Quant Tekel has rolled out significant updates to its funding rules, responding directly to feedback from its trader community. These changes apply to all new purchases and to traders advancing to the next evaluation phase. The updated Quant Tekel funding rules aim to create a more flexible, realistic, and trader-friendly environment.

Key Changes to Quant Tekel Funding Rules

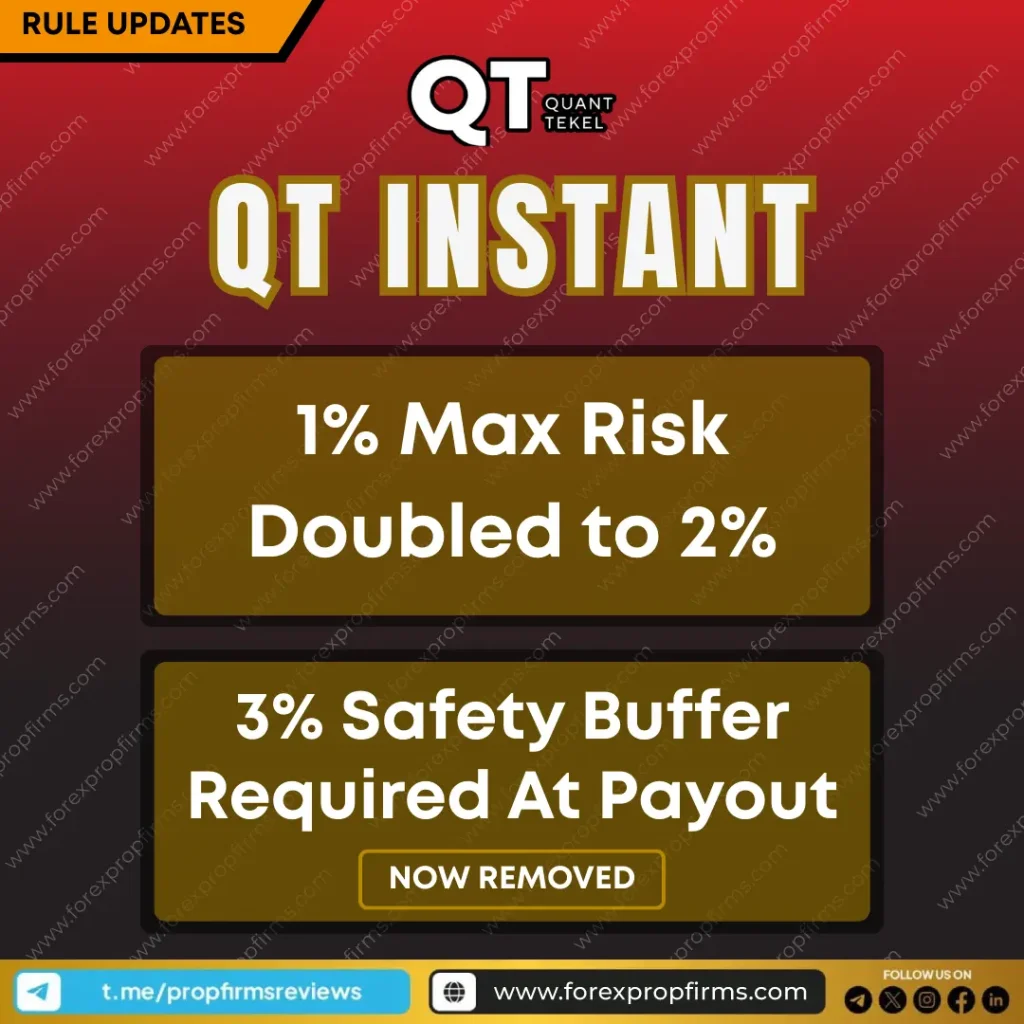

The latest adjustments affect QT Instant accounts, one of Quant Tekel’s most popular funding models. These rule changes focus on risk parameters and profit payout conditions, giving traders more breathing room and clarity in their evaluation process.

Increased Maximum Risk Limit

Under the revised Quant Tekel funding rules, the maximum daily risk limit has been raised from 1% to 2%. This increase gives traders more space to manage market volatility and apply their strategies without facing early disqualification.

Removal of the 3% Payout Buffer

Previously, a 3% safety buffer was required in order to be eligible for profit payouts. With the new rules, this requirement has been removed, making it easier for traders to receive their profit share once targets are met.

Why These Rule Changes Matter

These updates reflect Quant Tekel’s commitment to evolving with trader needs. By raising the risk threshold and removing payout barriers, the firm is providing:

- Greater flexibility in trading style

- Faster access to profit payouts

- A more realistic reflection of live trading conditions

Traders who use slightly more aggressive strategies—or who trade in volatile markets—will especially benefit from the updated Quant Tekel funding rules.

To see how Quant Tekel compares with other leading firms this month, check out our updated April Monthly Ranking Prop Firms list.

While these changes support traders, they also maintain essential risk controls to ensure the long-term sustainability of the funding model. Quant Tekel’s approach highlights the importance of listening to user feedback while balancing it with the firm’s risk management principles.

for

for