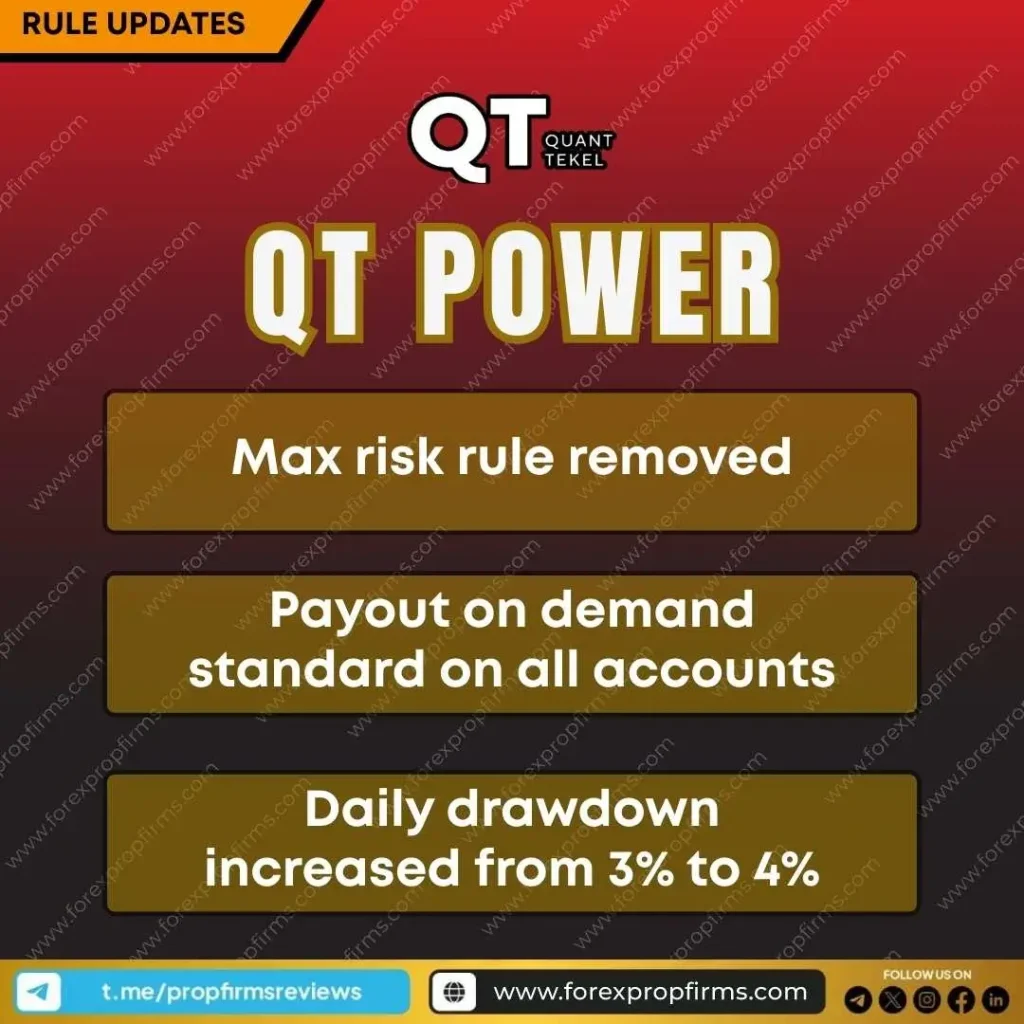

Quant Tekel has rolled out a major QT Power update aimed at giving traders more control, flexibility, and financial freedom. This latest move signals the platform’s shift toward a more dynamic and trader-centric approach—perfect for experienced traders using advanced strategies.

Key Features of the Quant Tekel Power Update

1. No Maximum Risk Rule

Traders can now operate without a hard cap on overall risk exposure. This update eliminates the maximum risk rule, making the QT Power program ideal for those using custom or dynamic risk management models. It’s a game-changer for advanced traders who previously felt restricted by rigid limits.

2. Increased Daily Drawdown Limit

The daily drawdown threshold has been raised from 3% to 4%. This seemingly small tweak offers much-needed breathing room during high-volatility sessions. It supports more strategic positioning and is particularly beneficial for traders in high-volume environments where small fluctuations are part of the game.

3. Payout-on-Demand Across All Accounts

With the new payout-on-demand feature, traders are no longer tied to scheduled payout cycles. Whether you manage one account or multiple, you can now request withdrawals when it fits your strategy. This update caters especially to full-time and high-frequency traders seeking more liquidity and cash flow freedom.

Applied to All New Accounts & Phases

These updates apply to all newly activated accounts and upcoming phase passes. Traders joining QT Power now have access to a more accommodating structure without compromising the importance of risk control and capital preservation.

For a complete evaluation of the firm’s performance, features, and funding models, don’t miss our Quant Tekel review.

Why This Matters

This Quant Tekel Power update reflects a broader trend among modern prop firms—offering greater autonomy and flexible terms without diluting risk management. By removing strict caps and empowering traders with payout options, Quant Tekel positions itself as one of the more progressive prop trading platforms in the industry.

for

for