emphasis on merit-based funding, where traders are rewarded for meeting performance standards and adhering to rules.

Payment Proof

Quant Tekel frequently shares payment confirmation posts and testimonials on its social channels and Discord community. These posts often include screenshots of successful withdrawals, showcasing the firm’s commitment to prompt and consistent payouts. Additionally, many traders within the community verify having received payouts in crypto and Skrill, reinforcing the platform’s reliability and payout speed.

For those evaluating prop firms, Quant Tekel’s no-nonsense approach to payments and refunds makes it a highly competitive option in the industry.

Quant Tekel vs. Funding Pips vs. FTMO: A Comparative Overview

In the evolving landscape of proprietary trading firms, Quant Tekel, Funding Pips, and FTMO have emerged as notable contenders, each offering unique opportunities for traders seeking funded accounts. This comparative analysis delves into their key features, aiding traders in making informed decisions.

| Feature | Quant Tekel | Funding Pips | FTMO |

| Initial Capital | $10,000 – $200,000 | $5,000 – $100,000 | €10,000 – €200,000 |

| Evaluation Process | Offers 1-step, 2-step, and 3-step evaluations with varying profit targets | Provides 1-step, 2-step, and 3-step evaluations tailored to trader levels | Two-step process: Challenge and Verification |

| Profit Split | Up to 90% | 75% – 95% | 80% (up to 90% with scaling) |

| Scaling Plan | Up to $2,000,000 with consistent performance | Up to $300,000 in simulated capital | 25% increase every 4 months upon achieving 10% profit |

| Tradable Instruments | Forex, commodities, indices | Forex, commodities, indices, cryptocurrencies | Forex, commodities, indices, stocks, cryptocurrencies |

| Trading Platforms | MetaTrader 5, DXTrade | cTrader, Match-Trader, TradeLocker | MetaTrader 4, MetaTrader 5, cTrader, DXtrade |

| Maximum Drawdown | 6% – 10% depending on evaluation type | 10% | 10% |

| Daily Loss Limit | 3% – 6% depending on evaluation type | 5% | 5% |

| Minimum Trading Days | Not specified | 3 days | 10 |

| Maximum Trading Days | Not specified | Not specified | 30 (Challenge), 60 (Verification) |

| News Trading Allowed | Conditional; breaches can lead to profit reset or challenge failure | No | No |

| Weekend Holding Allowed | Yes; swap fees are tripled during weekends | Not specified | No |

| Leverage | Up to 1:100 | Up to 1:100 | Up to 1:100 |

| Location | South Africa | Dubai, UAE | Czech Republic |

| Year Established | 2023 | 2022 | 2015 |

Key Insights

- Quant Tekel stands out with its flexible evaluation options, allowing traders to choose between 1-step, 2-step, or 3-step processes. Its generous profit split of up to 90% and a scaling plan reaching $2 million make it an attractive option for ambitious traders.

- Funding Pips offers high profit splits and multiple evaluation paths, catering to traders at different experience levels. However, concerns have been raised regarding its transparency and customer support, which potential users should consider.

- FTMO maintains its reputation with a structured evaluation process and a scaling plan that rewards consistent performance. Its diverse range of tradable instruments and robust trading platforms make it a preferred choice for many traders.

When selecting a proprietary trading firm, traders should assess their individual trading styles, risk tolerance, and growth objectives to choose the firm that best aligns with their professional goals.

Quant Tekel Trader Community and Support

Quant Tekel has positioned itself as a prop trading firm that not only provides access to capital but also cultivates a supportive ecosystem designed to empower and educate traders. By combining educational tools, active community engagement, and responsive customer support, Quant Tekel has created a platform that values trader development and long-term success. From onboarding to funded status, their infrastructure encourages continuous improvement and collaboration.

Educational Resources & Trader Development

Quant Tekel offers a suite of educational resources designed to prepare traders for both their evaluation phase and funded journey. While they do not currently have a structured learning academy like some firms, the firm actively shares trading guides, FAQs, and platform tutorials through its support portal. Topics range from navigating the QT Prime and QT Instant models, to understanding drawdown rules, leverage limits, and platform access (support.quanttekel.com).

Additionally, blog-style educational content and announcements are frequently shared on their official social channels and knowledge base. These updates aim to guide traders in both technical and operational aspects of trading with the firm.

Community Engagement and Social Media Presence

Quant Tekel has cultivated an active and growing trader community, particularly across social platforms. Their presence is notable on:

- Instagram: Regular updates, trader shout-outs, and motivational posts designed to keep the community informed and engaged.

- YouTube: Where they share updates, prop firm insights, and promotional content.

- TikTok and X (formerly Twitter): For engaging short-form content that connects with a younger demographic of traders.

Traders also frequently share their experiences and success stories online, including payout proofs and testimonials that reinforce the firm’s credibility. This organic content helps build trust and showcases Quant Tekel’s commitment to transparency.

These community touchpoints foster a collaborative environment where traders can exchange ideas, share strategies, and celebrate achievements.

Customer Support & Response System

Quant Tekel emphasizes a responsive and efficient customer support system to address trader concerns promptly. Their support system includes:

- Email Ticketing System: Traders can submit detailed inquiries through their online form, with responses often within 24–48 hours.

- Comprehensive Help Desk: Hosted on their support site, traders can browse detailed articles addressing topics such as account scaling, challenge conditions, payouts, and more.

- No Live Chat (Yet): Currently, there is no real-time chat option listed, but their written support materials are highly detailed and regularly updated.

This system ensures that traders receive reliable and prompt guidance throughout the evaluation and funded account processes.

Community Reviews and Trader Feedback

A strong indicator of Quant Tekel’s engagement is its positive community feedback on external review sites. Traders frequently highlight:

- Consistent payout reliability

- Simple rules and evaluation models

- Helpful support team responses

- Smooth onboarding process

On platforms like PropFirmMatch and FundedTrading.com, many traders commend Quant Tekel’s responsiveness and the firm’s transparency. These reviews often serve as informal testimonials that validate the company’s support and trader-first culture.

Giveaways and Community Promotions

To deepen engagement, Quant Tekel also runs occasional giveaways and discount campaigns—particularly during product launches such as QT Prime. These initiatives are typically announced via their social media platforms and offer traders the opportunity to win free challenges or discount codes, helping them get started with lower upfront costs.

Why It Matters

Quant Tekel’s commitment to supporting its traders extends beyond account funding. By investing in informative resources, nurturing an active online community, and delivering responsive support, the firm helps traders focus on what truly matters—improving their strategies and reaching consistent profitability. For anyone seeking a prop firm with a trader-centric approach, Quant Tekel’s growing ecosystem is a compelling part of the equation.

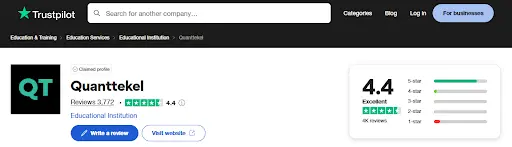

Traders Opinion

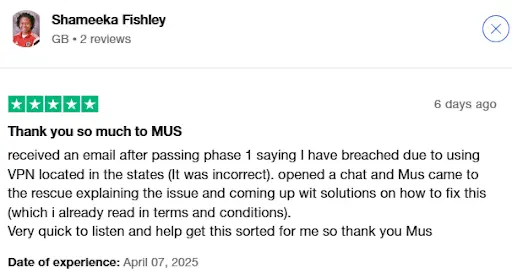

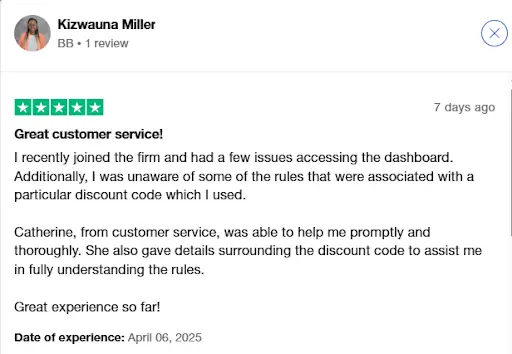

Quant Tekel has received overwhelmingly positive feedback from its trader base. Across various review platforms, including sites like Trustpilot, it boasts an impressive rating of 4.4 out of 5 stars, signaling strong customer satisfaction. Many of the Quant Tekel reviews highlight the firm’s fast payouts, responsive support team, and overall transparent approach to prop trading.

Traders frequently mention their confidence in the firm’s fair challenge rules and genuine funding process, noting that Quant Tekel delivers on its promises. In several user testimonials, traders praised the clear communication, timely updates, and the ease of getting assistance during both the evaluation and funded phases. If you’re researching Quant Tekel review feedback or browsing through platforms like Quant Tekel Trustpilot, you’ll find that most comments reinforce the firm’s trader-first reputation.

It’s also worth noting that some long-time users remember the company’s earlier days as AscendX Capital. Even older listings such as AscendX Capital Trustpilot entries reflect a consistent level of professionalism carried through the rebrand.

Quant Tekel Review: Pros and Cons

Evaluating Quant Tekel’s strengths and limitations is vital for traders aiming to partner with a reliable prop firm. Based on a detailed analysis of their platform and offerings, here’s a balanced view to help potential traders make informed decisions.

| Pros | Cons |

| Access to Capital: Quant Tekel provides funded accounts up to $200,000, allowing traders to grow their profit potential without risking personal capital. | Higher Drawdown Threshold: The firm allows up to 8% daily drawdown, which may be attractive for some but could also encourage risky trading behavior. |

| Flexible Profit Split: Traders can earn up to 90% profit split, offering strong earning potential for consistent performers. | Newer in the Industry: As a newer prop firm, Quant Tekel may not have the same long-standing credibility as more established firms. |

| No Time Limits: There are no time restrictions for completing challenges, providing flexibility for traders to pass evaluations at their own pace. | Limited Track Record: Due to its recent launch, there is limited historical data to assess long-term trader success or firm performance. |

| Weekly Payouts: Quant Tekel offers weekly payouts, ensuring faster access to trading profits. | Evaluation Fee Required: Traders must still pay an upfront evaluation fee, which may be a barrier for some. |

Key Takeaways:

- Quant Tekel stands out with a generous profit split, flexible evaluation timelines, and quick payout cycles.

- While it offers promising features, traders should carefully evaluate its track record and regulatory transparency.

- Its scalable capital model and lack of time pressure appeal to experienced traders seeking a customizable path to funded trading.

Is Quant Tekel Worth It?

Quant Tekel has emerged as a rapidly growing proprietary trading firm, offering traders access to funded accounts ranging from $10,000 to $200,000. By eliminating the need for personal capital, Quant Tekel addresses the critical barrier of underfunding—allowing traders to concentrate on performance rather than risk.

A key differentiator lies in its instant funding options, providing an expedited path for skilled traders to access capital without going through extended evaluation processes. Additionally, the firm is praised for its customized scaling plans, which reward consistency and discipline.

Quant Tekel, formerly known as AscendX Capital or AscendX prop firm, also maintains clear rules, such as an 8% profit target and 5% daily drawdown, positioning itself as both trader-friendly and risk-conscious.

Although relatively new under the Quant Tekel brand, its positive reputation across trading communities and its transparent model make it an attractive option for both novice and experienced traders seeking a modern, accessible funding firm.

The Final Words

Quant Tekel is steadily establishing itself as a competitive player in the prop trading space, offering scalable funding options with account sizes up to $200,000. The firm’s appeal lies in its flexible models, including both instant funding and evaluation programs, catering to a wide range of trading styles and risk profiles.

With its transparent rules, scaling opportunities, and streamlined payout structure, Quant Tekel—formerly operating as AscendX Capital—creates a supportive environment for traders aiming to grow professionally.

For those seeking a modern, accessible, and performance-driven prop firm, this Quant Tekel review affirms its credibility as a worthy evolution of the AscendX prop firm brand in today’s trading landscape.

FAQs

What is Quant Tekel?

Quant Tekel is a proprietary trading firm.

It provides traders with the opportunity to manage funded accounts of up to $200,000 without risking personal capital. Known for its trader-friendly rules and flexible funding models, Quant Tekel operates a two-phase evaluation or instant funding process to identify skilled traders.

What is the consistency rule of Quant Tekel?

Quant Tekel requires traders to demonstrate consistent performance across trading days.

While the firm does not impose strict profit distribution across all trading days, it expects traders to avoid large one-day gains that distort evaluation. Consistency is reviewed as part of risk management and to ensure long-term trading discipline.

What was the old name of Quant Tekel?

Quant Tekel was formerly known as AscendX.

The prop firm underwent a rebranding from AscendX Capital and AscendX prop firm to Quant Tekel as part of its evolution into a more trader-focused and globally positioned funding firm.

Does Quant Tekel payout?

Yes, Quant Tekel offers regular payouts to eligible traders.

Once a trader passes the evaluation (or qualifies under instant funding), they become eligible for profit splits—up to 90% depending on account type. Payouts are processed according to the firm’s set schedule and through various supported payment methods.

What trading platforms does Quant Tekel support?

Quant Tekel supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Through its partnership with Eightcap, traders gain access to these popular platforms known for their fast execution, advanced charting tools, and algorithmic trading support.

Is Quant Tekel regulated?

Quant Tekel itself is not a regulated broker.

However, it operates through Eightcap, a regulated brokerage licensed by ASIC and FSA. This ensures that trading conditions are backed by a compliant and reputable financial service provider.

for

for